Pre-Open Movers: Okta Sinks on Disappointing Results, Nutanix Gains on Solid Beat

2022.09.01 16:50

Pre-Open Movers: Okta Sinks on Disappointing Results, Nutanix Gains on Solid Beat

Pre-Open Stock Movers:

Okta, Inc. (NASDAQ:OKTA) 21% LOWER; reported Q2 EPS of ($0.10), $0.21 better than the analyst estimate of ($0.31). Revenue for the quarter came in at $452 million versus the consensus estimate of $430.64 million. Okta, Inc. sees FY2023 EPS of ($0.73)-$0.70. Okta, Inc. sees FY2023 revenue of $1.81-1.82 billion, versus the consensus of $1.82 billion.

Nutanix (NASDAQ:NTNX) 18% HIGHER; reported Q4 EPS of ($0.17), $0.21 better than the analyst estimate of ($0.38). Revenue for the quarter came in at $385.5 million versus the consensus estimate of $355.3 million. Nutanix sees Q1 2023 revenue of $410-415 million, versus the consensus of $372.63 million. Nutanix sees FY2023 revenue of $1.77-1.78 billion, versus the consensus of $1.66 billion.

C3 Ai (NYSE:AI) 16% LOWER; reported Q1 EPS of ($0.12), $0.12 better than the analyst estimate of ($0.24). Revenue for the quarter came in at $65.3 million versus the consensus estimate of $66.02 million. C3.ai sees Q2 2023 revenue of $60-62 million, versus the consensus of $71.7 million. C3.ai sees FY2023 revenue of $255-270 million, versus the consensus of $310.58 million.

AnaptysBio, Inc. (NASDAQ:ANAB) 15% LOWER; announced top-line data from its HARP Phase 2 trial for the treatment of moderate-to-severe hidradenitis suppurativa (HS). The trial indicated imsidolimab was safe and well tolerated, however, did not demonstrate efficacy over placebo in the trial’s primary endpoint and key secondary endpoints. Clinical development of imsidolimab is being discontinued in hidradenitis suppurativa.

MongoDB (NASDAQ:MDB) 15% LOWER; reported Q2 EPS of ($0.23), $0.05 better than the analyst estimate of ($0.28). Revenue for the quarter came in at $303.7 million versus the consensus estimate of $284.37 million. MongoDB sees Q3 2023 EPS of ($0.19)-($0.16), versus the consensus of ($0.14). MongoDB sees Q3 2023 revenue of $300-303 million, versus the consensus of $294.85 million. MongoDB sees FY2023 EPS of ($0.35)-($0.28), versus the consensus of ($0.21). MongoDB sees FY2023 revenue of $1.196-1.206 billion, versus the consensus of $1.19 billion.

Veeva Systems (NYSE:VEEV) 12% LOWER; reported Q2 EPS of $1.03, $0.02 better than the analyst estimate of $1.01. Revenue for the quarter came in at $534.2 million versus the consensus estimate of $530.71 million. Veeva Systems sees FY2023 EPS of $4.17. Veeva Systems sees FY2023 revenue of $2.14-2.145 billion, versus the consensus of $2.17 billion.

Pure Storage, Inc. (NYSE:PSTG) 8% HIGHER; reported Q2 EPS of $0.32, $0.10 better than the analyst estimate of $0.22. Revenue for the quarter came in at $646.8 million versus the consensus estimate of $636.04 million. Pure Storage, Inc. sees Q3 2023 revenue of $670 million, versus the consensus of $651.62 million. Pure Storage, Inc. sees FY2023 revenue of $2.75 billion, versus the consensus of $2.64 billion.

Semtech (NASDAQ:SMTC) 7% LOWER; reported Q2 EPS of $0.87, $0.02 better than the analyst estimate of $0.85. Revenue for the quarter came in at $209.3 million versus the consensus estimate of $208.29 million. Semtech sees Q3 2023 EPS of $0.60-$0.66, versus the consensus of $0.90. Semtech sees Q3 2023 revenue of $170-180 million, versus the consensus of $215.61 million.

Build-A-Bear Workshop (NYSE:BBW) 6% LOWER; reported Q2 EPS of $0.38, $0.07 worse than the analyst estimate of $0.45. Revenue for the quarter came in at $100.7 million versus the consensus estimate of $96.67 million. Build-A-Bear Workshop sees FY2022 revenue of $440-460 million, versus the consensus of $454.5 million.

