Reverse Stock Splits Surge in 2023, Reflecting Wall Street’s Unease

2023.08.29 11:14

-

Traditional splits were all the rage in 2021 amid a speculative frenzy in financial markets

-

2023 Trend: reverse splits are sharply on the rise

-

We highlight three firms, each impacted by the pandemic and its aftermath; two were forced to go the reverse-split route, and the other enjoying high times in the auto market

Bear markets will wear you out if they don’t scare you out. We are coming up on the first anniversary of the ’s 3491 bottom. It was just 12 months ago when investors were unnerved by Fed Chair Jay Powell’s short and stern 8-minute message at the 2022 Jackson Hole Economic Symposium. Equities would then go into a tailspin for the following eight weeks, eventually finding a floor after the September CPI report was released in mid-October.

Better Days? Depends On Who You Ask

For investors, while there have been some givebacks along the way, including a bout of financial turmoil this past March, returns have been impressive across sectors, market cap sizes, and styles. For companies and financial executives, though, there is still a great deal of unease.

Earlier this summer, we highlighted a concerning trend seen in the Late Earnings Report Index (LERI), a potential early warning signal for negative corporate news heading into the Q2 reporting season. While earnings results were decent, stock reactions were less than stellar – the S&P 500, Nasdaq, and are all enduring sizable August losses.

Reverse Split Count Skyrockets in 2023

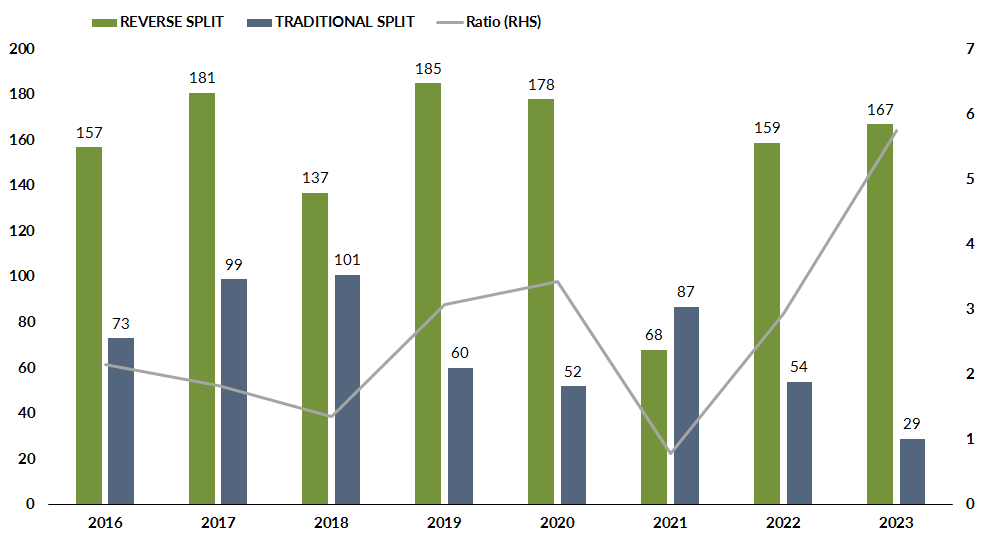

Another concerning trend playing out may go unnoticed by casual observers. Wall Street Horizon’s team found that reverse stock splits are sharply on the rise. The further we advance from the speculative mania that hallmarked 2021, the more we discover how abnormal certain data points were.

For instance, 2021’s era of rock-bottom interest rates and muted stock and bond market volatility resulted in just 68 reverse stock splits, a corporate action in which a company will reduce its share count and simultaneously increase its stock price, typically after a prolonged period of poor equity performance.

Annual Split Count & Ratio Line: Euphoria in 2021, Desperation in 2023

Annual Split Count & Ratio Line

Annual Split Count & Ratio Line

Source: Wall Street Horizon

Let’s Ratio That

The following year featured a more normal 159 reverse splits globally, and we are on pace to do more than 200 in 2023. It’s important to understand that reverse splits, while rarely attracting the media fanfare of a high-profile large-cap firm announcing a traditional split, are the more common type. Since 2016, for each traditional split, there have been 2.22 reverse splits. In 2021, that ratio was frothy at just 0.78. The multiple verified at 2.94 the next year while 2023 is the highest we have seen at 5.76 (Q3 2022 is when the ratio began to take off).

