Pound Sterling Falls As Inflation Rises

2022.10.19 15:22

[ad_1]

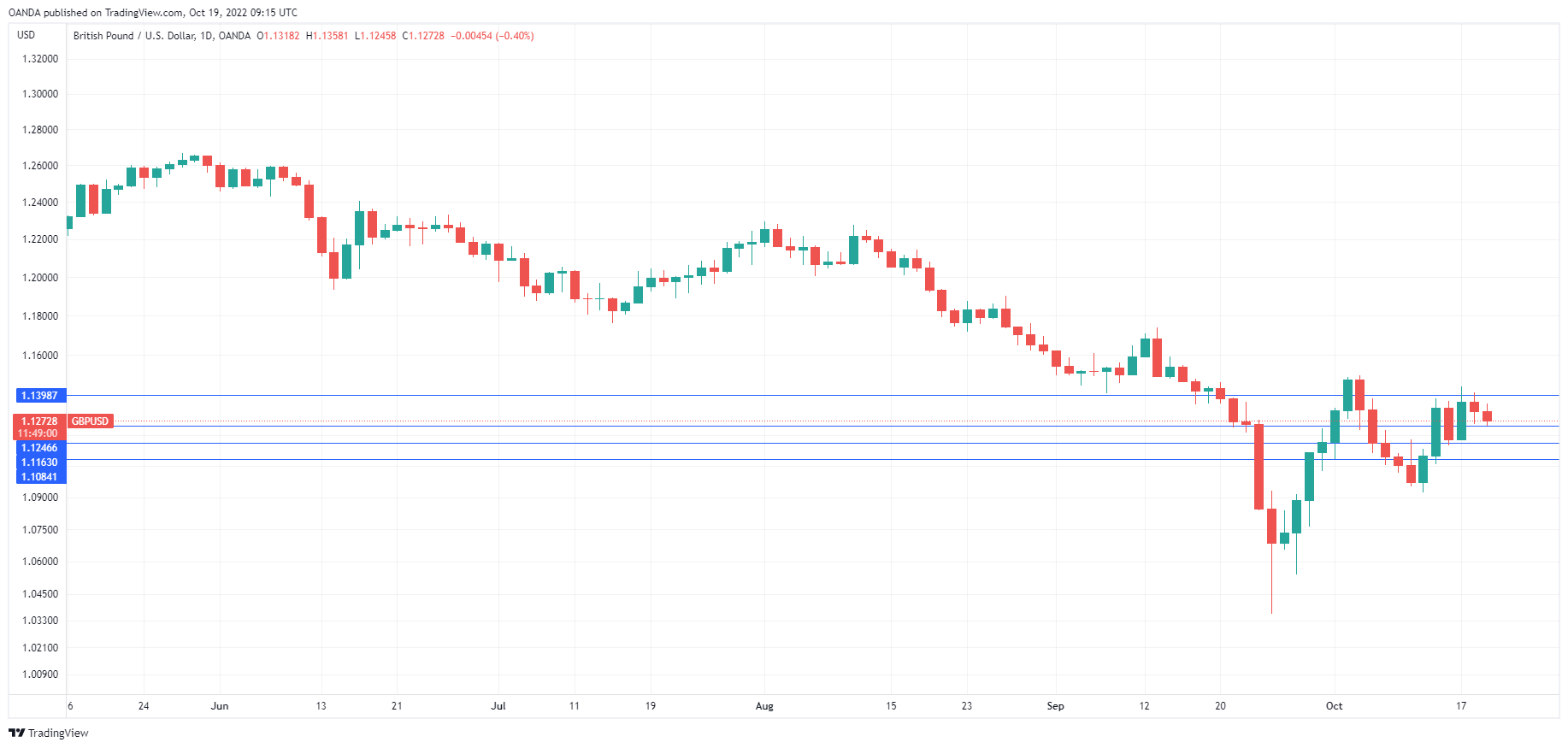

is in negative territory today. In the European session, the pound is trading at 1.1261, down 0.48%.

Inflation rises to double-digits

UK rose to 10.1% in September, up from 9.9% in August and above the consensus of 10.0%. It was a similar story from , which edged up to 6.5%, up from 6.4% and higher than the forecast of 6.3%. A return to double-digit inflation is certainly not something the Bank of England wanted to see. Inflation is not showing any signs of peaking, which leaves no doubt that the BoE will have to continue to raise interest rates.

The cash rate remains relatively low at 2.25% in comparison with the Federal Reserve (3.25%) and other major central banks. The cash rate will likely hit 4% or even higher by mid-2023, which means some oversize rate hikes are on the way. The BoE meets next on Nov. 3 and policy makers will need to deliver a hike of 0.75% or a full point in order to maintain credibility. The recent political maelstrom, in which Chancellor Hunt has abolished most of the planned tax cuts and signalled spending cuts instead, means that the BoE may not have to act as aggressively as anticipated just a few weeks ago.

A key point in the fiscal U-turn provided by Hunt is the energy cap plan. The cap, which was supposed to remain in place for two years, has been scaled down to just six months. Higher energy bills for households will mean higher inflation unless energy falls substantially in the winter.

The economic outlook for the UK does not look all that bright, which will likely be reflected in a weaker British pound. Goldman Sachs has downgraded its UK growth outlook, with the economy expected to decline by 1% in 2023, worse than the previous estimate of -0.4%.

GBP/USD Technical

- GBP/USD faces resistance at 1.1373 and 1.1455

- There is support at 1.1214 and 1.1085

Original Post

[ad_2]