Pro Research of the Week: Diversify Into Bitcoin With This Crypto Miner

2023.06.02 06:53

- Crypto stocks offer exposure to cryptocurrencies.

- Our InvestingPro advanced watchlist includes the best stocks in this category.

- Out of them, CleanSpark is a top pick with good potential upside and solid financial health.

Although cryptocurrencies like have a controversial reputation and are not yet fully regulated, they have gained some importance in the global financial market.

Some investors consider it a high-potential speculative investment, while others use it as a diversification tool.

Investing in the cryptocurrency market directly can be a challenge. This is why many investors seek exposure to cryptocurrencies through crypto stocks.

These are stocks of companies whose business activities are linked to the general trend of digital assets, making their stock price correlated with that of cryptos.

Various stocks fit this criteria, including shares of companies involved in blockchain technology and cryptocurrencies and those that invest in cryptocurrencies.

Additionally, crypto stocks encompass shares of companies that facilitate access to the cryptocurrency market and those that specialize in cryptocurrency mining.

The Best Stock to Gain Exposure to Cryptocurrencies

This article presents a comprehensive review of the top options for investors seeking exposure to the cryptocurrency market through the stock market.

We have carefully selected stocks and compiled them into an InvestingPro Advanced Watchlist.

Our analysis includes an assessment of analyst objectives, the overall financial health score, and the InvestingPro Fair Value, which combines various established financial models.

Do the same by signing up for a free 7-day InvestingPro trial!

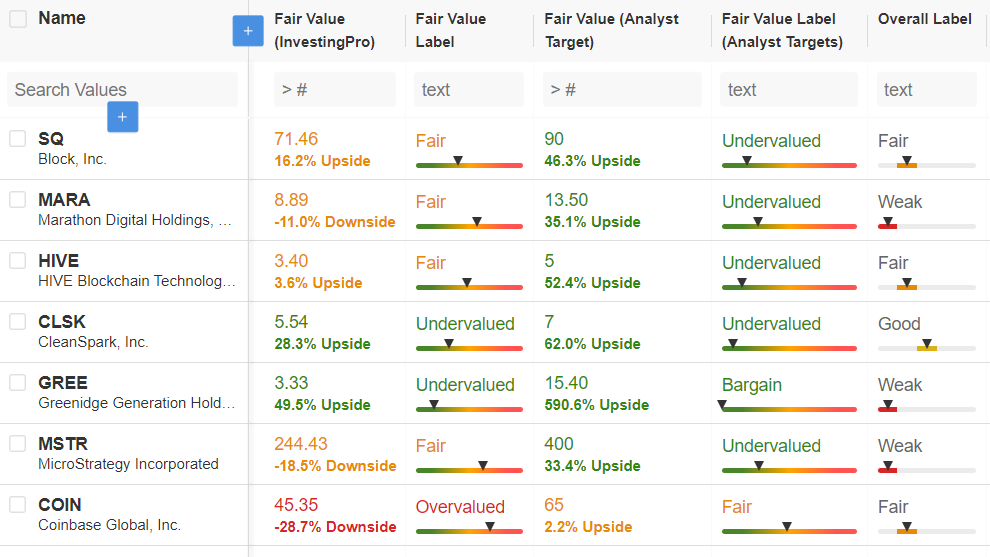

Source: InvestingPro, Watchlist screen

The list includes:

- Block (NYSE:) (payments and financial services)

- Marathon Digital Holdings (NASDAQ:) (blockchain technology and mining)

- HIVE Blockchain Technologies (NASDAQ:) (mining)

- CleanSpark (NASDAQ:) (sustainable crypto mining)

- Greenidge Generation Holdings (NASDAQ:) (energy, mining, and datacenter)

- MicroStrategy Incorporated (NASDAQ:) (Bitcoin investments from treasury)

- Coinbase Global (NASDAQ:) (one of the world’s leading crypto trading platforms)

When studying the profiles of these companies on InvestingPro, one immediately notices their low financial health scores, categorized as ‘fair’ or ‘weak.’

Investing in crypto stocks, therefore, carries risks, requiring careful allocation of a limited portion of your portfolio.

