Pro Research of the Week: 3 Stocks Cathie Wood Is Betting Her Comeback on

2023.06.09 06:11

- Cathie Wood is hoping to bounce back with these stocks following a difficult couple of years

- Let’s delve deeper into these companies’ fundamentals with InvestingPro

- Looking for more top-rated stock ideas to protect your portfolio amid the increasingly uncertain economic climate? Members of InvestingPro get exclusive access to our research tools and data. Learn More »

Cathie Wood’s Ark Invest ETFs performed impressively in 2020 but declined in 2021 and 2022 as the toxic combination of higher capital costs and 40-year high inflation took a heavy toll on companies with high multiples, especially those in the technology sector.

But despite the prolonged downtrend, Wood maintained her strong belief in innovative strategies all along. Now that financial conditions appear to be starting to soften, she aims to make a comeback in 2023. Moreover, the technological revolution promised by the widespread use of Artificial Intelligence, which began earlier this year, could prove her right.

Against this backdrop, we looked at Ark Invest’s most recent purchases, namely:

- Coinbase Global (NASDAQ:)

- Rocket Lab USA (NASDAQ:)

- Cerus Corporation (NASDAQ:)

To find out whether it might be wise to emulate Ark’s recent purchases, we turned to the InvestingPro fundamental analysis tool to learn more about the stocks.

InvestingPro subscribers can do the same! Try it free for seven days.

Methodology

First, we added Coinbase, Rocket Lab, and Cerus to an InvestingPro Advanced Watchlist.

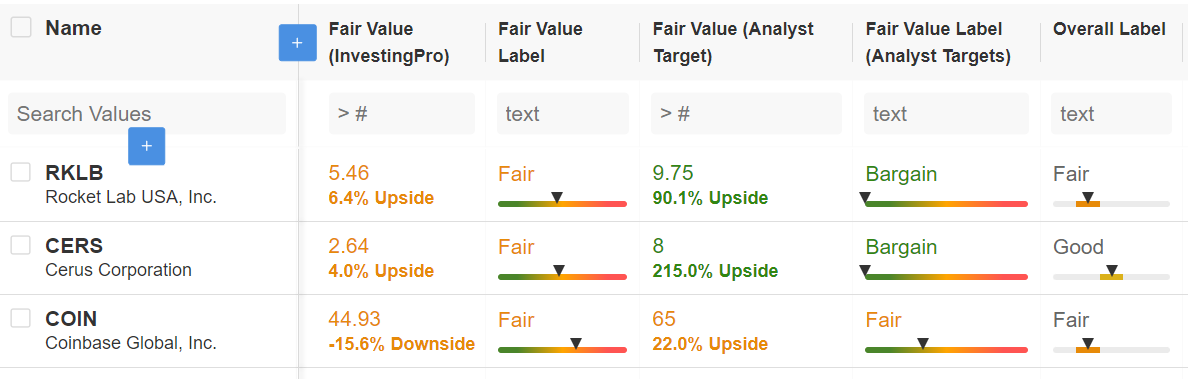

Cathie Wood Watchlist on InvestingPro

Cathie Wood Watchlist on InvestingPro

Source : InvestingPro

The first thing we notice is that Wood isn’t the only one optimistic about these three stocks. Indeed, analysts consider Rocket Lab and Cerus bargains, with average targets implying bullish potentials of 90.1% and 215%, respectively.

Coinbase, which has been in the spotlight this week as its share price plummeted in the face of the SEC’s announcement of proceedings against it, on the other hand, has a ‘fair’ valuation according to analysts, who still anticipate a 22% upside.

On the contrary, InvestingPro Fair Value, which combines various cash-flow-based models, suggests exercising more caution.

InvestingPro models rate the current valuations of Coinbase, Rocket Lab, and Cerus as ‘fair,’ with limited upside potential, or even negative in the case of Coinbase.

In addition, the financial health labels, which rate ‘fair’ for Rocket Lab and Coinbase and ‘good’ for Cerus, could be more reassuring.

However, this is not surprising. Ark Invest fund strategies are based on investing in advanced technologies and aim for very high returns by investing in often young companies that are not yet profitable or only marginally so (based on their EPS).

InvestingPro data shows that Rocket Lab and Cerus posted losses in the last reported quarter, while Coinbase a small profit after four consecutive quarters of losses.

However, this doesn’t mean that these are bad investments. Indeed, as seasoned investors know, it’s challenging to achieve high returns and a “first mover” advantage without accepting a certain level of risk-taking.

So, in the rest of this article, we’ll tell you more about the activity and revenue growth of the three stocks on which Cathie Wood’s Ark Invest funds strengthened this week.

1. Coinbase

Ark’s purchase of Coinbase shares this week was opportunistic. The stock had collapsed by 20% in 2 sessions on Monday and Tuesday as the SEC announced proceedings against it, a buying opportunity that Cathie Wood seized.

