Orders for US Business Equipment Decline by More Than Forecast

2023.04.26 12:12

(Bloomberg) — Orders placed with US factories for business equipment fell in March by more than expected, suggesting higher borrowing costs and a cloudy economic outlook are restraining capital investment.

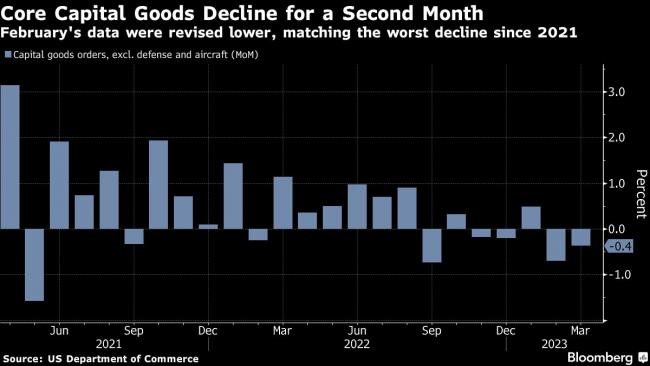

The value of core capital goods orders, a proxy for investment in equipment that excludes aircraft and military hardware, decreased 0.4% last month after a downwardly revised 0.7% drop in February, Commerce Department figures showed Wednesday. The data aren’t adjusted for inflation.

Core capital goods shipments, a figure that is used to help calculate equipment investment in the government’s gross domestic product report, fell 0.4% for a second month. The figures will help economists fine-tune their estimates for first quarter GDP, out Thursday.

Bookings for all durable goods — items meant to last at least three years — jumped 3.2%, boosted by a surge in orders for commercial aircraft.

With the economy showing signs of losing steam and credit conditions tightening, many businesses are dialing back investment plans. Many economists see a significant pullback in capital spending as a key factor of any downturn this year. It’s unclear when the manufacturing sector, which has already been grappling with less demand for merchandise, will turnaround.

While bookings for primary metals and machinery inched higher last month, orders for communications equipment and motor vehicles slid.

The report also showed unfilled orders for all durable goods increased 0.4% while inventories declined by the most since August 2009. The slide in inventories will weigh on first-quarter GDP. While the drop in stockpiles may indicate some pessimism about future business investment, it could also help underpin industrial production in coming months should demand strengthen.

What Bloomberg Economics Says…

“Negative core capital goods orders imply less production and fewer shipments ahead. We expect a recession to be driven by a pullback in investment, primarily in equipment spending and inventories, as businesses that can’t pass along higher costs to price-sensitive consumers see narrower profit margins.”

— Eliza Winger, economist

For the full note, click here

The Commerce Department’s report showed bookings for commercial aircraft, which are volatile from month to month, jumped more than 78%.

Boeing (NYSE:) Co. reported 60 orders in March compared to just five in February. While often helpful to compare the two, aircraft orders are volatile and the government data don’t always correlate with the planemaker’s monthly figures.

Excluding transportation equipment, durable goods orders rose 0.3%.

The median forecasts in a Bloomberg survey of economists called for a 0.7% increase in total durable goods orders and a 0.1% drop in core capital goods bookings.

Separate figures out Wednesday showed the US merchandise trade deficit narrowed in March to $84.6 billion, the smallest in four months, as exports increased and imports declined.

“Net trade was a huge swing factor in GDP growth last year, but will be broadly neutral in the first quarter,” Kieran Clancy, senior US economist at Pantheon Macroeconomics, said in a note.

Survey data also point to widespread weakness across the manufacturing sector. The Institute for Supply Management’s factory index dropped in March to the lowest level since mid-2020, and regional gauges of manufacturing activity in the Philadelphia, Dallas and Richmond areas were all weaker in April than anticipated.

Furthermore, a March survey of small businesses showed just 20% of owners plan to invest in equipment and structures over the next three to six months, the lowest share in two years.