QUOTES-China and U.S agree deal on audit dispute

2022.08.26 16:30

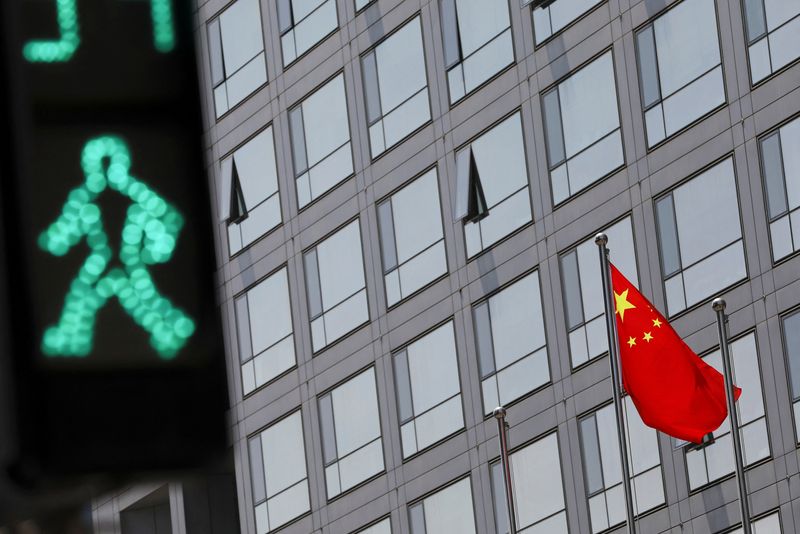

FILE PHOTO: A Chinese national flag flutters outside the China Securities Regulatory Commission (CSRC) building on the Financial Street in Beijing, China July 9, 2021. REUTERS/Tingshu Wang

HONG KONG (Reuters) – Washington and Beijing have reached an agreement allowing U.S. auditors to inspect China-based accountants, the first step in a process that could prevent around 200 Chinese companies being kicked off American stock exchanges.

THOMAS HAYES, MANAGING MEMBER, GREAT HILL CAPITAL, NEW YORK

“A long time coming! This has been a huge overhang on Chinese ADRs – causing some of the higher quality businesses like Alibaba (NYSE:BABA) to be mis-priced for some time. As the deal moves forward and the fog is lifted, many of these stocks will have significant appreciation. Not because the business changed (the big tech platforms have weathered the pandemic and crackdown fairly unscathed fundamentally), but because the uncertainty has been removed – inviting investors back to group.”

ZHANG ZIHUA, CHIEF INVESTMENT OFFICER, BEIJING YUNYI ASSET MANAGEMENT

“This is definitely great news for U.S.-listed Chinese companies, in particular the leading tech firms, as they don’t have to worry about being forced to delist from New York due to regulatory reasons. And their valuations can also be repaired.”

TARIQ DENNISON, MANAGING DIRECTOR, GFM ASSET MANAGEMENT, ZURICH

“It could signal an economic hunger for capital, but the bigger signal I think is how many investors believe this is a clear sign that the direction is back towards “Open China”, and not the “Closed China” that many Anglophone writers seem to have increasingly feared in recent years.

“My bear case on China for the past year plus has really been a dystopian scenario of China cutting itself off from the West in significant ways … this agreement would seem to put a big dent (of relief) in that bear case.

“I plan to continue allocating time and capital to China, it’s just too big and too important to ignore. If this results in better quality financials, of course that would be a huge plus.”