Retailers Get Ready to Report Earnings Amidst Growing Fears of a Consumer Slowdown

2023.11.13 14:20

- An impressive winning streak on the three major indices came to an end late last week as fears of sustained higher interest rates hit markets

- This week 1,410 companies are expected to report for Q3, 12 from the S&P 500.

- All eyes will be on retail this week with results expected from Home Depot, Target Corporation, The TJX Companies, Walmart, Macy’s, Gap Inc., Ross Stores, and more.

- Potential Surprises this week: Catalent, Henry Schein.

The hope for interest rate cuts in the near term as well as falling yields is what propelled major indices to multi-day rallies to start out November. It was the ending of those two things that snapped the longest winning streak in two years late last week. On Thursday, comments from Federal Reserve Chair Jerome Powell suggested that the Fed’s work to reduce inflation was likely not done yet, causing the , DJIA and to all post losses.

With peak earnings season complete, investors will be looking to the final leg of the Q3 season as retailers report in the coming weeks. Commentary from these companies will provide a read on the US consumer which has been hard to pin down as of late on account of mixed data. Last week results from apparel retailers began to trickle in and it was clear that while many companies continue to beat on the bottom-line, top-line growth has been more of a struggle. Both Under Armour (NYSE:) andSteven Madden Ltd (NASDAQ:) beat on EPS but came in line on revenues. Coach parent company Tapestry (NYSE:) beat on EPS but missed revenues. A bright spot in the space last week was RealReal Inc (NASDAQ:) which surpassed both metrics, causing the stock to pop 35% since the report.

With 92% of S&P 500 constituents reporting at this point, the blended EPS growth rate for Q3 has grown to 4.1% vs. last week’s 3.7%.

