Palantir Hits 2-Year High: Can Improved Outlook, Buybacks Sustain Uptrend?

2023.11.29 08:38

- Palantir recently hit two-year highs at $21.85, fueled by positive factors like government revenue, and a $1 billion buyback program

- Despite a partial pullback tied to lower-than-expected deals with the UK National Health Service, PLTR’s Q3 earnings surpassed expectations, prompting a 26% share price increase

- Analysts anticipate a favorable outlook for Palantir, with projections of increased revenue and earnings, expecting a 20% annual revenue growth for the next two years.

- Missed out on Black Friday? Secure your up to 60% discount on InvestingPro subscriptions with our extended Cyber Monday sale.

Palantir (NYSE:) is a key player in the artificial intelligence space and has been garnering investor attention. In the latter half of this year, the Denver, Colorado-based company’s stock gained significant momentum and eventually made new two-year highs at $21.85 last week.

A partial pullback from this peak was attributed to the somewhat lower-than-expected scale of Palantir’s anticipated deal with the UK National Health Service.

However, persistent positive factors, including the company’s ongoing collaborations, substantial revenue from government agencies despite disruptions, a continuous uptick in commercial sales, and the announcement of a $1 billion buyback program, maintain high expectations for PLTR.

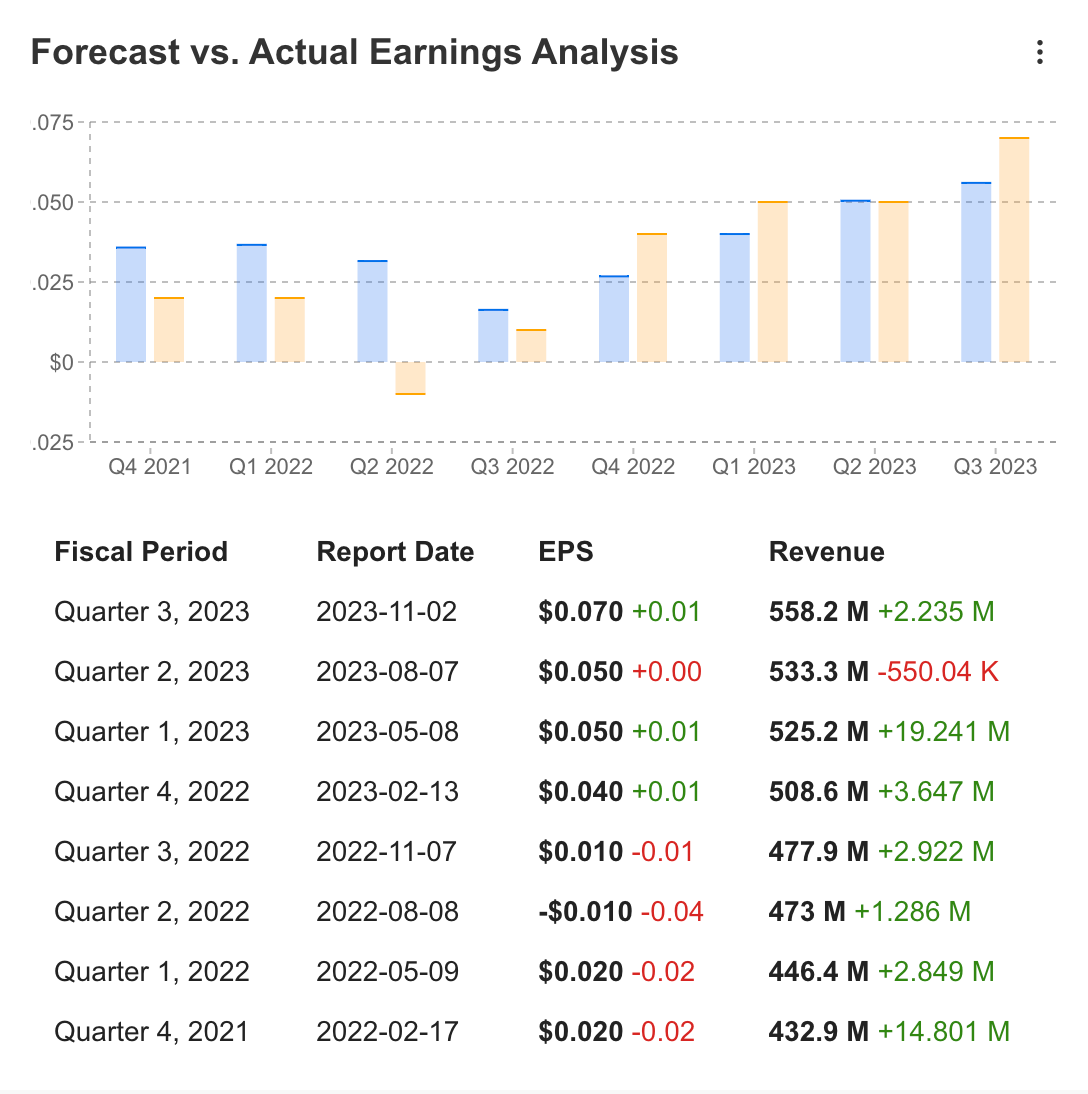

Moreover, the third-quarter exceeded expectations, sparking a substantial surge in the share price. Palantir posted an earnings per share of 7 cents with a revenue of $558.2 million in Q3, surpassing EPS expectations by 25%.

In the wake of these financial results, the initial response to PLTR shares was a remarkable 26% increase.

Earnings and Stock Price Reaction

Earnings and Stock Price Reaction

Source: InvestingPro

Following the positive figures, 12 analysts also revised their estimates for Palantir upwards. Accordingly, in the last quarter earnings report, which is expected to be announced on February 14, the EPS estimate is 0.076, while quarterly earnings are expected to be $ 603.2 million.

Source: InvestingPro

Palantir’s Fundamental Outlook: A Deep Dive into Revenue, Profit, and Market Dynamics

Palantir’s revenue for 2023 is estimated to be over 2.22 billion dollars, while its earnings per share are expected to reach 25 cents a year. Analysts’ long-term forecasts for the next 2 years is that Palantir will increase its revenue by 20% annually to 3.2 billion dollars by the end of 2025.

Revenue and EPS Forecasts

Revenue and EPS Forecasts

Source: InvestingPro

In fact, looking at the historical data on InvestingPro, it can be considered a positive development that the company’s quarterly earnings have exceeded expectations in every period since 2021, except for the 2nd quarter of 2023.

