Oil Prices Climb as Market Balances U.S. Crude Drop vs Reserve Sale

2022.10.19 15:59

[ad_1]

Oil Prices Climb as Market Balances U.S. Crude Drop vs Reserve Sale

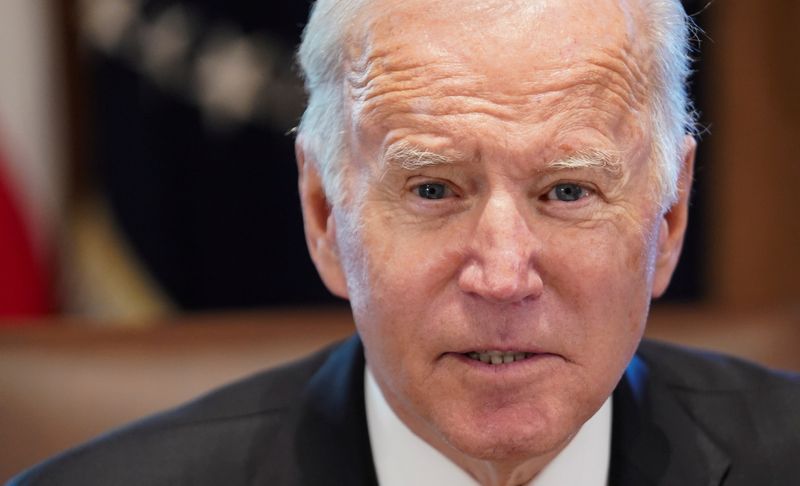

Budrigannews.com – President Joe Biden announced a new sale of 15 million barrels from the Strategic Petroleum Reserve (SPR), but oil bears hoping for a fresh price plunge on the news were dealt a setback as weekly crude stockpiles dropped while fuel inventories fell less than expected — creating a mixed demand picture.

New York-traded , the benchmark for U.S. crude, settled up $2.73, or 3.3%, at $85.55 a barrel, after dropping almost 7% over the past two sessions.

London-traded , the global benchmark for oil, settled up $2.38, or 2.6%, at $92.41. Brent lost nearly 5% over the Monday-Tuesday stretch.

With the Nov. 8 midterm elections just about three weeks away, Biden took the podium at the White House to announce another SPR release aimed at bringing fuel prices down for Americans.

The additional SPR release of 15 million barrels is expected to coincide with the 2 million barrels per day cut in global oil supply announced two weeks ago by producer alliance OPEC+ for November onwards.

The cut announced by OPEC+ had initially triggered a sharp rally in crude prices, bringing Brent back near $100, from an eight-month low of under $83. OPEC+ is led by Saudi Arabia, with Russia as its biggest ally — neither of whom are big fans of Biden.

The president lamented on Wednesday that the price of gasoline at pumps across the United States was not falling quickly enough, and “If necessary, extra oil could be made available for sale.”

He also hit out at U.S. oil companies for spending money on buybacks of their stocks instead of investing on output.

“Oil companies can increase production by acting right now,” said the president, who has somewhat pared back his administration’s ambitious alternative energy agenda versus fossil fuels since the outbreak of the Ukraine war that sent oil rallying back to above $100 a barrel.

Ahead of the new reserve sale announced by Biden, the Energy Information Administration announced that the United States drew down a relatively-small 3.6 million barrels from the SPR last week.

The outflow for the week ended October 10 was about half of what the administration has typically drawn down for a week in a bid to flood the domestic market with crude and keep pump prices of gasoline low.

Gasoline at U.S. pumps reached a record high of $5 a gallon in mid-June but has come down since to average at well below $4 a gallon.

Biden has taken much heat from rival Republicans who have accused him of risking the nation’s emergency oil reserves to try and appease voters and defend his Democrats’ control of Congress and Senate.

In response, the president said alleviating the hardship of Americans experiencing the in 40 years, contributed by high energy prices, was his top priority.

“It’s a sign of how concerned traders are about the economic outlook and how serious the Biden administration is about using the SPR to drive prices lower ahead of the midterm [elections],” said Craig Erlam, analyst at online trading platform OANDA.

“It’s such a huge political issue in the U.S. and could swing the midterms one way or another with the margins in the House and the Senate [being] so fine.”

Since November 2021, more than 200 million barrels have left the nation’s emergency oil stockpile, resulting in SPR balances standing at their lowest since 1984.

The EIA also reported that dropped by 114,000 barrels last week, against expectations for a draw of 1.114 million barrels. Gasoline balances rose by 2.02 million barrels in the previous week to Oct. 7.

rose by 0.124 million barrels last week. The expectation had been for a draw of 2.167 million barrels. During the previous week, distillate balances fell by 4.85 million barrels.

While gasoline is America’s top automobile fuel, distillates are typically used to make and the diesel required by trucks, buses, trains and ships, as well as the fuel for jets.

[ad_2]

Source link