WeWork is WeWeak

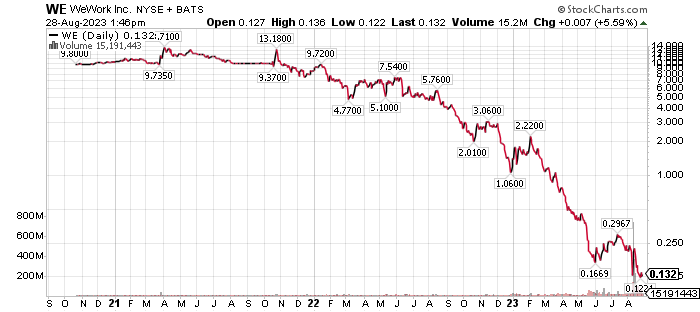

What sorts of companies are engaging in the desperate corporate action that is a reverse split? Former darlings of the pandemic era – including SPACs. WeWork (NYSE:) went public in October 2021 through a SPAC merger with BowX. The IPO fizzled, however, and WE’s valuation cratered from a peak of $47 billion to less than $300 million today.

It was reported just last week that the embattled coworking spaces company hired advisors for restructuring advice amid ‘going concern’ doubt. WE now embarks on a 1-for-40 reverse stock split, effective at the close on Friday, September 1, to regain compliance with NYSE listing requirements.

WeWork 3-Year History: Work from Anywhere Is Not Working Out

Source: Stockcharts.com

From Chic to Bleak: Express Stock Falls Out of Style

So, the whole coworking habitat idea for folks working from anywhere did not go as planned for WE. They were not alone in misreading the business and consumer landscape over the past few years, though.

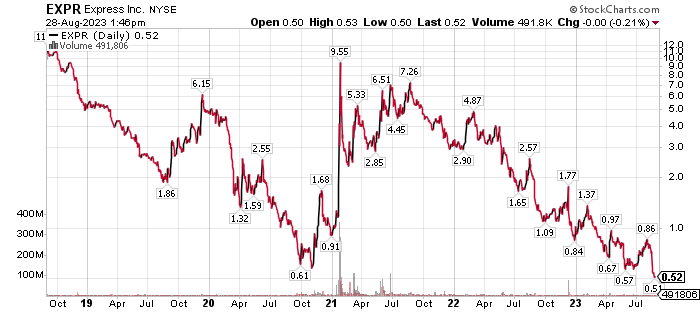

Express (NYSE:) soared in late 2020 and early 2021 when bullish animal spirits gripped Wall Street and Main Street alike.

EXPR, a once-popular retail outlet, was a full-blown meme stock in early 2021. Shares soared from a pandemic-low of $0.58 to nearly $10 just as Reddit traders were doing their thing with GameStop (NYSE:) and AMC Entertainment (NYSE:).

Express 5-Year History: Meme Stock Hype Short-Lived

Source: Stockcharts.com

Now thirty months later, execs at the apparel company hope to spark a share-price resurgence through a 1-for-20 reverse split expected to take effect on August 31.

As we saw during the two big weeks of retail earnings in August, there are winners and losers in this volatile niche of the Consumer Discretionary sector.

Changing preferences among back-to-school shoppers, ongoing competition with online retailers, and shrinkage are all risks for management teams lacking prescience. Be on the lookout for more volatility in EXPR as it reports Q2 on Thursday morning this week.

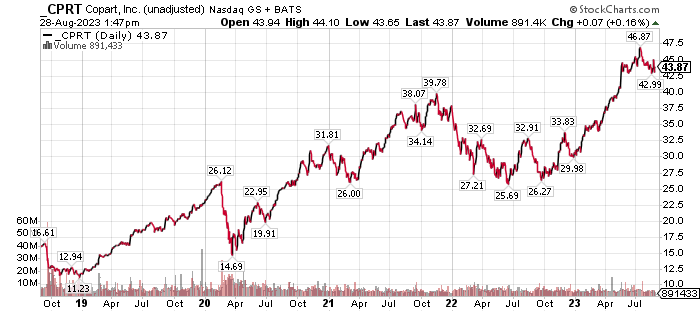

Revving Success: Copart Stock Races to the Top

We cannot end without some kind of feel-good story. Check out what’s happening with Copart (NASDAQ:). The Dallas-based $41 billion market cap Industrial launched a 2-for-1 traditional stock split in early August.

CPRT is like the king of junk cars. It provides online auctions and remarketing services around the world. It is no doubt a pandemic winner, and its share price recently hit an all-time high.

Earnings are expected to grow in the double digits through 2025, and the company sports big-time margins and a lofty valuation as investors pay up for that high-octane growth trajectory.

Earnings are on tap, too; we show an unconfirmed Q4 2023 reporting date of Wednesday, September 6, AMC.

Copart 5-Year History: An Industrials-Sector Standout

Source: Stockcharts.com

The Bottom Line

While the Fed nears the end of its rate-hiking cycle and as the stock market encroaches on a year of gains, many companies are still struggling. Reverse stock splits have been announced more frequently compared to recent years, while fewer firms are performing traditional splits.

What could rekindle the magical value creation that comes with traditional splits? We’ll leave you with this: Keep your eyes on Nvidia (NASDAQ:) and Eli Lilly (NYSE:).