Most of these stocks, excluding Coinbase, are undervalued according to analysts, with one even considered a ‘bargain.’

Regarding Fair Value, which assesses cash flows, only two stocks are undervalued and exhibit significant bullish potential: CleanSpark and Greenidge Generation.

Greenidge boasts a phenomenal upside potential of 590%, according to analysts, and 49.6%, according to InvestingPro. However, its ‘weak’ financial health score warrants caution.

Therefore, our top pick is CleanSpark, offering a potential upside of 28.3% according to InvestingPro, and 62% according to analysts, with a ‘fair’ financial health score.

CleanSpark’s Business Model

CleanSpark primarily generates revenue through its Bitcoin mining operations. However, the company distinguishes itself by prioritizing sustainability and investing in clean energy sources.

Specifically, the company engages in sustainable Bitcoin mining by selecting locations with robust portfolios of low-carbon energy and participating in renewable energy credit programs.

It also develops advanced energy technology solutions for commercial and residential customers.

The Nevada-based company operates four Bitcoin mining facilities in Georgia and has established partnerships with other miners in upstate New York.

With growing investor emphasis on environmental preservation, the company’s commitment to clean mining becomes a significant advantage.

Furthermore, as a Bitcoin miner, CleanSpark’s revenues are expected to closely align with fluctuations in the Bitcoin price, making it an attractive option for those seeking direct exposure to the crypto’s movements.

CleanSpark’s Key Financial Metrics

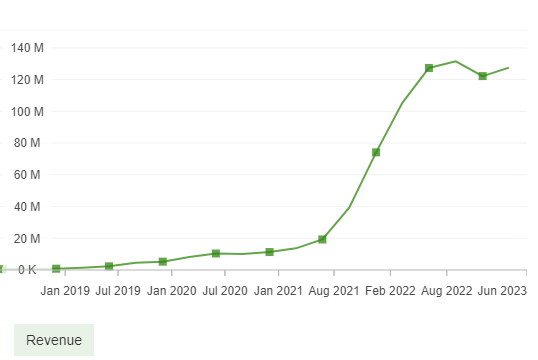

CleanSpark’s revenues surged in 2021 during Bitcoin’s bull market and remained stable despite the cryptocurrency’s sharp fall in 2022.

CleanSpark Revenue Trend

Source: InvestingPro, screen charts

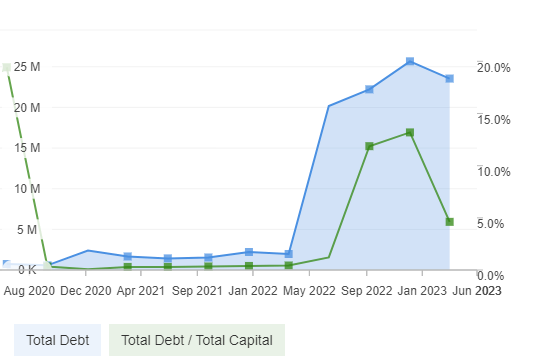

As the business requires heavy investment in hardware, debt is also a factor.

CleanSpark Debt

Source: InvestingPro, screen charts

And although the company began to take on debt in 2022, it remains pretty reasonable to date, amounting to no more than 4.6% of capital according to the latest published .

Conclusion

CleanSpark presents an enticing opportunity with its direct correlation to Bitcoin, strong revenue growth, and low debt. Analysts and valuation models also indicate significant upside potential for the stock.

Nevertheless, it is crucial to acknowledge the inherent risks associated with cryptocurrency investments. Investors should exercise caution, maintain a diversified portfolio, and allocate only a small portion to such stocks.

InvestingPro tools assist savvy investors in analyzing stocks, as we did in this article. By combining Wall Street analyst insights with comprehensive valuation models, investors can make informed decisions while maximizing their returns.

Start your InvestingPro free 7-day trial now!

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for information purposes only; it does not constitute a solicitation, offer, opinion, advice, or investment recommendation as such, nor is it intended to encourage the purchase of any assets in any way whatsoever. I would like to remind you that any type of asset is evaluated from multiple points of view and presents a high level of risk. Consequently, any investment decision and the associated risk remain the responsibility of the investor.