Pound Sterling Has Passed Its Bottom Despite UK Job Market Data

2022.10.11 08:23

[ad_1]

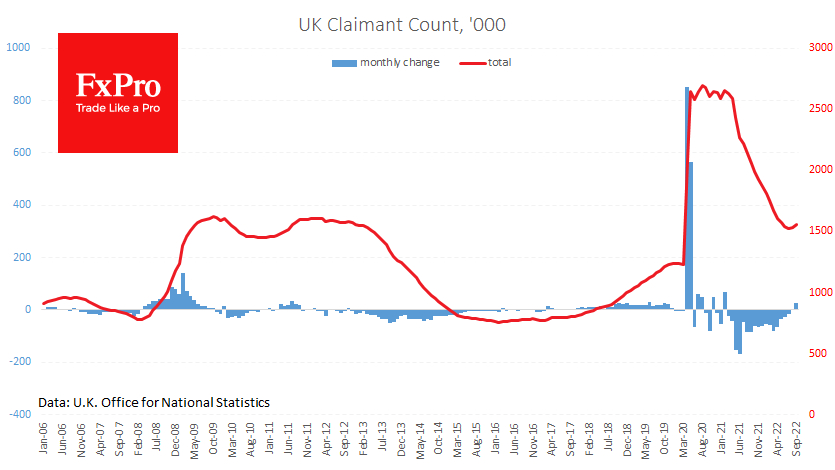

A fresh batch of UK labor market data points to a turn for the worse, foreshadowing an economic slowdown sooner than in Europe or the USA.

The Claimant count in September rose by 25.5k

The Claimant count in September rose by 25.5k

The in September rose by 25.5k after a nominal increase of 1.1k a month earlier. This is a much more substantial increase than the expected 4.2k and demonstrates an apparent reversal in the trend.

Just over 1.5M people in the UK are now receiving benefits, not far from the highs of the 2009-2013 period and 0.3m higher than before the pandemic. So, the cycle in the labor market here has reversed without ever reaching the point of full recovery.

In this context, the fell to 3.5% – the lowest since 1974 – resulting from an exit from the labor force rather than a tight labor market.

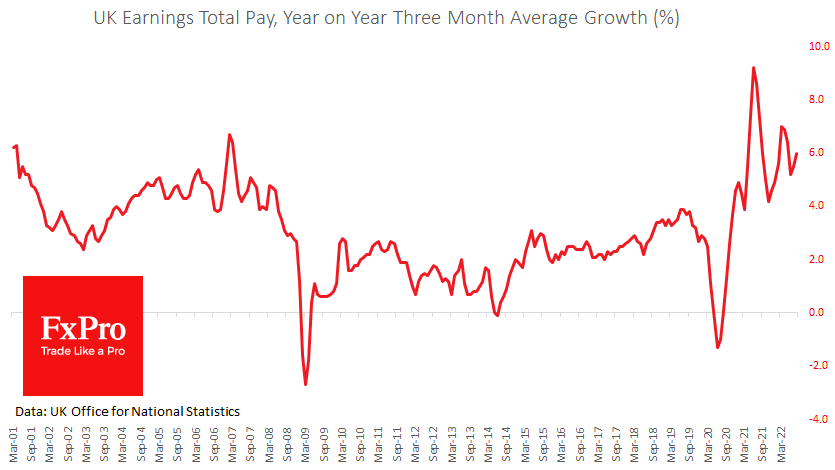

UK Earnings Total Pay rose by 6%

UK Earnings Total Pay rose by 6%

In the three months to August, wages, , rose by 6% to the same period a year earlier – a marked acceleration from 5.5% the month before. This attempt to catch up with , which stood at 9.9% YoY in August, is triggering the increase in the claimant count we mentioned above.

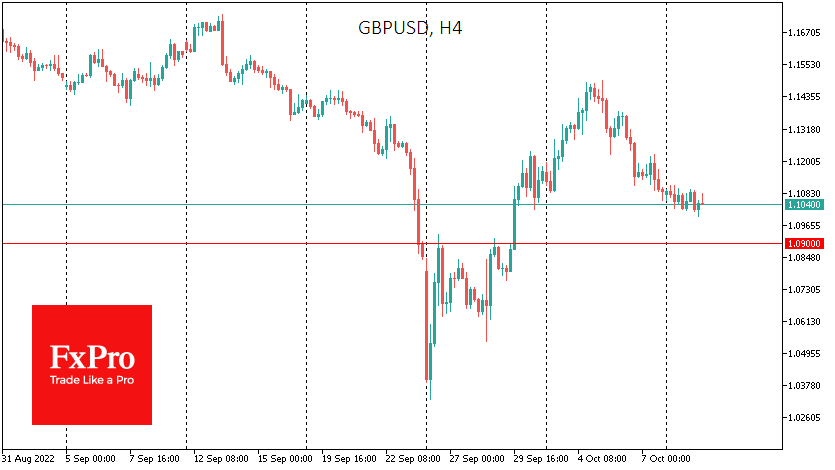

Meanwhile, is declining for the fifth consecutive trading session on the FX market. The initial downward momentum in the pair after the employment data came up against moderate buying around 1.10, a psychologically crucial round level. For now, however, it is unlikely that Pound buyers have enough strength at this stage to reverse the trend of recent days.

GBPUSD is declining for the fifth consecutive trading session

GBPUSD is declining for the fifth consecutive trading session

A glance at the short-term dynamics of GBP/USD allows us to expect more buying activity at 1.0900, where local resistances of Sept. 26 and 28 are located and where the rapid growth of Sept. 29 started.

Despite the worsening macroeconomic backdrop for the pound, many problematic expectations may already be embedded in the pound’s quotes. If we are right, a period of consolidation could start for GBP/USD, as it did from April to May 2020 or from October 2016 to January 2017, followed by a reversal to growth.

[ad_2]

Source link