Petrobras: 35% Dividend? Still Not Worth The Risk

2022.10.26 17:40

[ad_1]

- Petrobras’ latest dividend is unprecedented, making for a 35% dividend yield

- The run-off presidential election set for October 30th poses enormous risks to the company, as leftist candidate Lula da Silva maintains his lead

- Should the political risk coincide with a heavy downturn, Petrobras would quickly be drained of its free cash flow

Intro

A glance at its financials will tell you that Petrobras (NYSE:) is doing well, producing record levels of free cash flow which allow it to distribute earnings to shareholders, who have been promised an unprecedented R$6.73/share dividend for the second quarter, making for a 35% dividend yield (annualized). Despite the potential payout, the upcoming elections in Brazil and the fragile macro environment pose serious risks to the name. Should the political and economic risks coincide – which seems more likely by the day – Petrobras would be drained of its free cash flow and shareholders would be left out to dry.

Business

Petrobras – Brazil’s partially state-owned oil producer and refiner – owns very high-quality upstream assets that are proving to be incredibly profitable in the current macro environment. It’s world-class crude warrants premium prices on the global market, also making it more resilient in downcycles. Petrobras boasts an attractive combination of large reserves and low production costs that make their deposits profitable at oil prices as low as $30 per barrel.

Given the government’s majority stake (29%), Petrobras must often balance political objectives with financial objectives. For example, it is not uncommon for Petrobras to offer discounts on their domestic products to win over politicians. Given their political nature, the local refining and marketing businesses contribute to the company’s bottom line far less than the upstream business.

Despite the political constraints holding the firm back from maximizing profits in its downstream operations, it remains very profitable with much of that margin translating into strong free cash flow generation.

Financials

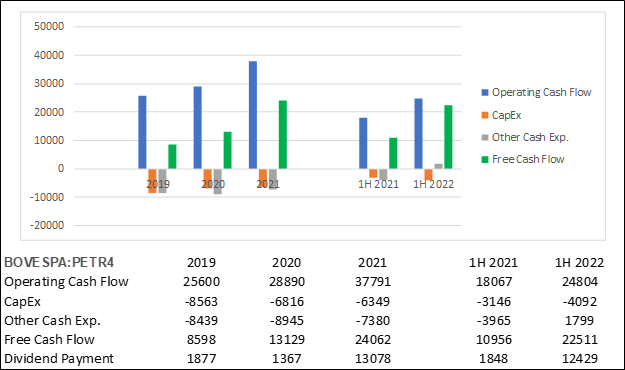

Petrobras’s Financials

Source: InvestingPro (Figures in USD)

The spike in oil and gas prices we saw in 2Q22 saw Petrobras report that beat the already record numbers of 1Q22. Operating cash flow more than doubled from $10.3b to $24.8b, a 37% increase on 1H21. In the first half of 2022, shareholders saw a free cash flow of $22.5b, with more than 70% of that being generated in the second quarter alone. Petrobras has also managed to keep its profit margins above that of other oil producers with similar production levels.

In terms of debt, the company has made its balance sheet substantially healthier over the last 8-10 years. As of this year’s second quarter, net debt stood at $34b, down from $53 billion last year. Debt to EBITDA is also near all-time lows, at only 0.5x (on $65b est. EBITDA). Given Petrobras’ free cash generation, these debt levels are far from worrisome.

This strong financial performance has led Petrobras to announce an unprecedented dividend which has attracted the attention of many investors, myself included.

Dividend

Petrobras announced a R$6.73/share dividend for its second quarter, or $1.28/share at current rates. On an annualized basis, that translates to roughly $5/share, making for a 35% dividend yield.

Petrobras has paid out $8.3b of its $12.8b in free cash for the second quarter. A $5/share dividend for FY22 would cost the oil producer ∼$32.2b – considering free cash flows of $22.5b for 1H alone, it should be covered easily.

For those who bought before the ex-dividend date, bravo. For those who bought after or are looking to buy, I suggest taking a careful look at the future – it doesn’t look too bright.

