Nvidia: Can Chipmaker Reclaim Market-Cap Throne Amid Antitrust Scrutiny?

2024.07.03 09:22

- Nvidia briefly held the world’s most valuable company title but lost ground to tech giants like Microsoft and Apple.

- The chipmaker faces antitrust investigations in Europe and potential fines for its dominant market share.

- Despite challenges, analysts remain bullish, citing Nvidia’s strong financials and future potential.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Nvidia’s (NASDAQ:) meteoric rise in 2024 wasn’t without its bumps. After a brief dip in April, the chipmaker surged to become the world’s most valuable company by market cap on June 18th.

However, its reign was short-lived. Since then, Nvidia has stumbled, falling behind tech giants Microsoft (NASDAQ:) and Apple (NASDAQ:) in terms of market capitalization.

Source: Investing.com

CEO Jensen Huang’s company now faces the challenge of regaining its lost ground. Can Nvidia recapture the market cap crown once again?

Nvidia Faces Antitrust Heat in Europe

France has thrown a wrench into Nvidia’s plans with antitrust investigations, mirroring the challenges faced by tech giants like Apple, Microsoft, and Meta (NASDAQ:).

The European authorities are concerned about Nvidia’s dominant position in the graphics processing card (GPU) market, where they hold an 84% market share against competitors like Intel (NASDAQ:) and AMD (NASDAQ:). Here’s the catch: Nvidia’s GPUs are currently the go-to option for running generative AI systems, a technology with massive future potential.

This situation presents a double-edged sword. While Nvidia offers the best product for customers, it raises red flags for regulators. A violation of European antitrust rules could result in a hefty fine – up to 10% of annual global turnover. Considering Nvidia’s 2023 revenue, that translates to a potential $6 billion penalty.

Numbers Back Nvidia’s Meteoric Rise

Nvidia’s exceptional numbers highlight its status as an undisputed leader in today’s most crucial industry. The company recorded $60.9 billion in revenues in 2023, marking a 125.9% year-on-year increase, and posted profits of $44.3 billion. This remarkable growth underscores Nvidia’s strategic positioning and market dominance.

Nvidia’s meteoric rise contrasts sharply with the tech boom that propelled Cisco (NASDAQ:) to the top in 2000, a period that ultimately led to the dot-com bubble burst. Unlike the hype-driven surge that saw Cisco lose 80% of its value, Nvidia’s ascent is rooted in tangible results and industry innovation. Initially known primarily to gaming enthusiasts, Nvidia has gained widespread recognition through its solid performance and financial success, not just its brand name.

Analysts Bet on Nvidia

Analysts are bullish on Nvidia’s future. Morgan Stanley recently raised its target price for the stock from $116 to $144 per share, reflecting a 17.4% increase from its July 2 closing price of $122.67. This “overweight” rating from Morgan Stanley is echoed by many market experts, who see Nvidia’s shares as a strong buy.

Nvidia’s sustained growth and robust financial health continue to attract investor confidence, reinforcing its position as a key player in the tech sector.

Source Investing.com: data as of July 3, 2024

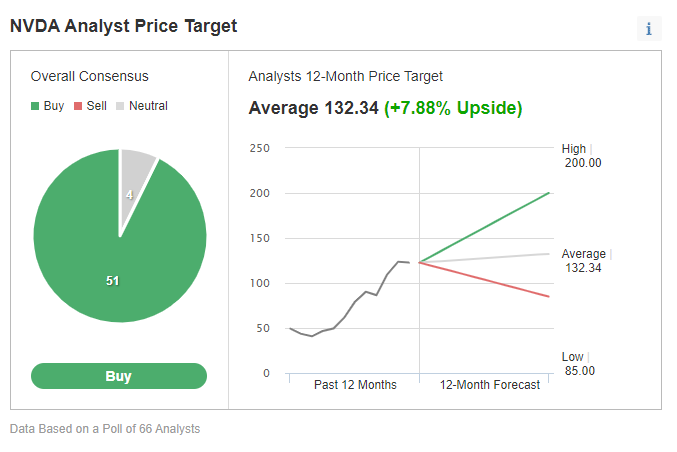

On average, analysts surveyed by InvestingPro set Nvidia’s target price at $132.34 per share, up 7.88% from the July 2 price. As many as 51 experts assign the stock a Buy rating, for 4 it is Hold, while none recommend selling the stock.

Nvidia: Fairly Valued, But Can It Maintain the Meteoric Rise?

InvestingPro’s Fair Value analysis, based on 13 investment models, suggests Nvidia’s current price might already reflect its intrinsic value. The model predicts a potential 6.6% decline. However, this indicator frequently updates with new data, and the current reading could be a sign that the company’s strong fundamentals justify its massive $3 trillion market cap.

Source: InvestingPro

In simpler terms, Nvidia isn’t necessarily overvalued based on Fair Value analysis. But after such a rapid ascent, it’s natural to see consolidation periods where the stock regroups before its next leg up.

Adding to the positive outlook, all indicators point towards Nvidia’s excellent financial health. The company boasts a Piotroski score of 9, the highest possible rating for financial strength.

The Biggest Challenge: Living Up to Its Success

Perhaps the biggest uncertainty surrounding Nvidia is its explosive growth. According to Chris Metcalfe, chief investment officer of IBOSS Asset Management, Nvidia has been responsible for a staggering 30% of the ‘s returns this year. In essence, Nvidia’s biggest hurdle might not be French regulators, but rather exceeding the incredibly high expectations it has set for itself through its phenomenal performance.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you’re left on the sidelines?

InvestingPro’s revolutionary AI tool, ProPicks, puts the power of Wall Street’s secret weapon – AI-powered stock selection – at YOUR fingertips!

Don’t miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.