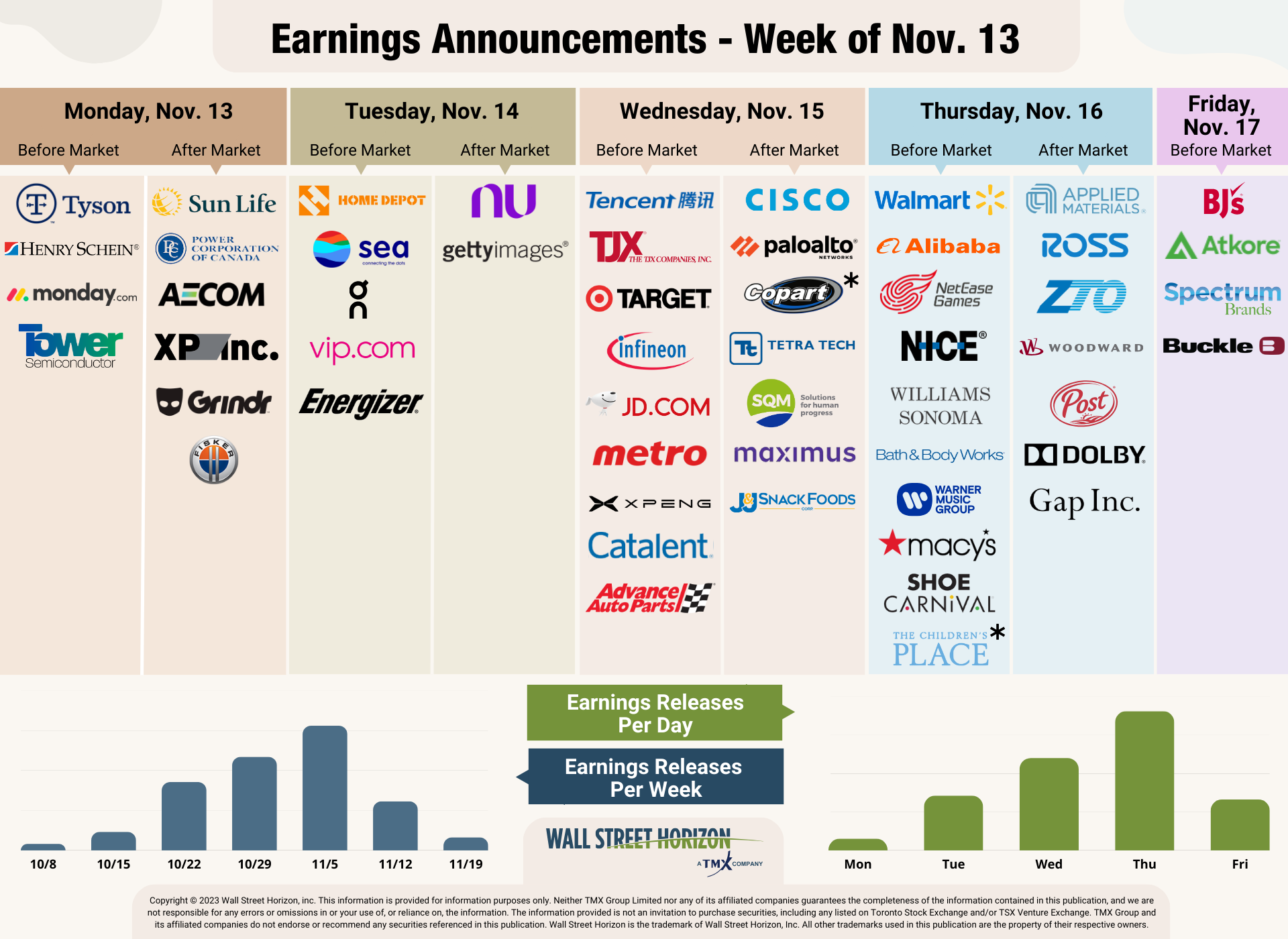

Earnings on Deck – Week of November 13, 2023

Peak earnings season is now in the rearview mirror, but there are still plenty of companies left to report for the third quarter. This week we expect earnings releases from 1,410 publicly traded companies (out of our universe of 10,000), with 12 of those coming from companies. There will be a big focus on retailers with reports from Home Depot Inc (NYSE:), Target Corporation (NYSE:), TJX Companies Inc (NYSE:), Walmart Inc (NYSE:), Macy’s Inc (NYSE:), Gap Inc (NYSE:), Ross Stores Inc (NASDAQ:) and more.

Source: Wall Street Horizon

Potential Surprises This Week: Henry Schein and Catalent

This week we continue to get results from companies that have pushed their Q3 2023 earnings dates outside of their historical norms. Only two of those companies are within the S&P 500 and have confirmed later than usual earnings dates and therefore have negative DateBreaks Factors*. Those companies are Henry Schein Inc (NASDAQ:) and Catalent Inc (NYSE:), both in the healthcare sector. According to academic research, the later-than-usual earnings dates suggest these companies will report “bad news” on their upcoming calls.

Henry Schein

Company Confirmed Report Date: Monday, November 13, BMO

Projected Report Date (based on historical data): Tuesday, November 7, BMO

DateBreaks Factor: -3*

Medical supplies distributor, Henry Schein, is set to report Q3 2023 results on Monday, November 13, six days later than expected. This would be the latest they’ve ever reported (since we began collecting data for this company in 2006).

On the dental side, HSIC has a large portfolio of implants, veneers and clear aligners. As these are often considered for cosmetic use and therefore not covered by insurance, sales of these supplies depend heavily on consumer demand which has started showing signs of softening in the fourth quarter. A weak spot on the medical side of the business is waning sales of PPE products and COVID-19 test kits in comparison to the year-ago period.

Another thing to keep in mind is Henry Schein’s recent acquisition of Shield Healthcare which was just completed last month. Oftentimes acquisitions can be the culprit of delayed earnings dates.

Catalent, Inc.

Company Confirmed Report Date: Wednesday, November 15, BMO

Projected Report Date (based on historical data): Wednesday, November 1, BMO

DateBreaks Factor: -3*

This isn’t our first time highlighting a troublesome signal for Catalent. This global consumer health company develops and manufactures solutions for drugs, protein-based biologics, cell, and gene therapies. The $8 billion market cap New Jersey-based Pharma industry stock within the Health Care sector has a history of late earnings date confirmations and pushing back its quarterly results.

For FQ1 2024, CTLT has pushed back its earnings release to November 15, two weeks later than expected. This would be the latest they’ve ever reported (since we began collecting data for this company in 2014). It’s also their first Wednesday report after reporting on Tuesdays for the last 5 years.

Lower demand for its consumer discretionary products caused a guidance cut in the year-ago quarter, sending shares crashing. CTLT then soared earlier this year amid takeover speculation, but those gains were fleeting as a reorg in April cast doubt on the firm’s long-term viability. Next, a guidance cut in May sparked a plunge to its year-to-date low, which it is dangerously close to matching at present. Finally, after another dismal outlook, Q2 results beat Street expectations back in June. A new CFO was named thereafter. In August the company reported FQ4 2023 results that showed revenues falling 19% year-over-year (YoY) and EPS that missed sell-side expectations by two cents.