NVIDIA: Does AI Hype Justify Stock’s High Valuation?

2023.04.27 09:41

- NVIDIA stock has gained popularity among investors lately after its foray into the AI space.

- The company has managed to grow without affecting its margins over the past few years.

- While the upcoming earnings report may offer a boost because of the AI hype, investors should be cautious as the current valuations are high.

Lately, NVIDIA Corporation (NASDAQ:) has been a highly sought-after stock thanks to its foray into the Artificial Intelligence space.

As we wait for the earnings release in late May, let’s take a closer look at its fundamentals using InvestingPro tools.

What Does the Company Do?

NVIDIA focuses on personal computer (PC) graphics, graphics processing units (GPUs), and artificial intelligence (AI). It operates through two segments: GPU and Tegra processor.

Under the GPU segment, NVIDIA’s product brands are tailored to meet specific market demands. The GeForce brand caters to gamers, while the Quadro brand is designed for professionals in the field of design.

The Tesla and DGX brands are intended for AI computer scientists and big data researchers. Meanwhile, the GRID brand serves cloud-based visual data processing users.

The Tegra brand integrates an entire computer on a single chip. It includes graphics processing units (GPUs) and multi-core central processing units (CPUs) to power supercomputers for mobile gaming and entertainment devices, as well as autonomous robots, drones, and cars.

NVIDIA’s products are designed for four primary markets: Gaming, Professional Visualization, Data Center, and Automotive.

The company offers a range of solutions, including the NVIDIA DGX AI supercomputer, the NVIDIA DRIVE AI automotive computing platform, and the GeForce NOW cloud gaming service.

NVIDIA’s Fundamentals at a Glance

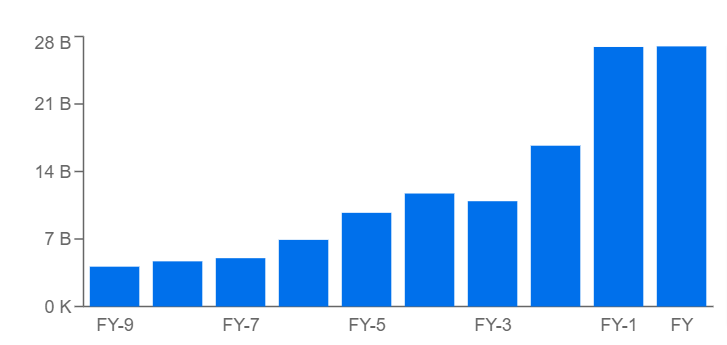

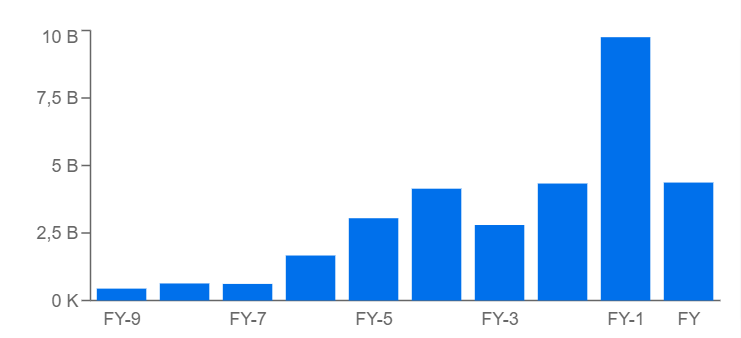

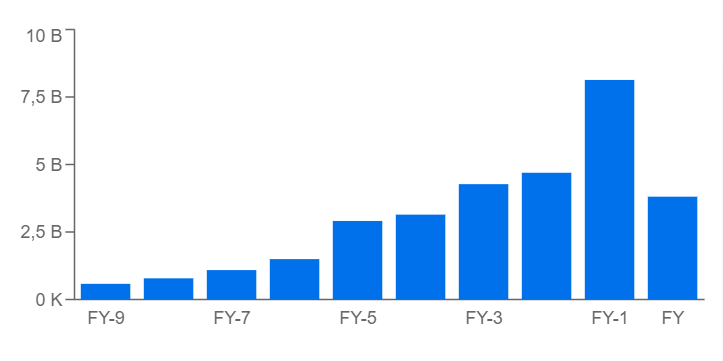

Let’s start by going through the financial statement history using the InvestingPro tools. This gives us several useful insights.

The steady increase in revenues and profits over time is positive. Last year was an exception, as it was challenging for the entire tech industry. It will be interesting to see how the company performs this year, especially if its AI segment has managed to boost revenues.

