NZD/USD Hits 7-Week Low Amid Ongoing Sell-Off Post RBNZ Rate Cut

2024.10.09 05:27

The pair has dropped to a seven-week low, touching 0.6091, as the sell-off that started on 1 October continues to intensify. The New Zealand dollar’s weakness is largely attributed to the Reserve Bank of New Zealand’s (RBNZ) recent decisions to lower interest rates in response to decreasing inflation pressures.

The has implemented consecutive rate cuts, most recently reducing the key rate by 50 basis points to 4.75% per annum, following a similar reduction in August. These measures aim to anchor inflation within the target range of 1-3%, with upcoming consumer price data anticipated to potentially show inflation consolidating around 2%, aligning well with the RBNZ’s objectives.

Globally, the focus is on the upcoming publication of the latest US Federal Reserve meeting minutes. These minutes are highly scrutinized as they provide crucial insights into the Fed’s future monetary policy direction. Market participants often use this information to gauge the likelihood of further Fed-rate adjustments, which, in turn, influences global currency dynamics.

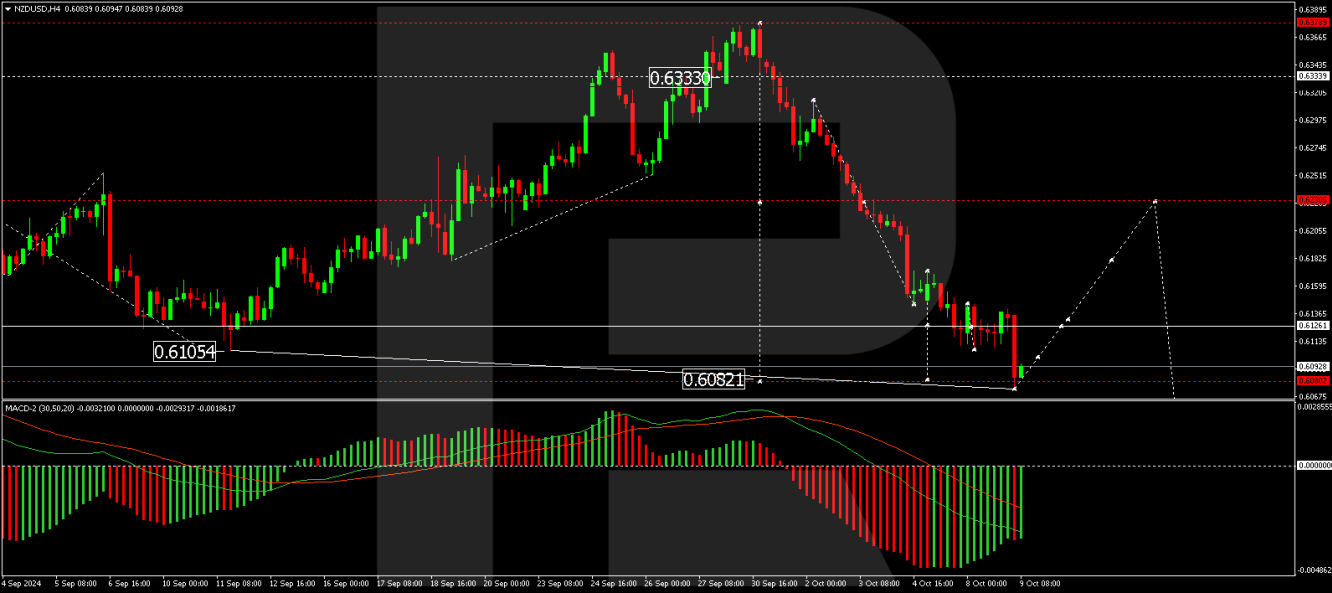

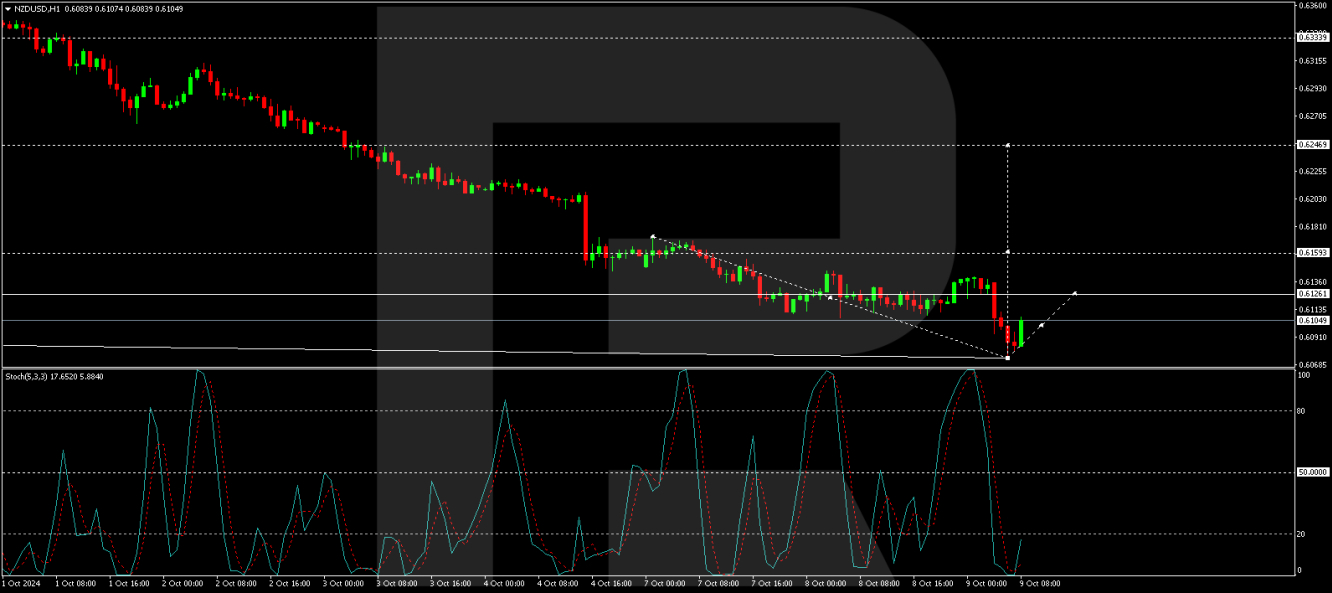

Technical analysis of NZD/USD

The NZD/USD market has reached the forecasted target of the downward wave at 0.6080. Currently, a new consolidation phase is expected to form above this level. If there is an upward breakout, a corrective movement towards 0.6230 could occur. Following this correction, the potential for a further decline to 0.5944 may be considered. Alternatively, if the consolidation resolves downwards, the downward trend could continue towards 0.5944. The MACD indicator supports this bearish outlook, with the signal line positioned below zero and trending downwards.

On the hourly chart, after forming a consolidation range around 0.6126, the pair achieved the downward wave target at 0.6080 with a downward exit. An upward movement to 0.6126 is expected today, followed by a retest of 0.6100. The market may develop a new consolidation range at these levels. An upward breakout could initiate a corrective rally towards 0.6230, considered a corrective response to the recent downward trend. The Stochastic oscillator, with its signal line below 20 and pointing upwards, suggests a potential for upward correction.

Disclaimer: Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.