Oil Demand Growth to Slow Dramatically as Peak Nears, IEA Says

2023.06.14 05:35

(Bloomberg) — Global oil demand growth will taper off over the next few years as high prices and Russia’s invasion of Ukraine speed up the transition away from fossil fuels, the International Energy Agency said.

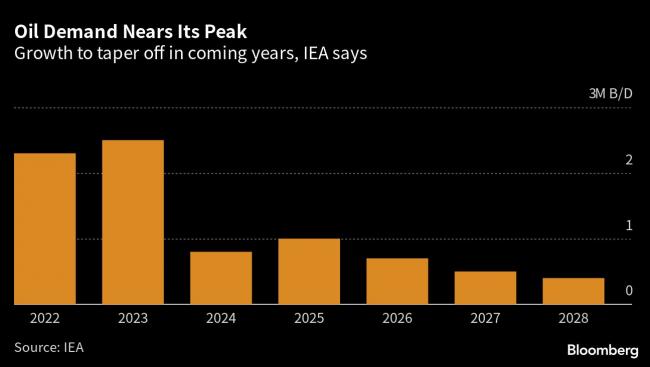

Consumption in 2024 will grow at half the rate seen in the prior two years, and an ultimate limit for demand will arrive this decade as electric vehicles send the use of gasoline by cars into decline, the Paris-based IEA predicted in a medium-term outlook. With production capacity still growing, markets will remain “adequately supplied” through to 2028, it said.

“Growth in the world’s demand for oil is set to slow almost to a halt in the coming years,” said the agency, which advises major economies. “The shift to a clean energy economy is picking up pace, with a peak in global oil demand in sight before the end of this decade.”

Consuming nations have for years been engaged in a shift away from fossil fuels in order to limit emissions of greenhouse gases and avert catastrophic climate change. That ambition that was fortified when oil and gas prices soared after Russia attacked its neighbor in early 2022.

The short-term and long-term outlooks differ greatly. World oil markets may tighten “significantly” over the next few months as China’s fuel consumption rebounds from the pandemic, while OPEC+ producers led by Saudi Arabia reduce production, the agency said. Oil is trading near $75 a barrel in London.

Next year also looks tight, particularly in the second half, with oil inventories set to decline even as global demand growth drops to 860,000 barrels a day, compared with 2.4 million barrels a day this year, or about 2%.

Yet the subsequent years will bring a world less dependent on hydrocarbons. Global growth in fuel consumption will dwindle to just 400,000 barrels a day in 2028, according to the IEA’s report. Global demand will reach 105.7 million barrels a day by that point.

The use of gasoline — the second-biggest oil product — will go into decline from 2023, and for oil as a transport fuel entirely three years later, with remaining growth for the commodity largely confined to petrochemicals and aviation fuel, the IEA forecasts. The need for combustible fossil fuels will hit an absolute peak of 81.6 million barrels a day in 2028.

Oil Expansion

While demand is slowing, investment in new supplies is rebounding. So-called upstream spending will surge 11% in 2023 to an eight-year high of $528 billion, helping ensure that output comfortably keeps pace with demand for the rest of the decade.

Output is set to grow by 5.9 million barrels a day, or about 6%, by 2028. That’s broadly in line with the expansion in demand over the same period thanks to rising capacity in the US, Brazil and Guyana. Capacity in the OPEC+ alliance will increase by just 800,000 barrels day, led by Middle East heavyweights Saudi Arabia and the United Arab Emirates.

The anticipated leveling-off in oil consumption still won’t be enough for governments around the world to meet ambitions for limiting carbon emissions. The IEA said in a report two years ago that the energy industry would need to halt investments in all new oil and gas projects in order to achieve “net zero” emissions by 2050.

The agency’s forecasts have had a questionable history, such as its repeated predictions during the last decade of a looming “supply crunch” that never materialized. Its call that Russian output would immediately collapse in the wake of the invasion of Ukraine last year also proved to be overly pessimistic.

The Organization of Petroleum Exporting Countries has pushed back against the IEA’s road-map to reduce oil consumption, insisting that greater investment in supplies is needed to avert price spikes and ensure affordability of energy for developing economies.

Yet the IEA’s analysis indicates the energy transition has gathered momentum as the attack by Russia — a member of OPEC+ — on neighboring Ukraine spurs alarm among consumers over their reliance on oil imports. More than $2 trillion of investment in clean energy has been lined up through to 2030, according to the report.

“Russia’s invasion of Ukraine sparked a surge in oil prices and brought security of supply concerns to the fore, helping accelerate deployment of clean energy technologies,” it said.

©2023 Bloomberg L.P.