Over Half Of Shares Bought During Meme Stock Frenzy Have Been Sold

2022.06.22 16:16

Retail trading frenzy comes to an end as necessities take priorities.

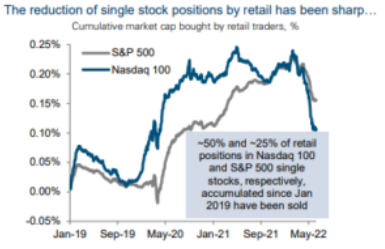

As inflation keeps eroding people’s savings, more retail money is exiting the equity market instead of buying the dip as usual. Last Friday, Goldman Sachs’ derivatives chief John Marshall provided another data point that shows this market downturn is not like the others.

According to GS, about half of single-stock retail positions accumulated in NASDAQ 100 since January 2019 have been sold. Likewise, a quarter of S&P 500 positions for the same time period.

Retail Traders Market Cap

Retail Traders Market Cap

This also reflects the -70% loss of interest in call-option volume that peaked in November 2021, which was when Bitcoin reached its ATH price of $68.9k. At that point, with inflation rising up, the Federal Reserve started to unroll interest rate hikes to cool down the economy. The Fed’s quantitative tightening (QT) ultimately led to the current market selloffs.

How Did “Meme Stocks” Come into Existence?

It is no secret that both GameStop (NYSE:GME) and AMC Entertainment (NYSE:AMC) would have gone bankrupt amid COVID-19 lockdowns. Social and economic disruption from these measures will likely unfold for many years to come.

One of the most immediate effects of cutting off regular social flows manifested as the Portnoy Top effect. For Wall Street players, it made perfect sense to short companies that rely on social activity—physical presence for entertainment (AMC) and retail stores (GME). Especially, when they have both been struggling to begin with.

However, social media influencers became a staging ground for financial activities, with Reddit’s r/wallstreetbets leading the charge. This anomalous trend spiked the playing field of Wall Street hedge funds. Not accounting for retail mobilization as they went about their usual shorting, they suffered multi-billion losses during the short-squeeze involving GME, AMC, and other stocks.

Up until recently, it appeared that Melvin Capital, the largest per-fund loser at $6.8 billion (54.4% of its AuM), was going to reinvent itself in April. The plan was canceled a month later. With markets in dire stress, it seems that retail traders too are running out of gas.

AMC vs GME Performance Chart

AMC vs GME Performance Chart

That the main meme stock (GME) is prioritized over another (AMC) speaks to the fact that trading resources are getting tighter by the day. Ironically, the reason for this is the same one that made meme stock trading rampant in the first place.

The Federal Reserve Giveth and Taketh Away

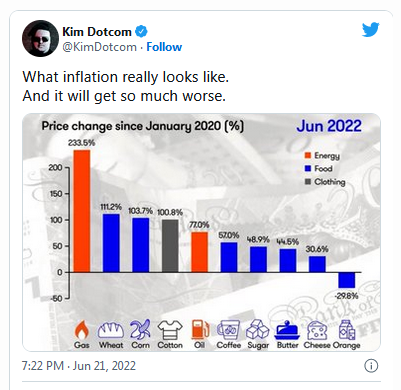

The Fed pumped $5 trillion into the economy over the last two years, of which $1.8 trillion was to individuals and families. While this intensified both the stock and crypto/NFT market activity, it inevitably spiked inflation. Although the current official number holds at 8.6%, a 40-year high, the true scope is best understood with one chart, courtesy of legendary internet entrepreneur Kim Dotcom.

Kim Dotcom Tweet

Kim Dotcom Tweet

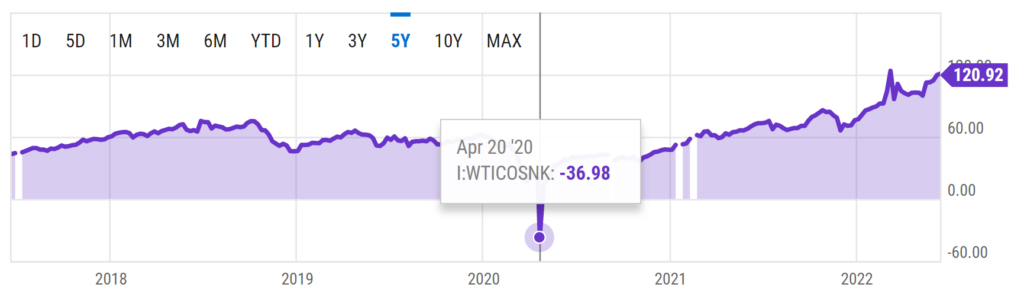

Lockdowns not only disrupted just-in-time (JIT) supply chains but inverted global oil supply and demand. This was demonstrated in April 2020 when West Texas Intermediate (WTI) went into the negative range at -$36.98 per barrel.

WTI Crude Oil Spot Price

WTI Crude Oil Spot Price

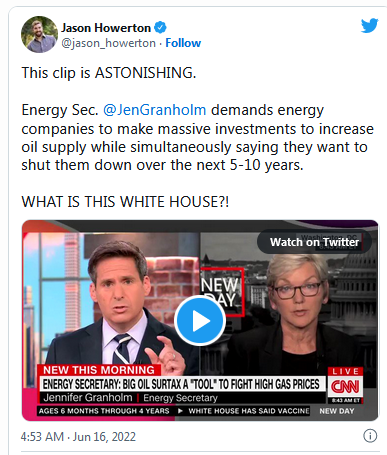

A restart of the economy, a great reset if you will, then had to catch up with the rising oil demand. The problem is that entrenched green energy initiatives, spearheaded by ESG, make that exceedingly difficult to accomplish. This leads to a great breakup of business strategy and even greater incoherency, exemplified by Energy Secretary Jennifer Granholm.

Tweet

Tweet

In addition to policy issues, the Fed is trying to undo the dilution of the USD. Just as one would burn billions of random altcoins to increase their value, the Fed’s interest rate hikes and QT are making the capital cost higher, cutting off the cheap money spigot for investing.

This continues to trigger selloffs across all markets, as one is tied to the other. Effectively, the Fed is turning back the clock to the pre-lockdown period to fight inflation, but amid worse macro-economic conditions than before.

Consumer Spending Still a Bulwark Against Recession

Depletion of accumulated gains during the last two years manifests in the personal savings rate, bottoming to the lowest rate in 14 years, at 4.4%. Likewise, to maintain living standards despite corrosive inflation, revolving credit card debt already surged to $1.103 trillion.

At the moment, consumer spending is still positive. Disposable personal income (DPI) increased $48.3 billion (0.3%) in April. However, this may come to an end when the next report is released at the end of June. After all, the real DPI increased less than 0.1%, according to the same BEA report for April.

Moreover, although the unemployment rate at 3.6% has been holding steady for three consecutive months, Fed Chair Jerome Powell repeatedly called for wage suppression.

The WSJ press transcript May 4.

As you can see from Powell’s own words, suppressing wages is another tool to fight inflation. Needless to say, the economic assault via gas prices, rising debt, wage suppression, and inflation leave little room to trade in meme stocks.

On the upside, more people may come to the realization that reliance on central banking puts them into an exceedingly vulnerable position. The remedy is already there, as noted by Bitcoin’s Genesis block message. It only remains to be seen if people take advantage of the cure to money supply manipulation.