Private equity firm TPG reports 60% drop in earnings as asset sales plummet

2022.11.09 15:29

[ad_1]

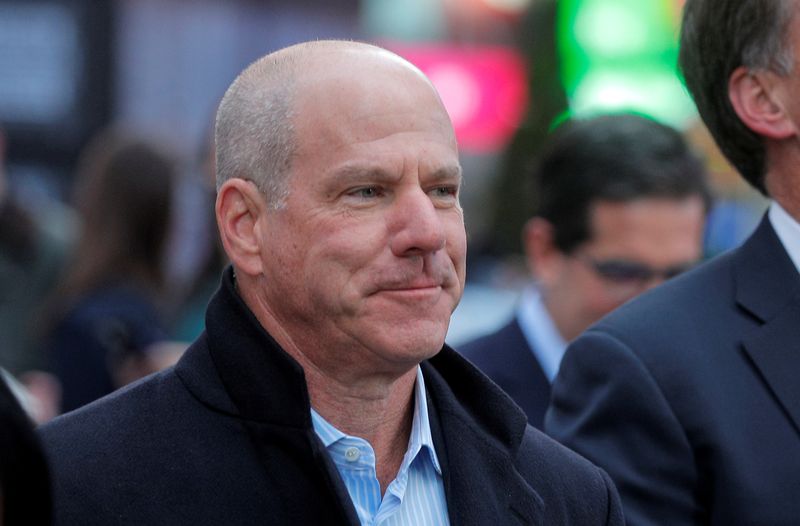

© Reuters. FILE PHOTO: Jon Winkelried, CEO of private-equity firm TPG, celebrates his company’s IPO outside the Nasdaq Market site in Times Square in New York City, U.S., January 13, 2022. REUTERS/Brendan McDermid/File photo

By Chibuike Oguh

NEW YORK (Reuters) -Private equity firm TPG Inc said on Wednesday its after-tax quarterly distributable earnings fell more than 60% due to a plunge in asset sales across its private equity, growth, real estate and impact businesses.

The Fort Worth, Texas-based firm said third-quarter after-tax distributable earnings, which represent the cash used to pay dividends to shareholders, fell to $113 million from $283 million a year ago.

However, TPG’s fee-related earnings, a closely watched measure that captures income from management fees, was flat at $121 million. That exceeded the average analyst forecast of $108 million, according to Refinitiv data.

TPG’s stock was up 7.72% at $34.88 per share, while the broader market was trading lower.

“What we’re seeing is that investors don’t care so much about performance fees but about fee-related earnings and its growth trajectory,” said BMO Capital Markets analyst Rufus Hone.

“Fee-related earnings is predictable; every dollar of fee-related earnings is worth $2 of performance fees,” Hone added.

TPG generated just $5 million of net performance fees stemming from asset divestments during the quarter, down significantly from $141 million a year earlier, as the firm held off from sales amid financial market volatility caused by higher interest rates and geopolitical tensions.

Blackstone (NYSE:) Inc, Carlyle Group (NASDAQ:) Inc, KKR & Co (NYSE:) Inc, and Apollo Global Management (NYSE:) Inc also reported declines in earnings owing to slower asset divestments and capital markets activity.

“We were a significant seller in much better market conditions for sellers. Our bias is to moderate our sales in this environment and focus on growing our companies,” TPG Chief Financial Officer Jack Weingart said.

During the quarter, TPG said its private equity funds appreciated by 2.3%, growth funds rose by 3.8% and impact funds were up 2.9%, though real estate funds depreciated by 0.4%.

Under generally accepted accounting principles, TPG reported net income of $53.2 million, down 74% from $205.1 million, driven by a sharp drop in investment gains.

“Our posture is the same, which is we think this is still an interesting environment with the right opportunities for investing,” TPG Chief Executive Jon Winkelried said.

TPG said it raised $8.2 billion of new capital, spent $2.5 billion on acquisitions, generated fee-related earnings of $121 million, retained $46.4 billion of unspent capital, and declared a dividend of 26 cents per share.

Total assets under management stood at $135.1 billion, up 7% from the prior quarter, driven by strong fundraising.

[ad_2]

Source link