Pent-Up Demand for Travel Takes Hold: Are These ETFs and Stocks Still a Good Buy?

2023.07.27 07:14

- Travel sector ETFs and individual stocks have bounced back strongly so far this year

- And, the sector is expected to have a good summer too

- Despite the surge, some stocks and ETFs could still offer some upside as the rebound continues

After the coronavirus pandemic, people were eager to catch up and get back to normalcy, and this was clearly reflected in their desire to travel again.

The travel sector, which faced significant challenges due to mobility restrictions, has now fully recovered and looks poised for more growth as the busy summer season brings record-breaking numbers of flights and peak levels of hotel bookings across the globe.

So, how can we make the most of this opportunity? Let’s check out some sector funds and stocks that are flying high.

Travel ETFs

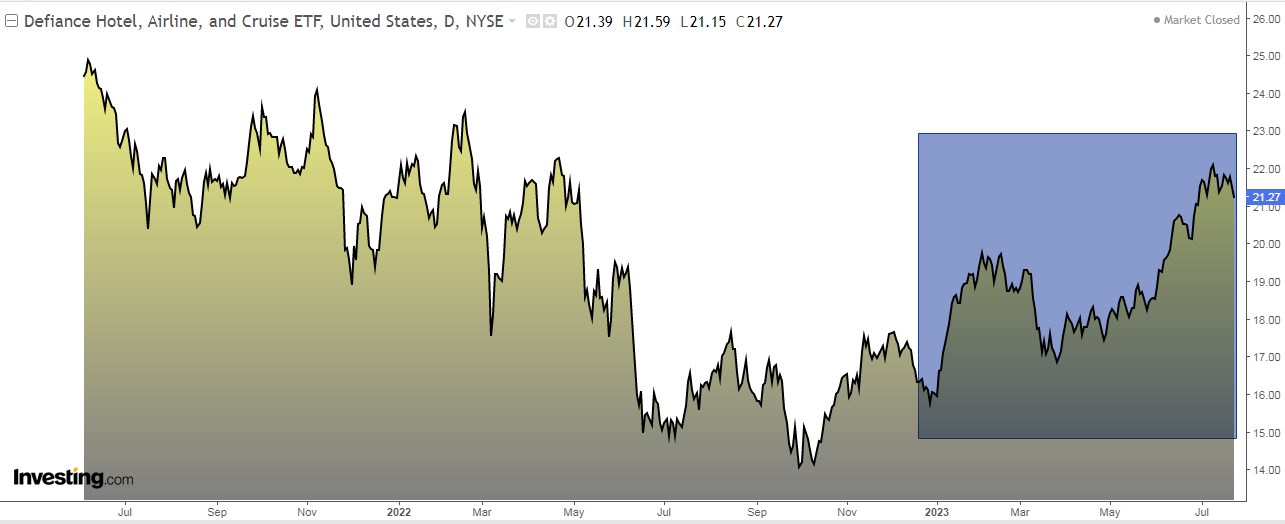

1. Defiance Hotel, Airline, and Cruise ETF

The Defiance Hotel, Airline, and Cruise ETF (NYSE:) was established in 2021 and comes with a manageable fee of 0.45%. This fund aims to mirror the performance of the BlueStar Global Hotels, Airlines, and Cruises index.

The index consists of publicly traded companies from around the world, all of which generate at least 50% of their revenues from the passenger airline, hotel and resort, or cruise industries.

So, by investing in this ETF, you can gain exposure to a diverse range of companies within these sectors.

ETF Defiance Hotel Daily ChartAmong its top stocks, the 10 with the highest weighting are:

ETF Defiance Hotel Daily ChartAmong its top stocks, the 10 with the highest weighting are:

- Carnival Corporation (NYSE:) 7.75%

- Delta Air Lines (NYSE:) 7.62%

- Marriott International (NASDAQ:) 7.57%

- Hilton Worldwide Holdings Inc (NYSE:) 7.45%

- Royal Caribbean Cruises Ltd (NYSE:) 6.46%

- United Airlines Holdings Inc (NASDAQ:) 4.15%

- Southwest Airlines Company (NYSE:) 4.08%

- Ryanair Holdings PLC ADR (NASDAQ:) 3.76%

- Norwegian Cruise Line Holdings Ltd (NYSE:) 3.40%

- American Airlines (NASDAQ:) 2.84%

Over the past 12 months, this ETF has generated a positive return of 42.23%. Additionally, 9 stocks within the ETF have experienced an increase of over 46% this year, including Carnival, and Royal Caribbean Cruises.

