Rate jitters wear down wary markets

2023.09.27 01:04

2/2

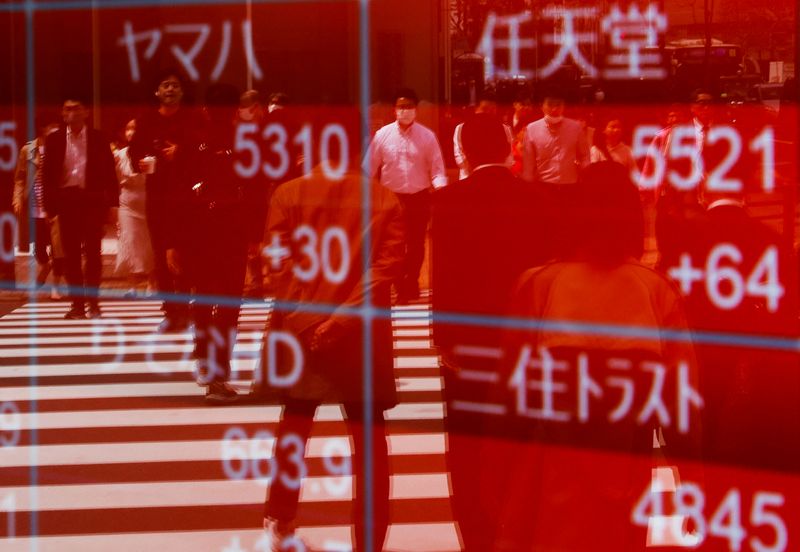

© Reuters. Passersby are reflected on an electric stock quotation board outside a brokerage in Tokyo, Japan April 18, 2023. REUTERS/Issei Kato/File photo

2/2

A look at the day ahead in European and global markets from Ankur Banerjee

Investor nerves remain frayed over the prospect of interest rates staying higher for longer, with a surge in U.S. Treasury yields pulling the dollar to a 10-month peak and driving Asian currencies, the pound and the euro to their lowest in months.

Resilient economic data, hawkish Federal Reserve rhetoric, and a budget deficit that will require increased borrowing have all combined to push the 10-year yield up more than 40 basis points this month. In Asian hours on Wednesday, short-dated Treasuries rallied while the longer end steadied. [US/]

Asian markets were under pressure as the day progressed, with MSCI’s broadest index of Asia-Pacific shares outside Japan sliding to its lowest in 10 months. The dipped below 32,000 for the first time since Aug. 28.

Futures indicate the sombre mood is likely to continue as Europe wakes, with markets there due to open lower.

Also in the background, another U.S. government shutdown looms. While the Senate on Tuesday took a step forward on a bipartisan bill meant to forestall a shutdown in just five days, the House of Representatives sought to push ahead with a conflicting measure backed only by Republicans.

Congress has shut down the government 14 times since 1981, though most of those funding gaps lasted only a day or two.

China’s property sector brought more bad news, this time that the chairman of China Evergrande (HK:) Group has been placed under police surveillance, according to a Bloomberg News report on Wednesday. That ratchets up pressure on the embattled developer whose outlook had already darkened significantly this week.

Meanwhile, tech stocks are likely to be in the spotlight after a long-awaited antitrust lawsuit against Amazon.com (NASDAQ:) from the U.S. Federal Trade Commission was filed on Tuesday.

The FTC asked the court to consider forcing the online retailer to sell assets, with the government accusing Big Tech of monopolising the most lucrative parts of the internet.

AI stocks (remember them?) will also be in focus after news that OpenAI, the artificial intelligence startup behind ChatGPT, is talking to investors about a possible sale of existing shares at a much higher valuation compared with a few months ago.

The proposed deal could value Microsoft-backed OpenAI at $80 billion to $90 billion, according to the Wall Street Journal, which first reported on the potential share sale.

And finally, for Candy Crush fans, its maker King said it would soon release levels up to 15,000 for the most dedicated players. It also said the popular game has reached $20 billion in revenue since its 2012 launch.

Key developments that could influence markets on Wednesday:

Economic events: German GfK consumer sentiment, Swiss investor sentiment, French consumer confidence