Forecast Vs. Actual Earnings

Forecast Vs. Actual Earnings

Source: InvestingPro

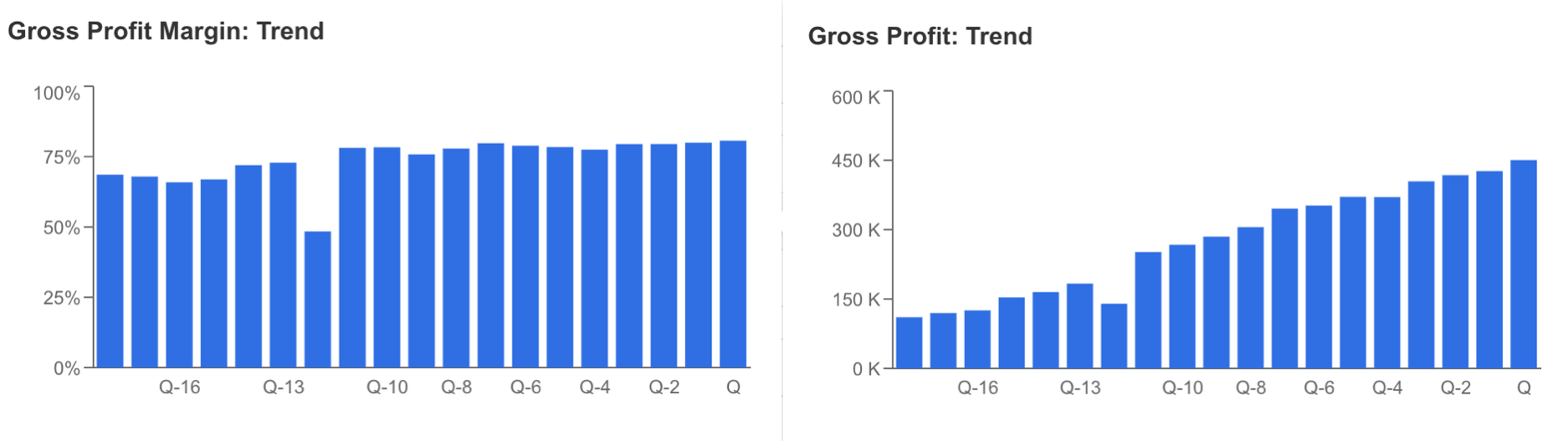

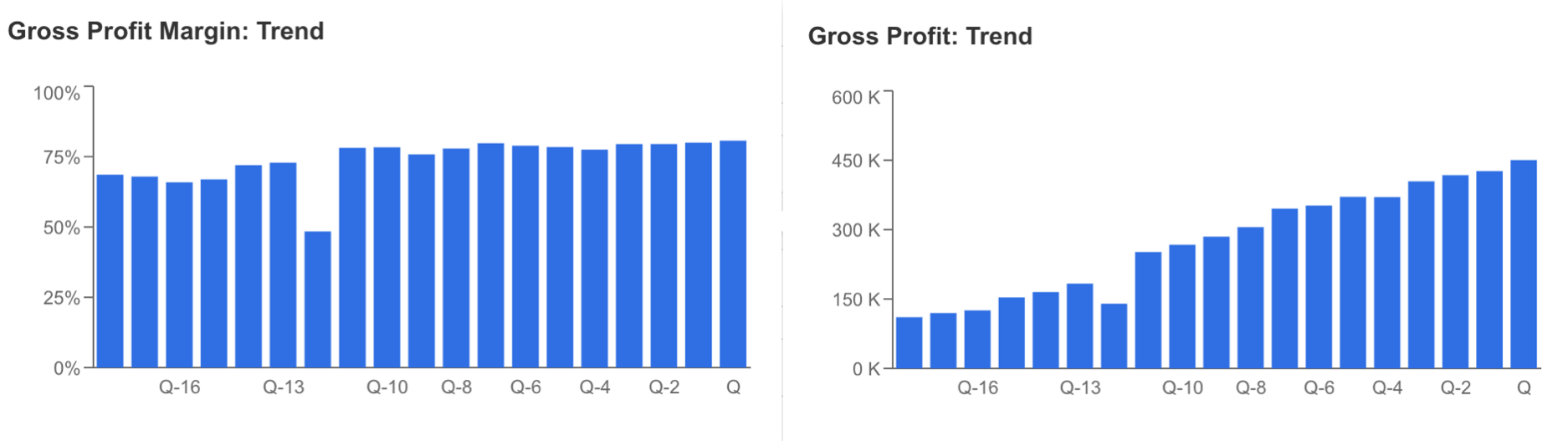

The company, which has improved financially this year, also ended the downward momentum in revenue growth in the last quarter results. With 16% year-over-year revenue growth in Q3, Palantir continued to increase its revenue, signaling an improvement in revenue growth, and offsetting the loss of momentum in the previous quarter.

Source: InvestingPro

The company is also poised to close the year in profit, with impressive margins as well as upward momentum in gross margin, maintaining gross margin above 75%.

