Powell green lights September rate cut

2024.08.23 10:59

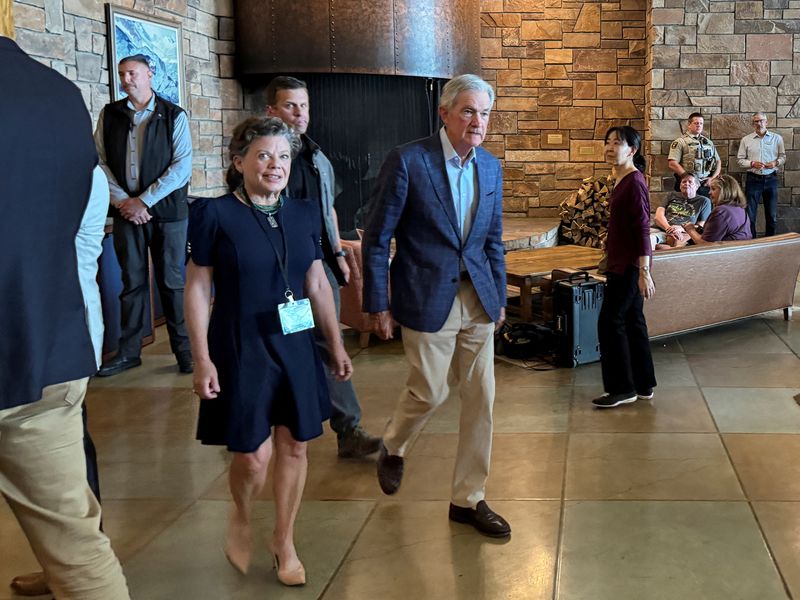

(Reuters) – Federal Reserve Chair Jerome Powell said on Friday “the time has come” for the U.S. central bank to cut interest rates as rising risks to the job market left no room for further weakness and inflation was in reach of the Fed’s 2% target, offering an explicit endorsement of an imminent policy easing.

“The upside risks to inflation have diminished. And the downside risks to employment have increased,” Powell said in a highly anticipated speech to the Kansas City Fed’s annual economic conference in Jackson Hole, Wyoming. “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

STOCKS: The extended a gain to 0.92%

BONDS: The yield on benchmark U.S. 10-year notes fell and was at 3.812%The yield fell to 3.955%.

FOREX: The turned 0.394% lower

COMMENTS:

PETER CARDILLO, CHIEF MARKET ECONOMIST, SPARTAN CAPITAL SECURITIES, NEW YORK

“Powell is on the dovish side, saying there’s ample room to respond to any risk we may face. I think that’s the key.”

“What he’s suggesting here is if the labor market continues to weaken, we’re looking at a 50-basis-point rate cut in September as opposed to 25.”

“’The time has come for policy to adjust,’ and ‘we do not seek or welcome further cooling in labor market conditions.’ That’s another key point and it tells me we’re looking at a 50 bp cut in September.“

“He seems that he’s responding to the big benchmark revision we had the other day.”

“He’s also saying that confidence has grown that inflation is on its way back down to 2%. This is a dovish Powell today, and we see markets responding accordingly.”

“I think we’ll have two cuts, a total 75 bp this year, especially if the labor report for august should indicate further weakness.”

MARC CHANDLER, CHIEF MARKET STRATEGIST, BANNOCKBURN GLOBAL FOREX, NEW YORK

“I think initially the market is really going to be dovish, taking interest rates down and taking the dollar down. I’m still not sure that this is going to stick. I think that I don’t really see him telling us anything that we didn’t really know.”

“He’s basically saying that the magnitude is going to be driven by the data, and as you look at what’s likely in the jobs data and the CPI before the Fed meets, and the general tone, I don’t see a strong sense of urgency or panic that a 50-basis point cut would seem to imply.”

KIM FORREST, CHIEF INVESTMENT OFFICER, BOKEH CAPITAL PARTNERS, PITTSBURGH

“It seems like while we’re walking through the economy’s history over the last couple of years, it seems we have come to a point where the Fed needs to be more accommodative and the markets are reacting to that.”

“Everything that (Powell) has ever told us is that it’s data driven. They are not going to immediately lower rates.”

“Especially on Bostic’s comments, and they all know what the script is and stick to it, he was fairly dovish especially when it came to what the real rate is. He said it is restrictive. These comments point to cuts beginning and the market is nodding it’s head in agreement.”