Pandemic Retirees in US Head Back to Work as Asset Boom Fades

2023.06.21 17:08

(Bloomberg) — The so-called Great Retirement is looking a little less great lately, as stalled house prices and the rising cost of living push some older workers back into the labor force, new research shows.

The disappearance of a few million people from the US labor force has been a striking feature of the pandemic era, and economists attribute part of it to people retiring early, along with a drop in immigration and the effects of long Covid.

Miguel Faria e Castro, an economist at the Federal Reserve Bank of St. Louis, and colleague Samuel Jordan-Wood estimate that the number of “excess retirements” — or older Americans quitting work at rates above historical trends — crested at about 3 million in December.

For sure, some retired out of fear of catching Covid-19, which has killed some 1.1 million people in the US, most of them older Americans. But soaring housing and stock prices, especially earlier in the pandemic, probably pushed others to make the leap, Faria e Castro suggested in a Fed research paper released in May.

Second Thoughts?

At least some of them now appear to have had second thoughts, according to Faria e Castro’s latest estimates, which are based on US Census Bureau data. The number of excess retirees is down by around 600,000, or 20%, since the end of last year, the economist found.

A few factors might be causing the dip in numbers, Faria e Castro says. Some older Americans may have been enticed back to work by a strong labor market and wages that, while now cooling somewhat, are still up more than 4% over the past year.

Others may have felt nervous about housing values that have declined from their peaks, compounded by higher interest rates and inflation. Americans ages 65 to 75 saw their wealth rise by about $62,000 on average between 2020 and 2022, more than any other group, Faria e Castro estimates. His model suggests those gains can explain up to 36% of the excess retirements.

Finally, part of the dip may be a technicality linked to the slowdown of immigration during the pandemic, which magnified the share of retirees in the overall population, he said.

While some early retirees are looking for work again, the majority are still on the sidelines in an economy that very much needs workers. The number of available positions in the US climbed to 10.1 million in April — a historically high figure, even if it’s down a little from post-Covid peaks.

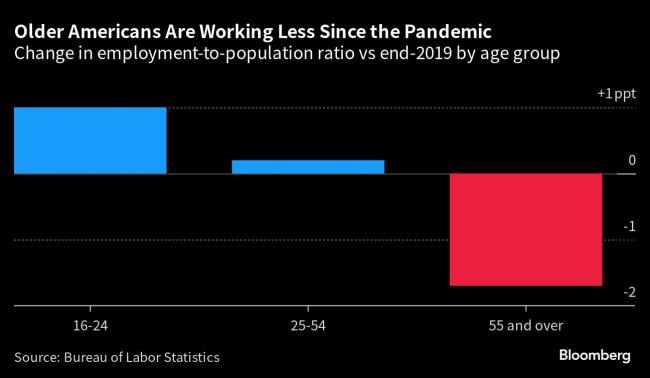

In its June report on monetary policy, the Fed’s Board of Governors noted that the employment-to-population ratio for Americans age 55 and over remains some way below its pre-Covid level, even as the figures for younger people have rebounded. It said the shift “largely reflects an increase in retirements since the onset of the pandemic.”