Pro Research of the Week: Top Lithium Stocks for Hefty Long-Term Returns

2023.06.23 06:18

- Investing directly in lithium is for the pros

- However, retail investors can gain exposure to lithium through stocks

- Let’s take a look at 6 stocks that move in tandem with lithium prices

- InvestingPro Summer Sale is on: Check out our massive discounts on subscription plans!

In 2021 and 2022, lithium staged an impressive rally, with gains of 442% and 72%, respectively, making it the top-performing commodity in both years. The beginning of 2023 posed challenges as it faced a substantial decline of over 60% from January to April.

However, the tide has turned in recent months for “white gold.” Its value has more than doubled, signaling a remarkable turnaround. While it may not have fully recouped the earlier losses yet, this surge could be the initial stride toward another year of exceptional performance.

Investing directly in lithium as a raw material is reserved for professionals. However, there is an alternative way to gain exposure to lithium by investing in companies involved in lithium production.

In this article, we set out to identify the top lithium stock to consider for the second half of 2023. We used the InvestingPro fundamental analysis tool to evaluate and compare the six best lithium stocks.

Before diving into our stock selection, let’s revisit why investing in lithium makes sense in many ways and explore the key factors driving its appeal.

By the way, InvestingPro is currently hosting its Summer Sale, offering massive discounts on subscription plans. This is your chance to access cutting-edge tools, real-time market analysis, and expert opinions at a fraction of the price.

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual (Web Special): Save an amazing 52% and maximize your profits with our exclusive web offer.

Hurry, the Summer Sale won’t last forever!

Why Invest in Lithium?

Lithium plays a vital role in powering electronic devices like smartphones and, most notably, electric vehicles (EVs). With many countries planning to phase out internal combustion engine vehicles in the coming decade, the demand for lithium in EV batteries is expected to soar.

For instance, California, one of the world’s major automotive markets, aims to achieve 100% EV sales by 2035, setting the stage for an exponential increase in lithium demand.

Moreover, the significance of lithium extends beyond EV batteries. It is also crucial for the large-capacity batteries used in renewable energy systems, which are poised to replace fossil fuels in the long run. As a result, the demand for lithium is expected to surge in these sectors as well.

In fact, electric vehicles and battery storage systems have already surpassed consumer electronics as the largest consumers of lithium.

While the International Energy Agency predicts a surplus of raw lithium supply in the near future due to capacity expansion efforts by producers, the economic challenges faced in 2023 may temporarily dampen the demand for electric vehicles.

However, considering long-term climate targets, experts anticipate that existing mines and ongoing construction projects will only meet approximately half of the projected lithium demand by 2030.

This creates a classic supply shock scenario, leading to a potential price surge in lithium as demand outpaces supply in the coming years.

Top Lithium Stock to Buy

Returning to our search for the best lithium stock using InvestingPro data, we have chosen to focus on lithium-producing companies, excluding downstream companies such as lithium battery producers, which will be the subject of a dedicated article at a later date.

Our list, therefore, includes the following:

- Piedmont Lithium Ltd ADR (NASDAQ:)

- Livent Corp (NYSE:)

- Sigma Lithium Resources Corp (NASDAQ:)

- Atlas Lithium Corp (NASDAQ:)

- Lithium Americas Corp (NYSE:)

- Albemarle Corp (NYSE:).

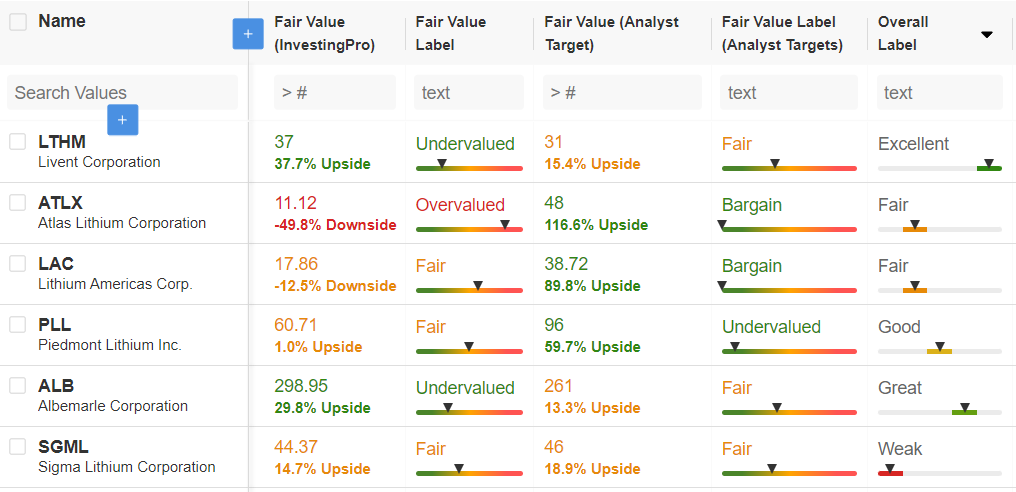

Source: InvestingPro

Among the analysts, Piedmont Lithium is deemed undervalued, with a potential upside of nearly 60%. Similarly, Atlas (NYSE:) Lithium and Lithium Americas are considered bargains, offering respective upside potentials of 116% and 90%.

When considering InvestingPro’s Fair Value, which combines various established models based on cash flows, Livent Corp and Albemarle stand out. They present upside potentials of 37.7% and 29.8%, respectively.

