Stock Markets Analysis and Opinion

Retail Stocks Could Lead Other Sectors Higher

2024.07.30 05:48

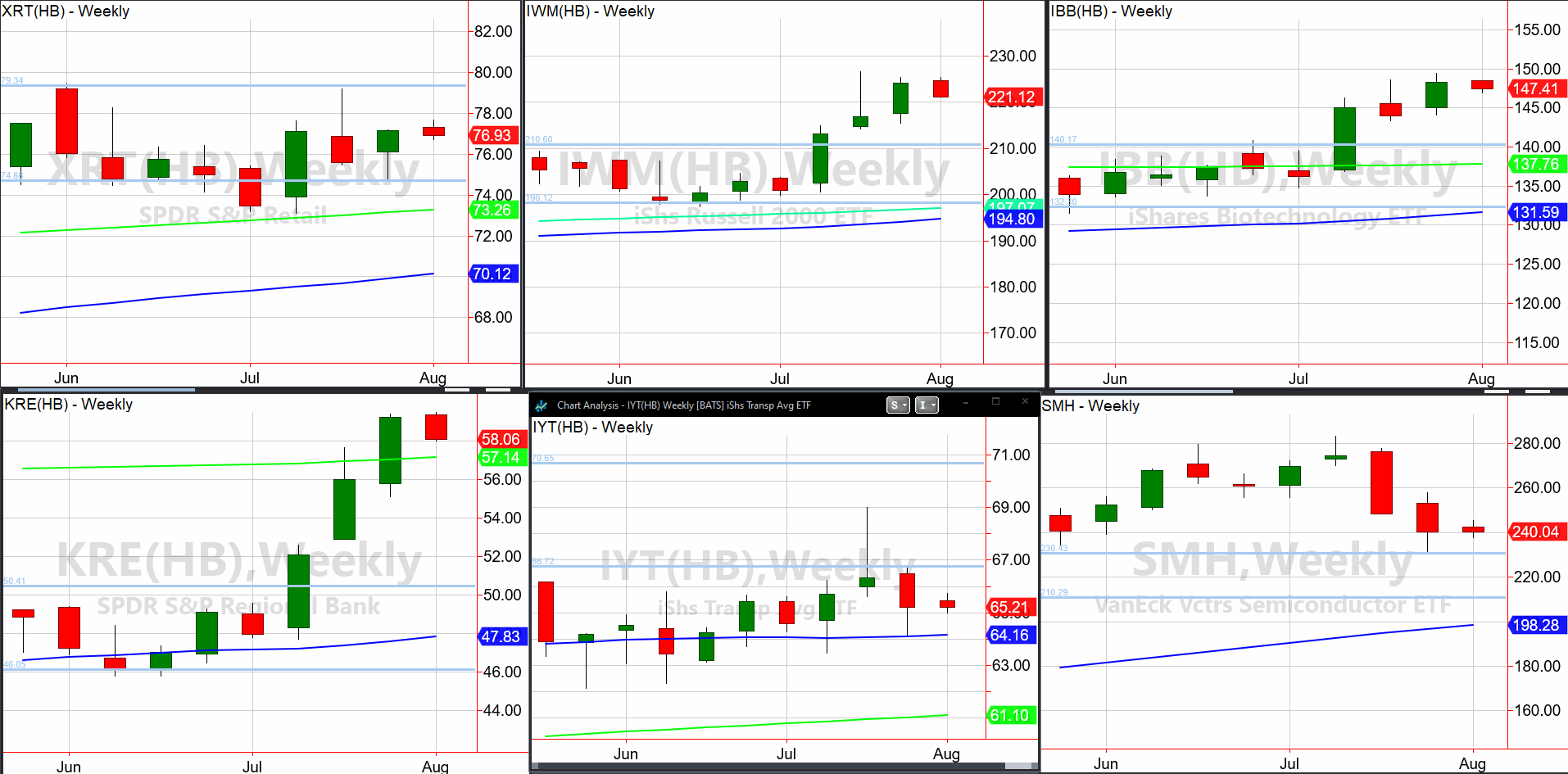

Over the weekend we had a lot to say about our Family.

- “If takes out the 227 level, we see no reason why the rally should not continue.”

- “Sister , after a huge bearish move the week prior, followed through with more downside this past week.”

- “ or our Prodigal Son, has had 3 spectacular weeks in a row. With KRE we still do not know if this is a massive technical bear market rally or a new bull market.”

- “ held the weekly channel low. Granny, with all the doom and gloom, closed the week up. Are there headwinds? Sure.”

- “ looks well on its way to 160 area.”

- “If joins in the rally, it will most likely infer a sea change coming for the Fed as well.”

- “Let us not forget that the long bonds have their own look of a squeeze coming.”

A lot of “ifs.”

So, is it any big surprise that the week begins with all the Family thus far, trading inside last week’s trading range?

All but Retail XRT. But XRT only garnered a rally early in the day and settled within last week’s range.

We have some waiting and wading to do given earnings, , and all on tap.

ETF Summary

- S&P 500 (SPY) 540 support

- Russell 2000 (IWM) 217 support 227 resistance

- Dow (DIA) 400 support

- Nasdaq (QQQ) weekly support 463

- Regional banks (KRE) 54 now support with 60 next level to watch

- Semiconductors (SMH) 230 important support

- Transportation (IYT) 64.10 support 67 resistance

- Biotechnology (IBB) 146 support 150 resistance

- Retail (XRT) 75 support 77.50 resistance

- iShares iBoxx Hi Yd Cor Bond ETF (HYG) 78.00 support