Source: InvestingPro

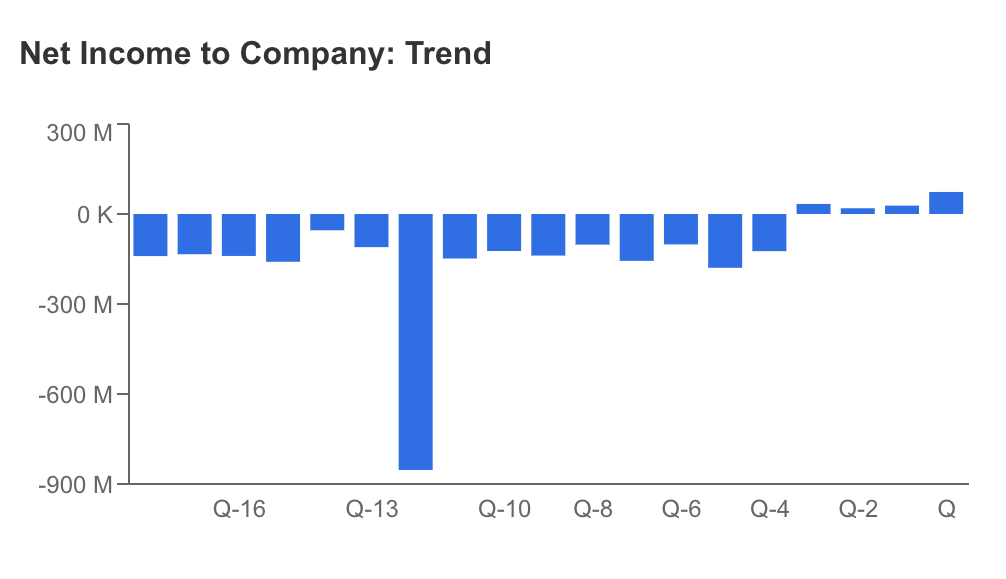

Palantir has consistently maintained its successful operations since its IPO and started to report quarterly profit for the first time this year. In the last quarter, Palantir reported a net profit of 73.4 million dollars, compared to a net loss of 123.9 million dollars in the same period last year.

Source: InvestingPro

The company’s cash flow situation is also among its positive aspects. According to the latest data, InvestingPro’s cash flow score for Palantir, whose cash position on its balance sheet is above its debt, is affected as very good performance with 4 out of 5.

Among the most important developments that contributed to Palantir’s impressive performance this year was the launch of its “Artificial Intelligence Platform”. The platform, which has seen an increase in users throughout the year, has started to generate a new revenue stream for the company.

The AI company increased its government revenues by 12% to $308 million this year, but this amount fell short of forecasts. Fortunately, a 23% increase in private company revenue helped boost this line item from $234 million to $251 million. This shows that commercial market revenue is catching up with government revenue. Thus, by diversifying its revenue items, the company is starting to achieve a healthier structure by avoiding the risk of revenue concentration.

The partnerships and acquisitions that the company has established within the framework of its growth plans are also very important. Last year, Palantir acquired a joint venture in Japan that sells the company’s software, making Japanese insurance company Sompo its largest customer. Palantir also recently expanded its collaboration with with a cloud computing initiative for government agencies.

The company also has a partnership with IBM (NYSE:) to help enterprises adopt AI software faster. In addition to these positive acquisitions and collaborations, a challenge for the company is the upcoming renewal of contracts with the US Government. Although the company continues to increase its portfolio of private company customers, about 60% of its revenue comes from government agencies.

On the other hand, although the company announced a $1 billion buyback program, it has not yet started buying shares. However, in cases of possible share price retracement, the company’s start of share purchases may be a factor supporting the price.

Another expectation regarding Palantir stock is the inclusion of PLTR in the S&P 500, which was also mentioned by the company’s CEO Alex Karp after the Q3 earnings report. If PLTR is included in the index, it could significantly increase demand for this stock.

Fair Value: Is the Stock Currently Overvalued?

