Powell remarks watched for sign of pushback or support of Fed rate cut

2024.12.04 11:23

By Howard Schneider

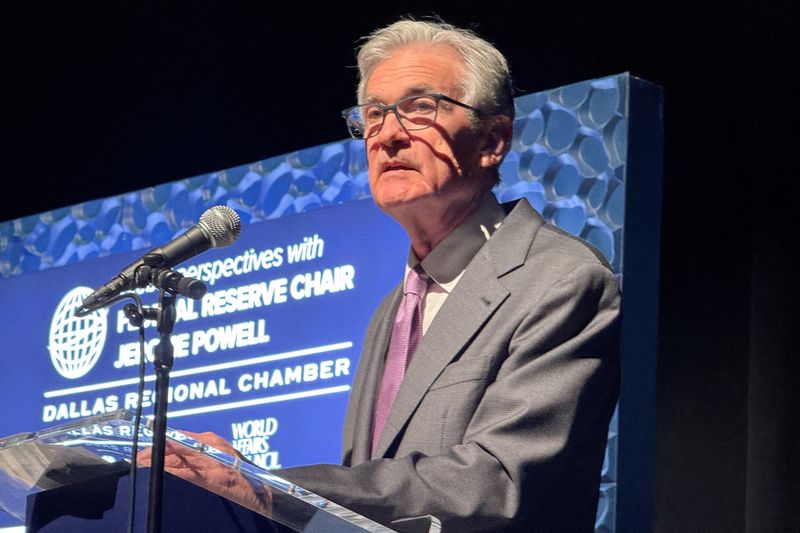

NEW YORK (Reuters) – U.S. Federal Reserve Chair Jerome Powell speaks on Wednesday with key jobs data due Friday, a “quiet” period for Fed officials ahead of the Dec. 17-18 meeting beginning on Saturday, and investors leaning into an expectation for a third straight interest rate cut when the central bank meets in two weeks.

Comments by some of Powell’s key colleagues this week pointed in that direction, with Governor Christopher Waller saying on Monday he was “leaning toward” a cut at the upcoming meeting even as others decline to pre-commit to that outcome.

Powell’s remarks in a 1:45 EST (1845 GMT) interview at a New York Times (NYSE:) event may be less demonstrative, but could still bolster expectations for a cut as long as he doesn’t say anything to directly undermine the idea.

When he said in mid-November that the Fed could “carefully” deliberate over its rate cuts and need not be in a hurry, it seemed to make a December rate reduction less likely – at least in the minds of market participants who pushed down the odds to near 50-50.

Inflation and jobs data since then, and Waller’s comments in particular, have now put the odds back at nearly 4-to-1 in favor of a quarter-point cut in the benchmark rate to a range of 4.25% to 4.50%.

“The question is whether (Powell) again does something, intentionally or not, that appears to either push back on or reinforce market expectations,” analysts from LH Meyer, including former Fed Governor Larry Meyer, wrote ahead of Powell’s appearance. “We don’t see what would motivate Powell to attempt a pointed signal. The market expects a cut in December, but it still attaches a substantial probability to a hold. That seems like a setup that wouldn’t bother Powell.”

The Fed chair in fact has pressed on the need for the central bank to keep its options open at a time of increased uncertainty about the shape of broader economic policy in the coming year, some concern that its progress on inflation has stalled, and evidence that a feared drop-off in the job market has been avoided.

Earlier on Wednesday, two other Fed officials – the heads of the regional banks in Richmond and St. Louis – hewed to that keep-all-options-open approach.

“I’m keeping all my options open,” St. Louis Fed President Alberto Musalem said at a Bloomberg monetary policy conference, adding he will look at incoming data before deciding whether rates need to come down again in two weeks.

Richmond Fed President Thomas Barkin said at the CNBC CFO Council he believes both inflation and employment are heading in the right direction, but with more data to come before the meeting, he won’t prejudge the outcome.

A key measure of inflation, the personal consumption expenditures price index excluding food and energy costs, has run sideways in a range of from 2.6% to 2.8% since May, well above the central bank’s 2% target. While Fed officials routinely say they feel price pressures are still set to ease, with housing costs in particular slowing in real time but not yet reflected in lagging government data, they also will want proof of that before cutting rates much further.