Purdue creditors seek approval to sue Sackler family members

2024.07.08 18:35

By Dietrich Knauth

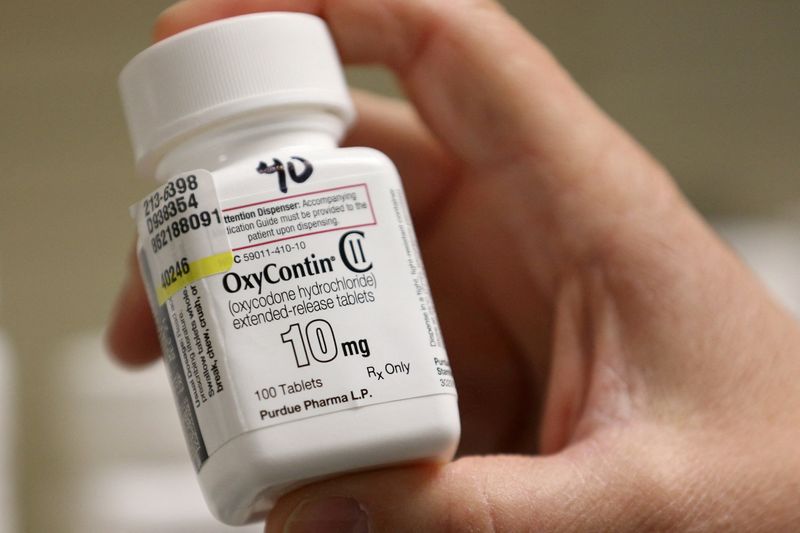

NEW YORK (Reuters) – Purdue Pharma’s creditors sought permission from a U.S. bankruptcy court on Monday to sue the company’s wealthy owners, arguing that the litigation can serve as both a negotiating tool and a fallback option as the OxyContin maker re-starts talks on a bankruptcy settlement.

Purdue is going back to the drawing board to negotiate a comprehensive settlement of lawsuits against it and its Sackler family owners alleging that the company’s deceptive marketing of OxyContin spurred an opioid addiction crisis in the U.S. A U.S. Supreme Court decision last month upended a previous bankruptcy deal.

The Supreme Court ruled that Purdue Pharma’s bankruptcy settlement can not shield the Sackler family members, who have not filed for bankruptcy themselves, from lawsuits over their role in the opioid epidemic. The decision imperiled billions of dollars in funding that Purdue and the Sacklers had promised to pay toward addressing the harms of the deadly crisis.

A court-appointed committee of Purdue creditors, which includes individuals harmed by the opioid crisis as well as insurers and companies with opioid claims, said in a Monday court filing in White Plains, New York that they need the ability to sue to ensure that the Sacklers are not “allowed ‘off the hook’ for their grotesque misconduct in creating and fueling the opioid crisis.”

The committee said it intends to engage in mediation and settlement talks with Purdue and the Sacklers before pursuing litigation.

A spokesperson for the Sackler family members said the committee’s court filing was “riddled with factual errors” and “contrary to the goal of working together towards a resolution that provides billions of dollars for communities and people in need.” The family members have denied wrongdoing but previously expressed regret that OxyContin “unexpectedly became part of an opioid crisis.”

The committee said it supported Purdue’s previous bankruptcy settlement as the most efficient way to get money to the victims of the opioid crisis, but it believes that the legal claims against the Sacklers are worth more than the $6 billion that the family members agreed to pay.

The committee asked U.S. Bankruptcy Judge Sean Lane for “derivative” standing to pursue Purdue’s own legal claims against the Sacklers.

Purdue likely has the largest claims against the Sacklers, including claims that they drained over $11 billion from the company and that their conduct made Purdue liable for other lawsuits, according to the committee.

The Sackler family members disputed the $11 billion figure on Monday, saying that half of the money they took from the company was used for tax payments.

Purdue, which pleaded guilty to misbranding and fraud charges related to its marketing of OxyContin in 2007 and 2020, supported the committee’s request, saying in a Monday court filing that the company is “not the most appropriate entity to pursue litigation” against the Sacklers.

In exchange, Purdue insisted that the creditors’ committee give mediation a chance before taking further action, and said it remains “hopeful” that a new deal can be reached without further litigation.

The company has spent nearly five years in bankruptcy, attempting to reach a comprehensive settlement of legal claims by state and local governments, family members of opioid overdose victims, and others who have sued or may sue in the future.

Purdue is scheduled to appear in court on Tuesday for the first time since the Supreme Court’s June 27 ruling.