Pro Research of the Week: Warren Buffett’s 5 Big Japan Bets

2023.06.16 05:46

- Warren Buffett has bet big on Japan

- So far, his bets have paid off handsomely

- Japan has broken free from decades of deflation, making equities attractive again

In 2020, Warren Buffett, who usually confines himself to the US markets, surprised everyone by announcing a massive $6 billion bet on the following five Japanese trading houses:

- Itochu Corp (OTC:)

- Mitsui & Company (OTC:)

- Mitsubishi Corp. (OTC:)

- Marubeni Corp (OTC:)

- Sumitomo Corp (OTC:)

Less than three years later, these five stocks have gained an average of around 180% and now account for $17 billion in Berkshire Hathaway’s (NYSE:) portfolio.

Why Did Warren Buffett Choose to Invest in These 5 Japanese Stocks?

Warren Buffett’s investments primarily focus on Japan’s largest conglomerates known as sogo-shosha or general trading companies. Historically, these companies played a vital role in importing a wide range of products, including energy, minerals, and foodstuffs, to Japan—an archipelago lacking significant natural resources. Additionally, they were responsible for exporting finished goods produced in Japan.

However, the landscape has transformed considerably, and these Japanese firms now generate most of their revenue through non-commercial activities. They have transitioned from mere import-export operations to comprehensive business management, diversifying their holdings across various sectors. Their investments span industries such as logistics, real estate, frozen foods, aerospace, electric vehicles, and renewable energies.

In essence, these companies bear a resemblance to Berkshire Hathaway, a point recently emphasized by Warren Buffett himself.

The Oracle of Omaha told CNBC during his visit to Japan in April,

“I just thought these were great companies. They were companies whose businesses I generally understood. It’s kind of the same with Berkshire, which has a lot of different interests,”

In May, Buffett further explained the reasons for this investment at Berkshire’s annual meeting, noting that these companies were “ridiculously” cheap, well-established in familiar sectors, focused on the long term, and large enough to have a significant impact on Berkshire’s earnings.

Investing in Japan Makes Sense From a Macroeconomic Point of View

In addition to discussing the qualities of these stocks using the InvestingPro fundamental analysis tool later in this article, it is worth noting that Japanese equities have been performing exceptionally well recently.

Indeed, on Thursday, the , Japan’s main stock market index, reached a new all-time high at 33,805 points. This came after five consecutive positive sessions in which the index surged 6.8%.

This solid rise comes on the back of concrete macroeconomic factors that make investing in Japanese equities worthwhile, with encouraging signs that the country is finally leaving the path of deflation, which, in its case, is a good thing.

Indeed, analysts were surprised in early June when the Japanese didn’t bat an eyelid at a wave of price rises on thousands of consumer goods.

This growing acceptance of is one of the factors, along with signs of improved corporate governance and Warren Buffett’s investments, that have helped the Japanese stock market set recent record highs, according to analysts.

Indeed, there is a belief among many that inflation could have a positive impact on corporate margins, serving as a crucial factor that could help the world’s third-largest economy break free from a period of low or zero growth that has persisted for several decades.

Given that Warren Buffett’s investments in Japan have more than paid off, and that he remains convinced of the merits of the position, and given the macroeconomic skies that seem to be clearing in Japan, it makes sense to take a closer look at the stocks the Oracle of Omaha has set his sights on.

That’s why we’ve compiled an InvestingPro Advanced Watchlist.

You can do the same today by signing up for an InvestingPro free trial!