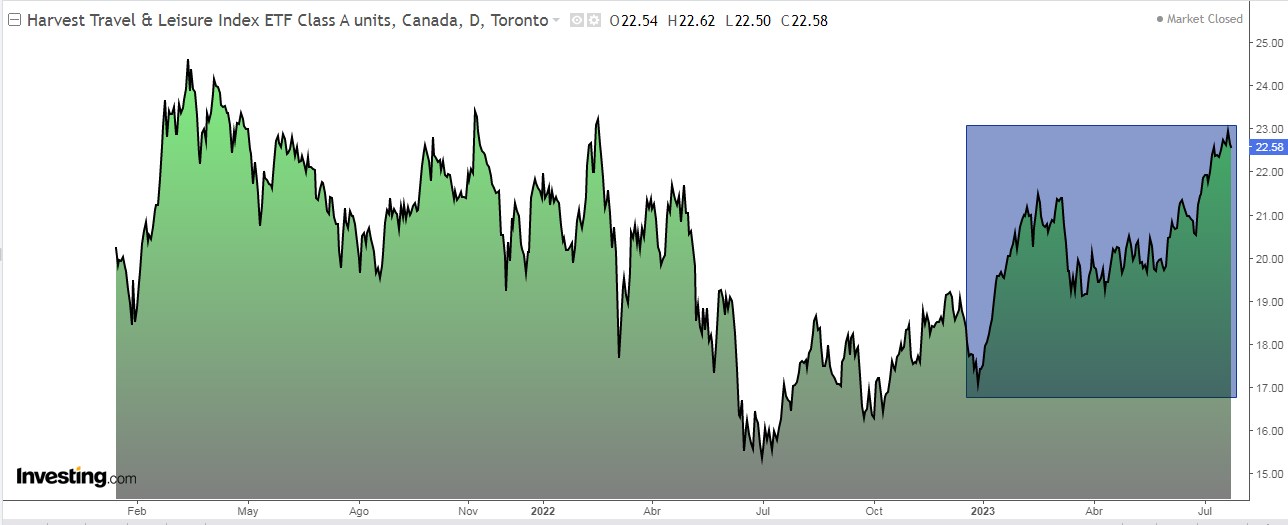

2. Harvest Travel and Leisure ETF

The Harvest Travel & Leisure Index ETF Class A units (TSX:) focuses on investing in a diverse portfolio of stocks from various sectors, including airlines, cruise lines, hotels, and online booking services.

The fund aims to identify companies that have the potential for medium- to long-term growth. It achieves this by tracking the performance of the Solactive Travel & Leisure Index, which includes companies that are well-positioned within the travel and leisure industry.

This ETF was established in January 2021 and comes with a competitive fee of 0.40%.

Harvest Travel Daily ChartHere are the top 10 holdings:

Harvest Travel Daily ChartHere are the top 10 holdings:

- Booking (NASDAQ:) 9.4%.

- Marriott International 9.4%.

- Airbnb Inc (NASDAQ:) 9.2%.

- Hilton Worldwide 7.4%

- VICI Properties Inc (NYSE:) 6.1%

- Delta Air Lines 5,9%

- Royal Caribbean Cruises 4.5%

- Southwest Airlines 4.2%

- Las Vegas Sands (NYSE:) 3.7%

- Carnival 3.6%

Over the past 12 months, the ETF has experienced a surge of 42%.

Travel stocks

Let’s look at some companies in the sector that are strong.

1. SkyWest

SkyWest (NASDAQ:) operates as one of the two airlines owned by SkyWest, alongside ExpressJet Airlines. As a U.S. regional airline based in Utah, it serves a vast network of 153 cities across 43 states in the U.S., as well as destinations in Canada and Mexico.