Risks

Presidential Race

On October 2nd, more than half of Brazil voted in the first round of their presidential elections. Incumbent President Jair Bolsonaro – a right-wing populist who has been in power since 2019 – did better than expected, garnering 43% of the vote. His main opponent, the former leftist president Luiz Inácio Lula da Silva (commonly known as Lula), won 48%. All polls indicated Lula would come in at a greater advantage. The two will go to a runoff election on October 30th, with Lula and his Workers’ Party still favored.

in Brazil is currently in the high single digits and conditions are becoming increasingly difficult. It is unlikely for the company to distribute billions in dividends while the population of Brazil suffers from shortages. No matter who wins, some degree of political pressure on Petrobras is a given. For investors, this poses a significant risk.

The government-linked oil producer has already been called out by both sides. During his election campaign, Bolsonaro has often fired shots against Petrobras, claiming that the company is systematically working against the Brazilian population and calling the company’s profits “absurd.” Though the president has momentarily chosen to refrain from directly intervening in Petrobras operations, it is hard to imagine a scenario where – in case of a win – he does not move against Petrobras in some way (e.g. windfall tax).

A potential leftist government might rock the boat even more. Given his comments in recent weeks, it is almost certain Lula will pressure Petrobras to lower gasoline and diesel prices in Brazil, further reducing the profitability of Petrobras’ downstream business. As election day approaches, he is increasingly calling for a separation of local oil prices from the world market. In Lula’s words: “I cannot make an American shareholder richer and impoverish a local housewife that will pay more for a bag of beans because gasoline prices have gone up.” The leftist candidate has also mentioned plans to increase Petrobras’ refining capacity, possibly forcing higher costs on Petrobras. Though it remains too early to pinpoint the extent to which future government policies might impact Petrobras’ financial performance, there is only downside risk.

Though not almost as serious, the current macro environment is also a risk to consider. I believe the downturn is already correctly priced in, but there is room for dividend and earnings misses should the market anticipate a worse-than-expected global recession. Not only this, but a serious downturn could also magnify the risks related to government intervention, as politicians would most likely shield the Brazilian population at the cost of Petrobras shareholders.

Conclusion

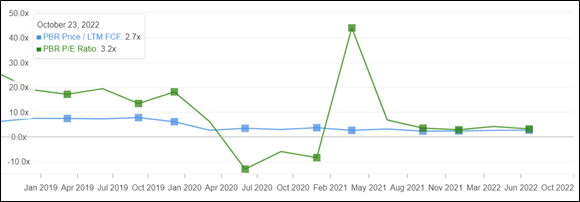

*Historical Multiples – P/LTM FCF, P/E. Source: InvestingPro*

PBR’s historical multiples

Trading at 2.7x P/LTM FCF and 3.2x P/NTM EPS, Petrobras is relatively cheap. Still, this doesn’t mean the stock price will move back up. The concern regarding the upcoming election is clearly impacting the stock, and rightly so. Only days from the final run-off, former leftist president Lula seems to be in the lead. Given his comments on price ceilings and forced refining capacity increases, a Workers’ Party win would be a serious blow to Petrobras. That said, a Bolsonaro win wouldn’t be advantageous either. Despite the low multiples and high dividend yield, the political uncertainty combined with a bleak macro outlook make the downside risk significantly greater than the upside. It’s not the right time to buy Petrobras.

Disclosure: The author does not currently hold a position in Petróleo Brasileiro S.A. – Petrobras. This article is written for informational purposes only. It does not constitute a solicitation, offer, advice, counseling, or an investment recommendation.

***

Looking to get up to speed on your next idea? With InvestingPro+, you can find:

- Any company’s financials for the last 10 years

- Financial health scores for profitability, growth, and more

- A fair value calculated from dozens of financial models

- Quick comparison to the company’s peers

- Fundamental and performance charts

And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »

[ad_2]

Source link