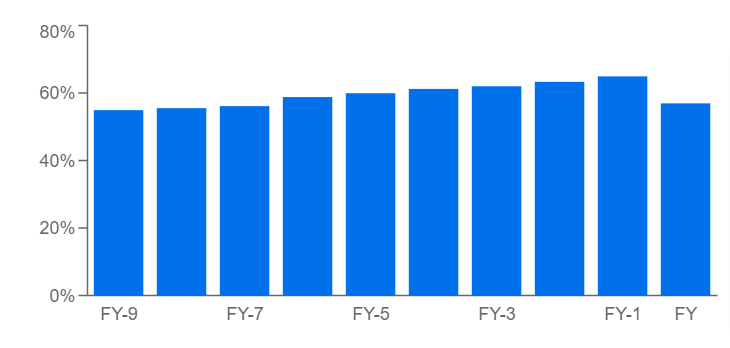

Margins are around 60% on average, also constant over the years with the exception of the last one, a sign that the company is managing to increase its revenues without any impact on margins.

Source: InvestingPro

Source: InvestingPro

NVIDIA Gross Profit Margins

NVIDIA Gross Profit Margins

Source: InvestingPro

The annual growth rate of diluted earnings per share (EPSd) over the last 10 years has been an impressive 29%. However, it is worth noting that the company experienced considerable downsizing in the last year. This prompts the question of whether these growth rates are still sustainable in the long term.

Taking a look at the past 5 years, the bulk of the growth has occurred in the early years.

Source: InvestingPro

Balance Sheet and Cash Flows

Between cash and short-term investments, NVIDIA has over $13 billion, for a total of around $23 billion in current assets. This shows an excellent short-term balance compared to current liabilities (approximately $6.5 billion).

The debt-to-equity ratio is under control (0.86). This gives a good balance on the equity side.

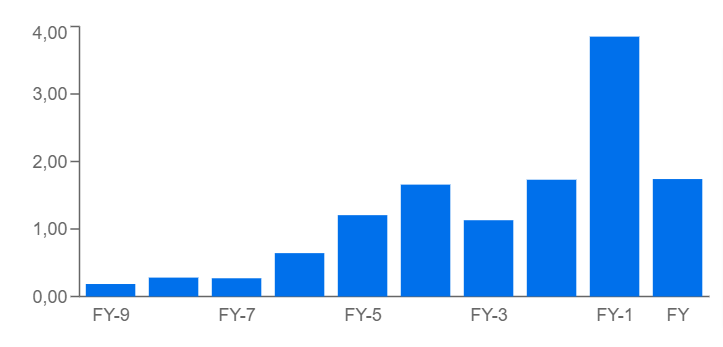

The operating cash flow and free cash flow trends have been fluctuating, with consistent growth until the last year. In 2022, they declined sharply.

Source: InvestingPro

With an FCF of $3.8 billion (the latest available), the return from FCF is about 0.5 percent, which is very low. On average, a good level of profitability is between 8-10%, so the company needs to improve on this metric.

Fair Value Estimate

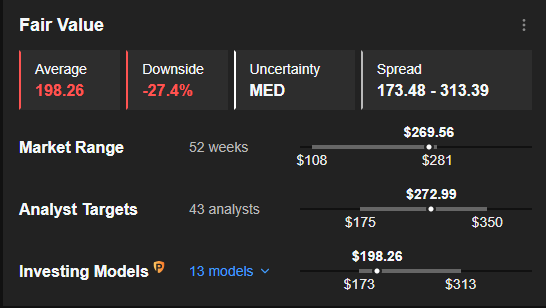

Currently, the stock is trading near $269, which indicates a significantly expensive value compared to the fair value of $198. The fair value estimate is based on an average of 13 different mathematical models, available on InvestingPro.

Furthermore, even taking into consideration analysts’ estimates that may factor in the boost from the company’s AI initiatives, the average target price is at $272. This is only slightly higher than the current stock price and leaves little room for a rally.

NVIDIA Fair Value Estimates

Source: InvestingPro

The stock price has surged by over 90% since January, driven by the rebound in markets and the AI narrative. However, the current valuations pose a high level of risk for investors with a long-term horizon.

While the upcoming quarterly report may offer a boost, caution is advised. Investors should carefully evaluate their investment goals and risk tolerance before making any decisions.

The analysis was done using InvestingPro, access the tool by clicking on the image.

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.