Source: InvestingPro

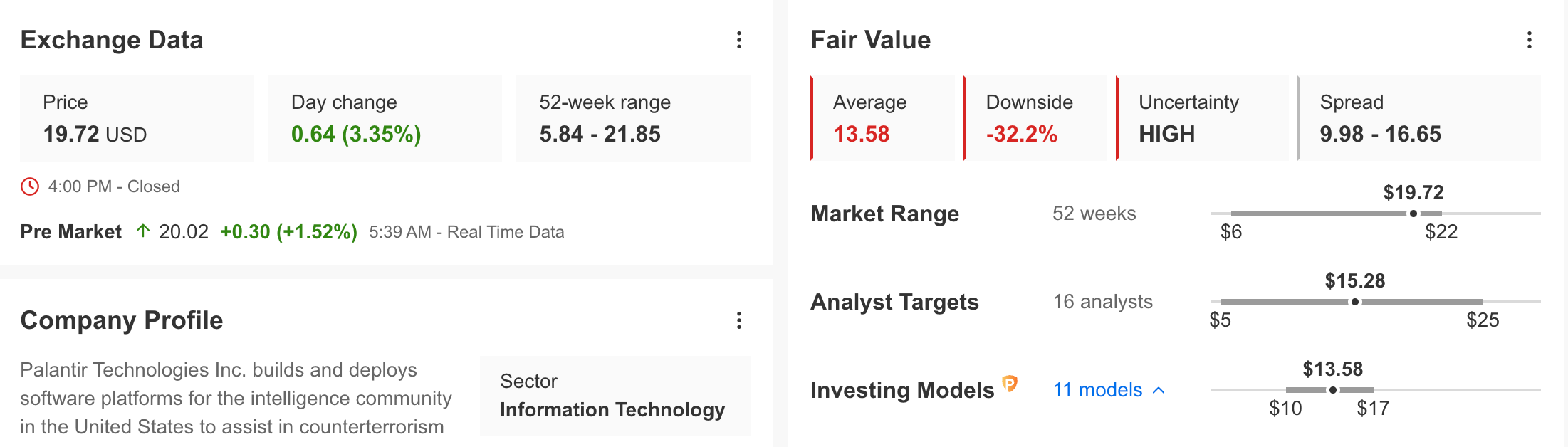

If we check the fair value analysis of PLTR onInvestingPro; we see a bearish expectation for PLTR. The calculation made according to 11 financial models on InvestingPro shows that the stock is currently overvalued by 31% in high uncertainty and its fair value is $ 13.58. The consensus forecast of 16 analyses is that PLTR’s fair value is in the $15 band.

Palantir Technical View

Assessing PLTR shares from a technical perspective reveals their high volatility, as indicated by a beta exceeding 2.

After remaining horizontal in the $ 20 – $ 30 band for a long time after the IPO, PLTR entered a downward trend up to $ 5. At the beginning of this year, the share, which started to be in demand rapidly with the support of artificial intelligence, reached up to $ 20 this month, the lower band of the channel movement in the 2020 – 2021 period. This level also corresponds to the Fib 0.618 ideal correction value based on the deep downtrend.

Therefore, if the PLTR stock, which I predict is at a critical juncture, cannot exceed the $ 20 resistance at the weekly close, it may make a correction of this year’s uptrend and we may see a pullback towards $ 14. If this price zone, which was defended in the May – September period, is broken in the possible decline, it may become possible for the retreat to continue up to the $ 11 area.

However, in a positive scenario, if buyers can overcome the $ 20 barrier, we can see that the upward momentum could continue towards the $ 35 – $ 43 region, with the $ 25 – $ 30 range being an intermediate resistance.

***

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your own criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 60%), by taking advantage of our extended Cyber Monday deal.

Claim Your Discount Now!

Disclaimer: The author does not own any of these shares. This content is purely for educational purposes and cannot be considered as investment advice.