Warren Buffett’s 5 Favorite Japanese Stocks

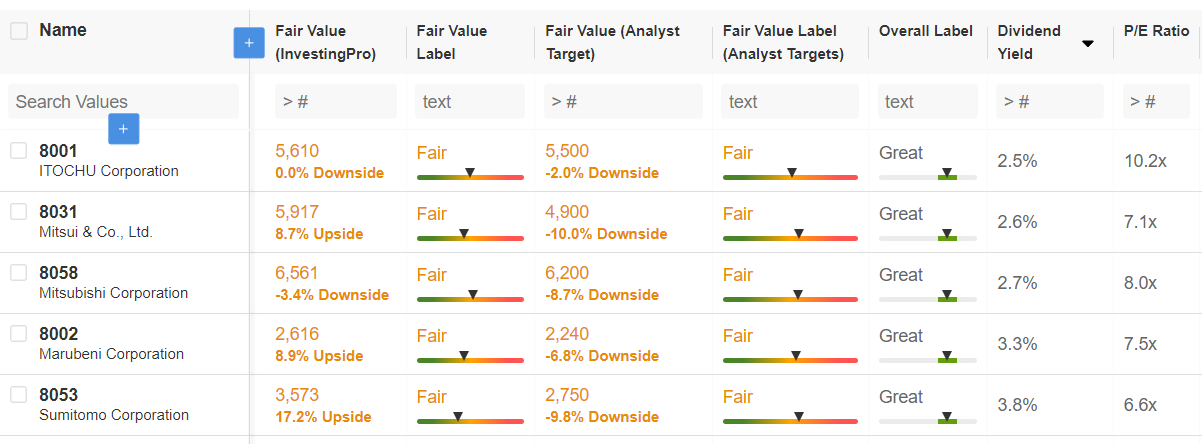

As you can see below, these stocks don’t stand out for their upside potential, at least as far as analysts’ forecasts are concerned.  Warren Buffett InvestingPro Watchlist

Warren Buffett InvestingPro Watchlist

Source: InvestingPro, Watchlist screen

The average analysts’ targets indicate downside risk rather than potential upside for each of the 5 stocks, suggesting that they believe these stocks are currently valued correctly at their current prices.

As for InvestingPro Fair Value, which uses several recognized financial models, the picture is slightly more positive, with Mitsui showing an upside potential of 8.2%, Marubeni at 8.1%, and Sumitomo at 16.6%.

By contrast, InvestingPro values Mitsubishi at 8.2% below its current price, while Itochu is currently around fair value.

However, unlike more daring investors like Cathie Wood of Ark Invest, Warren Buffett rarely chooses stocks with impressive short- and medium-term potential, preferring to focus on safety, long-term gains, and dividends.

In fact, the biggest position in Warren Buffett’s portfolio, Coca-Cola (NYSE:), doesn’t show the greatest potential either, with InvestingPro Fair Value valuing it at just 2% above the current share price.

On the other hand, the company is in solid financial health and pays a dividend corresponding to an annual yield of over 3%.

In fact, all the Japanese companies in which Warren Buffett has invested have an overall InvestingPro financial health rating of “very good.” They all pay dividends, with yields ranging from 2.5% to 3.5%, depending on the share.

Finally, as Buffett pointed out when he described them as “ridiculously inexpensive,” their PE ratios are indeed well below the average for leading Japanese stocks.

Conclusion

While the Japanese stocks in Warren Buffett’s portfolio may not be the stuff of dreams in terms of short-term upside potential, they are definitely solid investments.

In fact, they are all in solid financial health, with highly diversified business activities and revenues, making them safe long-term bets in line with the investment philosophy that the Oracle of Omaha has always stuck by.

You can subscribe and try out the InvestingPro premium tool, which provides comprehensive tools for conducting in-depth analyses, allowing you to pick solid stocks that pay off in the long term, just like Warren Buffett’s picks.

The InvestingPro tools assist savvy investors in analyzing stocks. By combining Wall Street analyst insights with comprehensive valuation models, investors can make informed decisions while maximizing their returns.

You can conveniently access a single-page view of complete and comprehensive information about different companies all in one place, saving you time and effort.

Start your InvestingPro free 7-day trial now!

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or investment recommendation. As such, it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remain with the investor. The author does not own the stocks mentioned in the analysis