Nvidia Stock Set to Crater Post-Earnings?

2023.05.22 03:14

With mega-cap tech/growth up 25.95% this year (Vanguard Mega Cap Growth Index Fund ETF Shares (NYSE:)), the semiconductor group is being pulled higher with it despite the memory-related names still being in a tough downcycle. The VanEck Semiconductor ETF (NASDAQ:) is up +31.95% YTD both as of Friday, May 19, 2023.

NVIDIA (NASDAQ:) this coming week – Wednesday after the close – while Costco (NASDAQ:) after the closing bell on Thursday night. NVIDIA is up a whopping 113.96% regarding its YTD return, while COST is up a smidge over 9% YTD. (All return data courtesy of Morningstar.)

Looking at Briefing.com consensus, NVIDIA consensus EPS is expected at $0.91 per share, versus $1.36 a year ago, a 34% decline YoY, for a stock up 113% YTD. That being said, this blog has never owned, followed, or modeled NVIDIA, but having owned the semis in the late 1990s and early 2000s, the cycles in this sector are something to comprehend. (Micron (NASDAQ:) is up 36% YTD, and that is a DRAM and NAND producer.)

I have no fundamental or technical opinion on NVIDIA.

This week’s big economic data point will be Friday morning, April ’23, PCE Prices, with Briefing.com consensus expecting +0.3% overall and +0.3% for . Some attention will likely be paid to Thursday’s 2nd look at Q1 ’23 and the GDP deflator.

data:

- The forward 4-quarter estimate slipped to $224.38 this week from last week’s $224.61 and December 31’s $222.91;

- The PE on the forward estimate is 18.6x versus 18.6x as of 3/31/23, and 17.2x as of 12/31/22;

- The S&P 500 earnings yield was 5.35% as of this week’s close, the same as on 3/31/23.

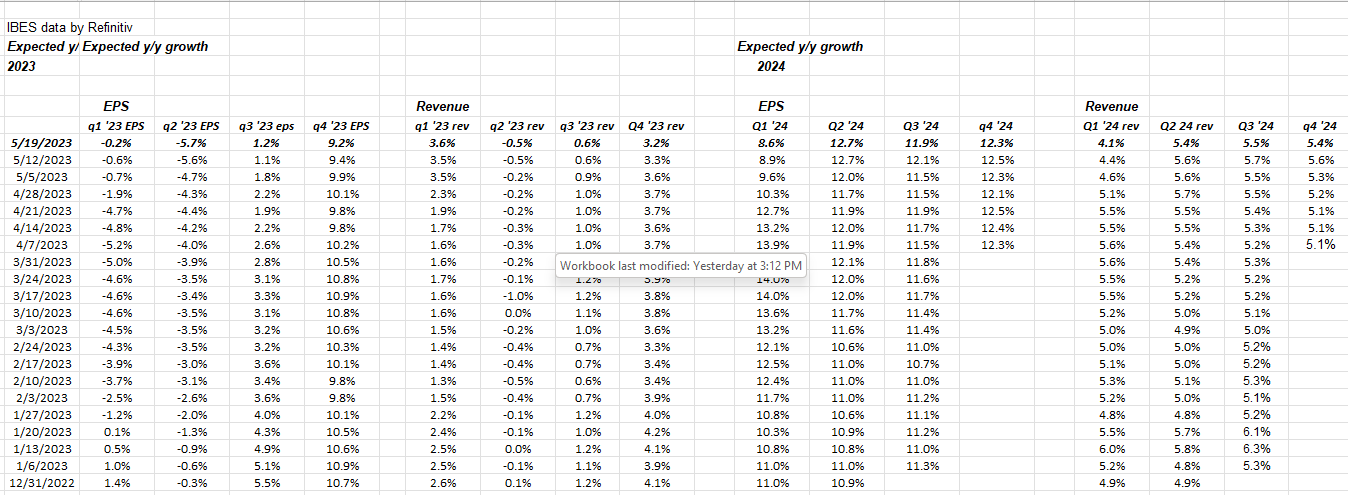

S&P 500 Qtrly EPS Revenue Growth Rates

S&P 500 Qtrly EPS Revenue Growth Rates

If readers click on the above table, look at Q1 ’23 EPS and revenue revisions by week. Note the strong improvement since Q1 ’23 started being reported.

Q4 ’23 EPS and revenue have not seen the kind of downward drift that other quarters have, which tells me. The data and revisions tell us that the end of ’23 could see strong EPS and revenue growth for the S&P 500 in terms of the 4th quarter.

Conclusion

Several traders on social media seem to be hoping for NVIDIA to crater post-earnings to take some of the TYD return “heat” off mega-cap tech and technology in general.

Being long some SMH but never owning NVIDIA directly, I don’t have a dog in this fight, but I will simply watch the action.

Inflation data has heated up (or at least not cooled down enough to the Fed’s liking), so Friday’s PCE data could have greater import to the general equity and bond markets than NVIDIA’s much-anticipated earnings report.

With last Friday’s interview of both Jay Powell and Ben Bernanke, the fed funds futures fell sharply in terms of an expected June 14, ’23 fed funds rate hike, back down to the 14% range after spiking up towards 35% after Jay Powell sounded like he was willing to give the currently fed funds rate hikes and the regional bank situation, time to see what evolves.

This past week, the Treasury yield curve showed the largest sequential increases in Treasury yields seen in ’23. This blog tracks that data weekly, and this week, Treasury yields across , , , , , and saw the sharpest jump since June 10, 2022, even with a little bounce on Friday, May 19, 2023.

Take everything you read here with substantial skepticism. One person’s opinion is that past performance does not guarantee future results. All S&P 500 EPS and revenue data is sourced from IBES data by Refinitiv, although the tables and any manipulations are this blog’s work. None of this is advice. Capital markets can change quickly for both the good and the bad, so understand your comfort level around market volatility.