When combined with ExpressJet Airlines, the two airlines hold a significant position, ranking as the eighth largest airline based on the number of aircraft operated. Together, they manage a fleet of 440 aircraft.

Remarkably, SkyWest emerged as the best-performing company this year among those included in the Defiance Hotel, Airline, and Cruise ETF. The stock has surged by 143% YTD and contributed to the ETF’s gains despite having a relatively low weight of 0.43%.

The company’s latest , announced on April 27th, surpassed expectations in terms of both revenue and earnings per share. Investors are eagerly anticipating the publication of the next results on July 27.

According to InvestingPro models, SkyWest has significant potential and is estimated to reach $46, making it an attractive prospect for investors seeking growth opportunities.

The stock is in an uptrend, particularly since it successfully broke through the downward trend line and rose above both the 50-day and 200-day moving averages.

2. Delta Air Lines

This U.S. commercial airline, headquartered in Atlanta, Georgia, holds a prominent position in the aviation industry. It is a founding member of the SkyTeam global airline alliance, which includes Aeromexico, Air France, and Korean Air.

Through this alliance, passengers can access a wide range of destinations worldwide, along with various flights and services.

Notably, this airline leads the way in transatlantic flights, surpassing all others in terms of destinations served in Europe and Asia. Additionally, it ranks as the second-largest U.S. carrier in Latin America, following American Airlines.

Impressively, the company’s latest , unveiled on July 13, exceeded market expectations. Investors are eagerly anticipating the next results, scheduled for October 12, with even higher prospects.

For the year, its shares have experienced an impressive growth of +48%. According to InvestingPro models, there is a potential for further growth, with an estimated value of $64.80.

It appears that the stock is currently in a bullish trend and has even moved outside of the range of the ascending channel. However, it seems to be taking a brief pause and does not feel the need to immediately push toward its resistance level.

3. Royal Caribbean Cruises

Royal Caribbean Cruises is a major player in the cruise industry, born in 1997 through the merger of Royal Caribbean, founded in 1968, and Celebrity Cruises, established in 1988. The company’s headquarters are based in Miami, Florida, United States, and it currently stands as the world’s second-largest cruise operator.

On May 4, Royal Caribbean Cruises reported its latest , which were exceptionally strong. Notably, its earnings per share surpassed market expectations by an impressive +66%. The company’s next results are eagerly anticipated on July 27, with expectations of another positive outcome.

According to InvestingPro models, the company’s potential value is estimated to be near $112. This indicates a promising outlook for investors. With 21 ratings in total, there are 14 buy recommendations, 7 hold recommendations, and no sell recommendations, further indicating positive sentiment surrounding the company’s performance and potential.

Royal Caribbean Cruises Daily Chart

Royal Caribbean Cruises Daily Chart

This year, its shares have increased by 104%, and it has successfully broken out of its ascending channel and resistance levels. It is currently attempting to move past the corresponding throwback.

4. Allegiant Travel

Allegiant Travel Company (NASDAQ:), headquartered in Las Vegas, Nevada, operates as a leisure travel company specializing in scheduled air transportation on limited-frequency nonstop flights between various cities. In addition to its air services, the company also provides hotel room bookings, ground transportation, and car rentals for travelers. Allegiant Travel boasts an impressive fleet of 122 Airbus A320 series aircraft as of February.

The company’s latest , announced on May 3, were remarkable, surpassing all market forecasts. Both revenue and earnings per share (EPS) experienced a significant increase of 32%, showcasing its strong performance in the industry.

According to InvestingPro models, Allegiant Travel shows substantial potential with an estimated value of $137.45.

Allegiant Travel Daily Chart

Allegiant Travel Daily Chart

Allegiant Travel’s shares have surged by +90% this year, maintaining an upward trend within an ascending channel and remaining above the 50-day and 200-day moving averages.

Disclaimer: This article is written for informational purposes only; it is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, advice, counseling, or recommendation to invest. We remind you that all assets are considered from different perspectives and are extremely risky, so the investment decision and the associated risk are the investor’s own.