ONEOK Stock Offers ‘Serene’ Dividends

2022.11.29 18:58

[ad_1]

Beware of Wall Street “wisdom” now more than ever. Especially when it comes to the most commonly quoted maxim for retirement: it’s based on a rule that was never designed for times like these!

I’m talking about the so-called “4% rule,” which says you should sell 4% of your nest egg every year in retirement.

Sounds simple, right?

Trouble is, it slashes your income stream and caps your upside in one go! It’s especially dangerous advice to follow in a downturn like the 2022 mess.

Let’s say, for example, you own $200,000 worth of Cisco Systems (NASDAQ:) shares. Cisco is one of the most reliable dividend payers in the tech space, hiking its payout for years and continuously growing it (though not spectacularly: Cisco’s annual hikes usually only come in at just one or two cents a share).

Your holding would pay $1.52 per share in dividends on an annualized basis, for a 2.8% yield, based on today’s share price. Let’s also say you were slated to sell 4% of your holding—or $8,000 worth—on December 29, 2021, just before year end, when the stock hit an all-time high of $63.53. To get your $8K back then, you’d have had to sell 126 shares.

With 126 shares gone from your account, your yearly dividend income drops by $192. Plus, you’ve got 126 fewer shares to appreciate in the future. It’s the worst of both worlds!

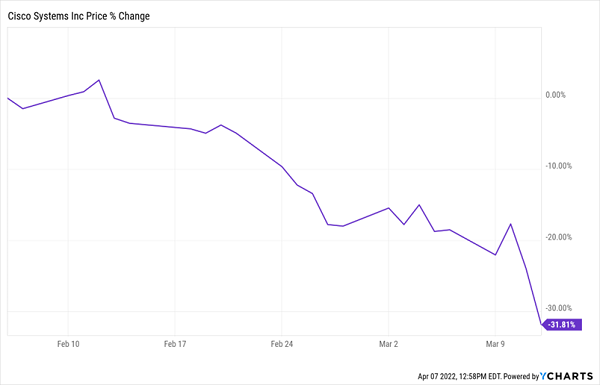

That’s bad enough, but it gets worse when these sells fall during a pullback like the beating tech has taken this year. Imagine what would happen if you had to sell today:

The Worst Kind of Market Timing

CSCO-Price-Chart-2022

Cisco’s dividend is still fine, but the stock cratered 25% from its December 29 high. So now you’d now have to unload more shares (167, to be exact) to get your $8K.

That puts an even harder cap on your future gains and slices your yearly income even more: by $254. Get hit by a few pullbacks like that and you’re well on your way to running out of money in retirement!

You and I both know that crashes like these are far from uncommon. Take a look at the header Cisco took in just two weeks during the March 2020 crash:

You Do Not Want to Be Caught Selling Into This

CSCO-Bad-Time-To-Sell

Your Return: From Sketchy to Serene

Luckily, there’s a better way than Wall Street’s flawed 4% approach. It involves moving more of our return away from wild stock charts like Cisco’s and toward a huge cash stream that holds up through a crisis.

Swap This Wild Ride …

CSCO-Volatile-Chart

… For a Smooth Cash Stream Like This

- February: $0.935 a share

- May: $0.935 a share

- August: $0.935 a share

- November: $0.935 a share

And on and on it goes …

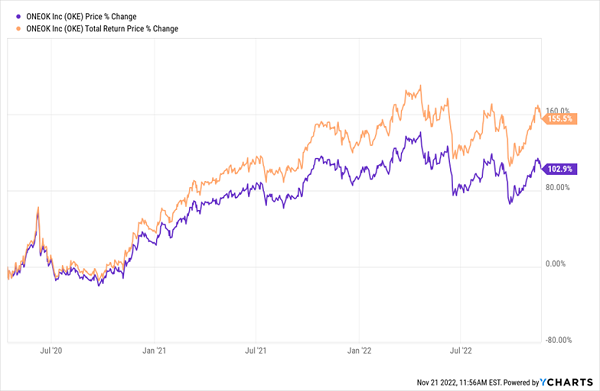

That smooth payout stream is what we have collected since we bought pipeline operator ONEOK (NYSE:) in April of 2020, in the middle of the COVID collapse.

That was not easy from an emotional perspective, but investors who took the plunge locked in an 11.8% dividend (because dividend yields rise as share prices fall, and OKE was a bargain thanks to fears of a pandemic-driven depression).

With a yield like that, you can forget about the 4% rule! On a $200K stake, your dividends would amount to $23,600 a year. That’s nearly 12% in dividends coming into your portfolio annually, which you can use to pay your bills or reinvest.

Reinvesting is a particularly savvy move because buying a fixed amount through a dividend reinvestment plan (DRIP), for example, lets you buy more shares when they’re cheap (like during a crash) and fewer when they’re pricey.

Think about that for a second: it’s the reverse of the flawed 4% rule—and it’s a proven way to build wealth over the long haul.

And we haven’t even talked about price gains yet: CIR members who bought on my recommendation did quite well indeed, whether they DRIPed in following their initial buy or not: the stock has soared 103% since our buy call, for a 156% total return, including dividends!

OKE’s Price—and Total Return—Soar

OKE-Total-Returns

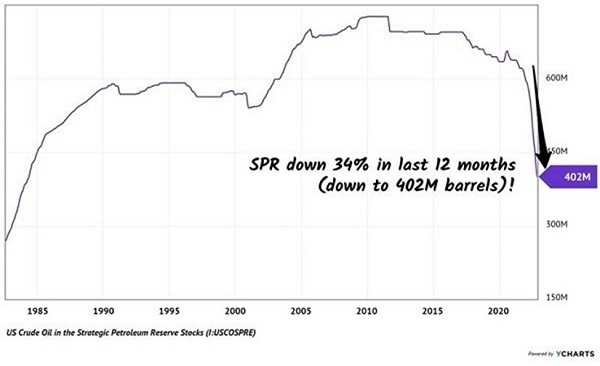

That gain has whittled OKE’s dividend yield down to a still-decent 6.1%. And despite oil’s recent pullback, the long-term case for higher prices remains. A major reason why is that current oil (and gasoline) prices are pinned down by the Biden Administration’s release of oil from its “emergency” supply, the Strategic Petroleum Reserve (SPR).

SPR-Low-Levels

The SPR release can’t continue forever—and stopping it will put upward pressure on prices. And these barrels will in theory have to be replaced—more demand. Smartly run “tollbooth” plays like OKE are primed to benefit.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”

[ad_2]

Source link