Furthermore, Livent Corp has an “excellent” overall financial health label, according to InvestingPro, while Albemarle is labeled as “very good.” The remaining stocks on the list display more uncertain financial health.

Given a long-term perspective with an emphasis on maximizing safety, our preference leans towards Albemarle, currently the world’s leading lithium producer.

Top Lithium Stock: Albemarle

Albemarle, recognized as the world’s leading lithium producer, operates mines across Australia, Chile, and the USA, providing a reassuring geographical diversification that sets it apart from other lithium companies with more limited regional focuses.

Notably, the company is rapidly expanding its operations and has plans to commission another major lithium mine, Kings Mountain in North Carolina, by 2027.

In addition, Albemarle is investing in the construction of a state-of-the-art processing plant in South Carolina. Valued at $1.3 billion, this facility will be capable of producing battery-grade lithium hydroxide.

It will contribute to the manufacturing of approximately 2.4 million electric vehicle batteries annually while also enabling the processing of lithium from recycled batteries, opening up new revenue streams for the company.

Albemarle’s Solid Revenue Growth

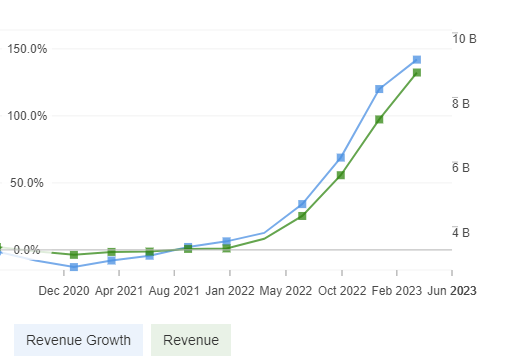

Albemarle’s financial performance has been impressive, with solid revenue growth observed in recent years. Since 2022, the company has experienced explosive revenue growth, with sales increasing by an average of 141.9% annually over the past 12 months.

Albemarle Revenue Vs. Revenue Growth

Source: InvestingPro

According to InvestingPro data, revenue growth has averaged 25.9% annually over the past four years. This positive trend is expected to continue, with analysts projecting revenue growth of 38.1% in the coming 12 months.

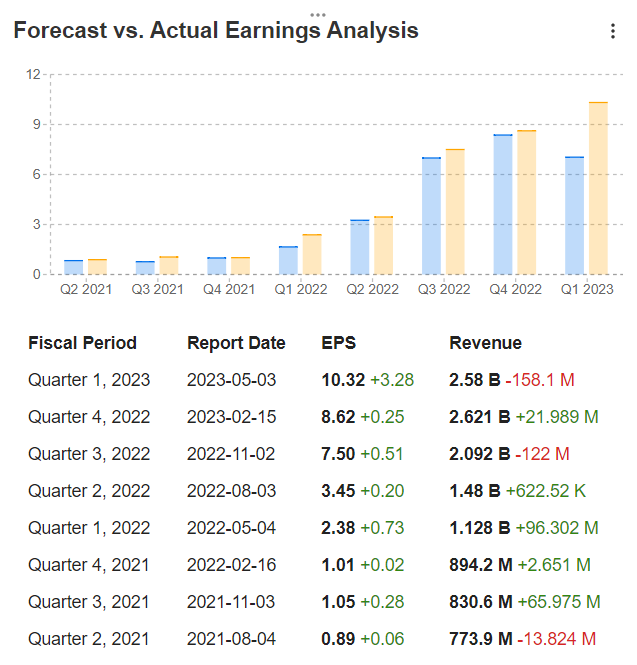

One notable strength of Albemarle is its consistent track record of surpassing analysts’ earnings expectations. The company has developed a habit of consistently exceeding profit forecasts.

Forecast Vs. Actual Earnings

Source: InvestingPro

Albemarle has consistently outperformed earnings per share (EPS) expectations for the past 8 consecutive quarters.

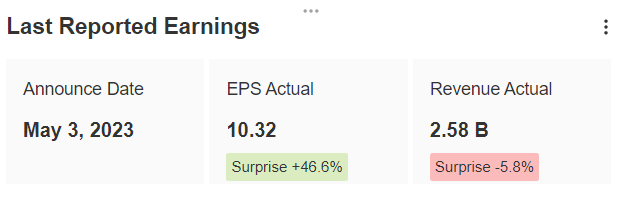

Albemarle Earnings

Source: InvestingPro

The outperformance was particularly significant for the latest published on May 3, with EPS exceeding the consensus by 46.6%.

Conclusion

If you’re looking to invest in the promising future of lithium, buying shares in companies that produce this valuable metal makes a lot of sense for a long-term investment strategy.

Albemarle continues to expand and strengthen its position in the market, making it an obvious choice for those looking to invest in lithium through stocks.

Not only does Albemarle hold a dominant position in the industry, but it also boasts impressive revenue growth, bullish forecasts from analysts, and according to InvestingPro, solid financial health.

Get ready to boost your investment strategy with our exclusive summer discounts.

As of 06/20/2023, InvestingPro is on sale!

Enjoy incredible discounts on our subscription plans:

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual (Web Special): Save an amazing 52% and maximize your profits with our exclusive web offer.

Don’t miss this limited-time opportunity to access cutting-edge tools, real-time market analysis, and the best expert opinions.

Join InvestingPro today and unleash your investment potential. Hurry, the Summer Sale won’t last forever!

***

Disclaimer: This article was written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel, or recommendation to invest, nor is it intended to encourage the purchase of assets in any way.