Ollie’s Bargain Outlet (NASDAQ:OLLI) 6% LOWER; reported Q2 EPS of $0.22, $0.11 worse than the analyst estimate of $0.33. Revenue for the quarter came in at $452.5 million versus the consensus estimate of $456.38 million. Ollie’s Bargain Outlet sees Q3 2022 EPS of $0.39-$0.43. Ollie’s Bargain Outlet sees Q3 2022 revenue of $426-434 million, versus the consensus of $430.03 million. Ollie’s Bargain Outlet sees FY2022 EPS of $1.74-$1.79. Ollie’s Bargain Outlet sees FY2022 revenue of $1.843-1.861 million, versus the consensus of $1.88 million.

Five Below (NASDAQ:FIVE) 5% HIGHER; reported Q2 EPS of $0.74, $0.05 worse than the analyst estimate of $0.79. Revenue for the quarter came in at $668.9 million versus the consensus estimate of $682.26 million. Five Below sees Q3 2022 EPS of $0.08-$0.19, versus the consensus of $0.29. Five Below sees Q3 2022 revenue of $600-619 million, versus the consensus of $636.5 million. Five Below sees FY2022 EPS of $4.26-$4.56, versus the consensus of $4.83. Five Below sees FY2022 revenue of $2.97-3.02 billion, versus the consensus of $3.07 billion.

Hormel Foods (NYSE:HRL) 5% LOWER; reported Q3 EPS of $0.40, $0.01 worse than the analyst estimate of $0.41. Revenue for the quarter came in at $3 billion versus the consensus estimate of $2.99 billion. Hormel Foods sees FY2022 EPS of $1.78-$1.85, versus the prior of $1.87-$1.97 and the consensus of $1.88. Hormel Foods sees FY2022 revenue of $12.2-12.8 billion, versus the prior of $11.7-12.5 billion and consensus of $12.45 billion.

NVIDIA (NASDAQ:NVDA) 5% LOWER; concerns about new U.S restrictions on chip exports to China

Culp, Inc. (NYSE:CULP) 4% LOWER; reported Q2 EPS of ($0.47), $0.42 worse than the analyst estimate of ($0.05). Revenue for the quarter came in at $62.6 million versus the consensus estimate of $69.64 million.

Greif, Inc. (NYSE:GEF) 3% HIGHER; reported Q3 EPS of $2.35, $0.35 better than the analyst estimate of $2.00. Revenue for the quarter came in at $1.62 billion versus the consensus estimate of $1.6 billion. Greif Inc sees FY2022 EPS of $7.90-$8.10.

SentinelOne, Inc. (NYSE:S) 2% LOWER; reported Q2 EPS of ($0.20), $0.05 better than the analyst estimate of ($0.25). Revenue for the quarter came in at $102.5 million versus the consensus estimate of $95.67 million. SentinelOne , Inc. sees Q3 2023 revenue of $111 million, versus the consensus of $108.2 million. SentinelOne, Inc. sees FY2023 revenue of $415-417 million, versus the consensus of $406.23 million.

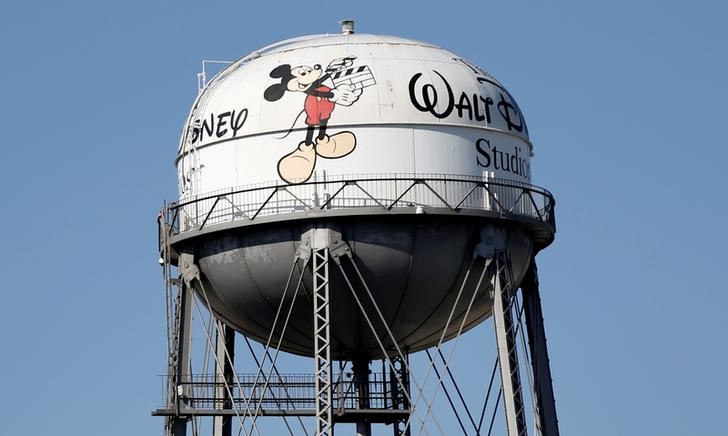

Walt Disney (NYSE:DIS) 2% HIGHER; Explores Amazon (NASDAQ:AMZN) Prime-Like Membership Program to Offer Discounts and Perks — WSJ

Baidu (NASDAQ:BIDU) 1% HIGHER; JPMorgan upgraded from Neutral to Overweight with a price target of $200.00 (from $160.00).

Netflix (NASDAQ:NFLX) 1% HIGHER; looking to charge advertisers premium prices, aims for Nov. 1 launch of ad-supported tier – WSJ