The largest crypto platform in the US, Coinbase, is seen by many investors as a backdoor way of exposing their portfolios to the cryptocurrency market.

And while the SEC lawsuit represents a threat, there’s no denying that it is one of the best large-cap stocks to bet on a potential cryptocurrency comeback.

Ark Invest’s bull case puts at $1.48 million by 2030.

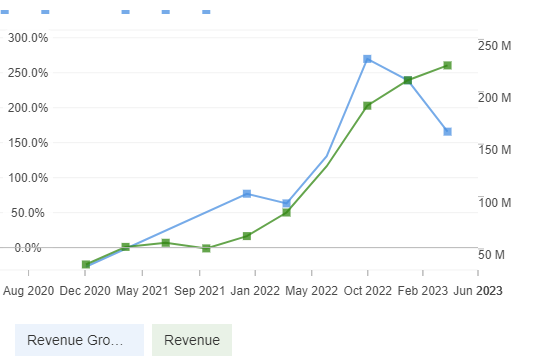

InvestingPro data shows that revenue growth has declined sharply since early 2022.

Coinbase Revenue

Source: InvestingPro

This is easily explained by the cryptocurrency bear market, which has reduced crypto traders’ activity on the Coinbase platform. In addition, nominal revenues have remained broadly stable, which is encouraging.

2. Rocket Lab

As InvestingPro points out, Rocket Lab USA is a space company that provides launch services and space systems solutions for the space and defense industries.

The company provides launch services, spacecraft design services, spacecraft components, spacecraft manufacturing and other spacecraft and in-orbit management solutions, constellation management services, and designing and manufacturing small and medium-sized rockets.

Rocket Lab is, therefore, a stock to bet on the space race, and unlike other stocks of the same type, it has the advantage of generating real, fast-growing revenues.

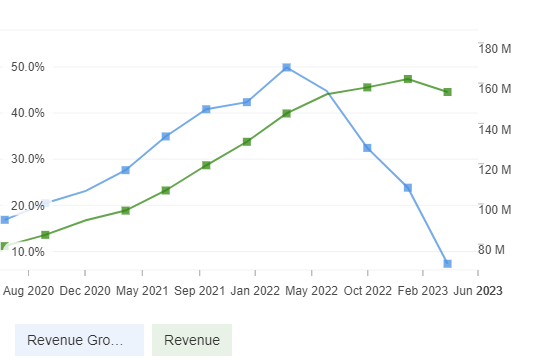

Rocket Lab Revenue

Source: InvestingPro

As seen from the InvestingPro chart above, revenue growth, although decelerating in recent quarters, has remained above 150% y/y, according to the latest .

And profitability could soon follow, with analysts estimating that the company should be profitable from 2026 onwards.

3. Cerus Corporation

Cerus Corporation is a biomedical products company. The company focuses on developing and commercializing the INTERCEPT Blood System to improve blood safety.

Its INTERCEPT Blood System is a patented biological replication control technology designed to reduce blood-borne pathogens in donated blood components intended for transfusion.

With a market capitalization of just $458 million, Cerus is one of the smallest companies in which Ark has invested.

Furthermore, InvestingPro data shows that the latest was difficult, with larger-than-expected losses for the second consecutive quarter.

In addition, revenue growth has shown a severe decline since the beginning of 2022, as seen in the graph below, with nominal revenues stagnating, which is anything but reassuring.

Cerus Revenue

Source: InvestingPro

However, the company believes it has now overcome the headwinds of the early part of the year and expects revenues to grow again for the remainder of 2023.

On Monday, the company was awarded an $8.7 million contract by the US Department of Defense for treatment for traumatic hemorrhage.

Although it may appear insignificant, this amount still holds weight compared to the company’s overall market cap.

Conclusion

These 3 are speculative stocks, coming from areas at the forefront of technology, as befits the company’s strategy.

Coinbase is exposed to the troubled cryptocurrency market, Rocket Lab is a bet on space conquest, and Cerus is developing advanced biotechnology with potentially far-reaching applications.

And for each of these fields, there are good reasons to be optimistic in the more or less long term. However, as we pointed out earlier in this article, low-risk and high-reward investments don’t exist.

Investors who are considering following Cathie Wood’s recent purchases should be aware of the high level of risk associated with these investments and consider portfolio allocation accordingly.

InvestingPro tools assist savvy investors in analyzing stocks. By combining Wall Street analyst insights with comprehensive valuation models, investors can make informed decisions while maximizing their returns.

Start your InvestingPro free 7-day trial now!

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or investment recommendation. As such, it is not intended to incentivize the purchase of assets in any way. I want to remind you that any asset is highly risky and evaluated from multiple points of view; therefore, any investment decision and the associated risk remain with the investor.