Our Second Chance to Buy the Bond Bounce for 10% Dividends Is Here

2023.03.14 11:28

Right now we’ve got a terrific setup happening in Treasuries—and we’re going to use it to “flip” the near-4% yield the 10-year pays into a gaudy 7.9%+, paid monthly, to boot.

And there’s more: we’re going to give ourselves a rare “double discount” on our bond buys.

We’ll do it by taking already-discounted bonds (thanks to Jay Powell’s Dirty Harry act on rates) and applying a second discount by purchasing through two closed-end funds (CEFs) we’ll talk about in a bit.

The window to use this strategy is now open. Take a look at this chart to see what I’m getting at here:

The Rate Bounces Off Its 4% Ceiling (Again)

10 Yr Treasury Rate

Over the past 15 years, the yield on the 10-year has zoomed higher plenty of times until it smacks into the 4% “ceiling.” A decline in yield and a bump in prices (as prices and yields move in opposite directions) ensue.

We’ve just bounced off 4% again, which is a logical place for the 10-year to take a breather, as it has been following the Silicon Valley Bank news. If the 4% ceiling holds again, bonds—and the funds we’ll delve into below—should rally.

To be sure, we contrarians know the “4% lid” will only hold until it doesn’t. But with a Powell-manufactured recession likely, bringing a drop in yields when it arrives (as recessions always send investors scurrying into bonds), it seems likely to hold fast for now.

This is the same “rinse ’n’ repeat” trade we pulled off in my Contrarian Income Report service in the fall, the last time the 10-year yield bounced off its 4% ceiling.

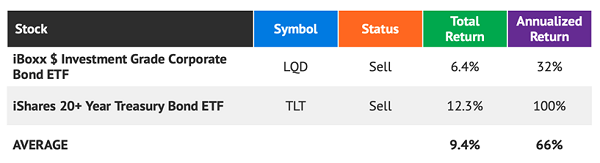

Back then, we played the “Bond Bounce” through two ETFs, the iShares iBoxx $ Investment Grade Corporate Bond ETF (NYSE:), which we picked up in the October issue, and the iShares 20+ Year Treasury Bond ETF (NASDAQ:), our November buy.

Boy, did these moves pay off:

Bond Bounce Trades

What’s our play today? TLT looks good here, and for once it actually pays (even though its posted yield is just 2.7%, its SEC yield, a truer measure, is 3.9%).

But if you want bigger yields—and bigger potential upside—look to bond CEFs, for three reasons:

- Deep discounts: CEFs trade at different levels than their portfolio values, and often at a discount. These discounts to NAV, as they’re called, don’t exist with ETFs.

- CEFs pay much higher yields than ETFs. The average CEF pays around 8% today.

- CEFs are run by humans, rather than algorithms, and that’s especially important in Bondland, where deeply connected managers get the best access to the best new issues.

Here are two bond CEFs that boast 7.9% and 10% dividends to put on your list, in order of quality (from good to great).

Good: PGIM High-Yield Bond Fund (ISD)

One of the biggest bond-CEF yields on the board is the 10.4% payout from PGIM High Yield Bond Fund Inc (NYSE:). The fund holds 588 bonds in all, mainly from US companies.

Credit quality is right in our “sweet spot”: most of its portfolio is in the B to BBB range, just outside the investment-grade line. That’s where some of the best bond bargains lie, as most of the big players are limited to investment-grade paper.

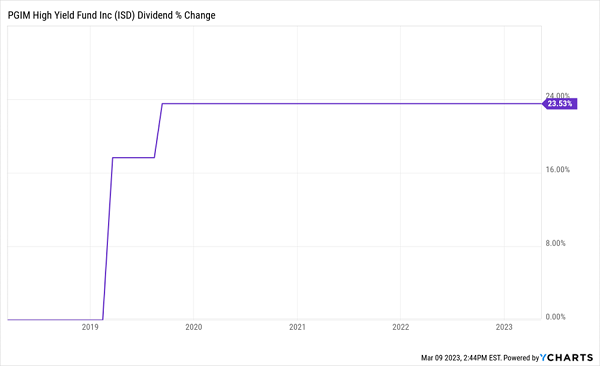

Moreover ISD’s 10% payout has actually grown—leaping higher twice in 2019 before holding steady through the ensuing three-year dumpster fire.

ISD’s “Crash-Resistant” Dividend

ISD-Steady Dividend

Moreover, the fund is run by Prudential, a cornerstone of the financial world, so you know management has an “in” when new bonds are issued. That’s important in the bond market, which isn’t as “democratic” as stocks: connections count, which is why many more bond-fund managers beat their benchmarks than on the stock side.

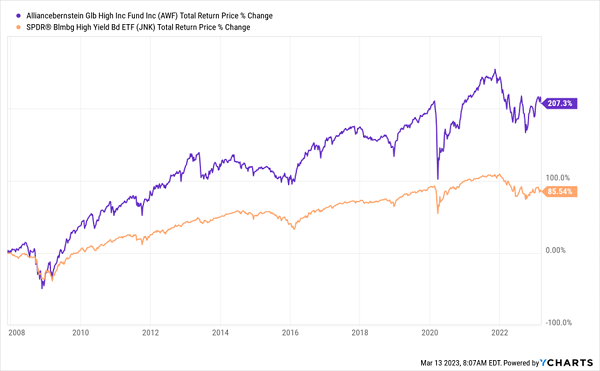

That, by the way, is the case with ISD, which has soared past the benchmark SPDR Bloomberg High Yield Bond ETF (JNK) since inception in 2012:

ISD’s Human Managers Get the Job Done

ISD-Outperforms

Finally, we’re getting a nice 10.8% discount on ISD, so we’re essentially buying its bond portfolio for 89 cents on the dollar.

Great: AllianceBernstein (NYSE:) Global High Income Fund (AWF)

AllianceBernstein Global High Income Closed Fund (NYSE:) yields 8.0% today and holds most of its portfolio (74%) in non-investment-grade bonds, mostly in the B to BBB range, like ISD. And despite its name, more than two-thirds of AWF’s portfolio is in the US.

But AWF has a leg up on the number of bonds it holds—1,580 at last count. That eliminates the risk that a defaulting bond or two could hurt our returns.

AWF also limits our duration risk because its bonds’ average term to maturity is 5.9 years, in the middle of the spectrum. (The longer a bond’s duration, the greater the risk of a decline as rates rise and new, higher-yielding bonds are issued.)

And finally, even though the bond-bounce bandwagon is starting to get a little crowded again, we’ve still got a chance to buy AWF at a 5% discount.

Sure, that’s less of a deal than ISD’s 8%, but AWF is still the better buy here, given its much longer history—AWF has been around since 1993 and has delivered a 1,300%+ return since, through rising rates, falling rates, boom and bust.

Moreover, like ISD, it’s dusted JNK, the high-yield-bond benchmark, since the ETF’s launch in 2007, despite a tough decade or so for bonds.

AWF Blows Past Its Benchmark

AWF-Outperforms

Finally, the payout is solid: AWF has kept it rolling out every month through the last three years and even paid a special dividend in January—to the tune of $0.0977 a share, in addition to its usual $0.0655 monthly payout.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”