Nvidia: $1 Billion Top-Line Beat Might Not Be Enough if Guidance Falls Flat

2024.08.28 03:08

It was another quiet day for the stock market, with everyone holding their breath for Nvidia’s (NASDAQ:) results coming out today after the close.

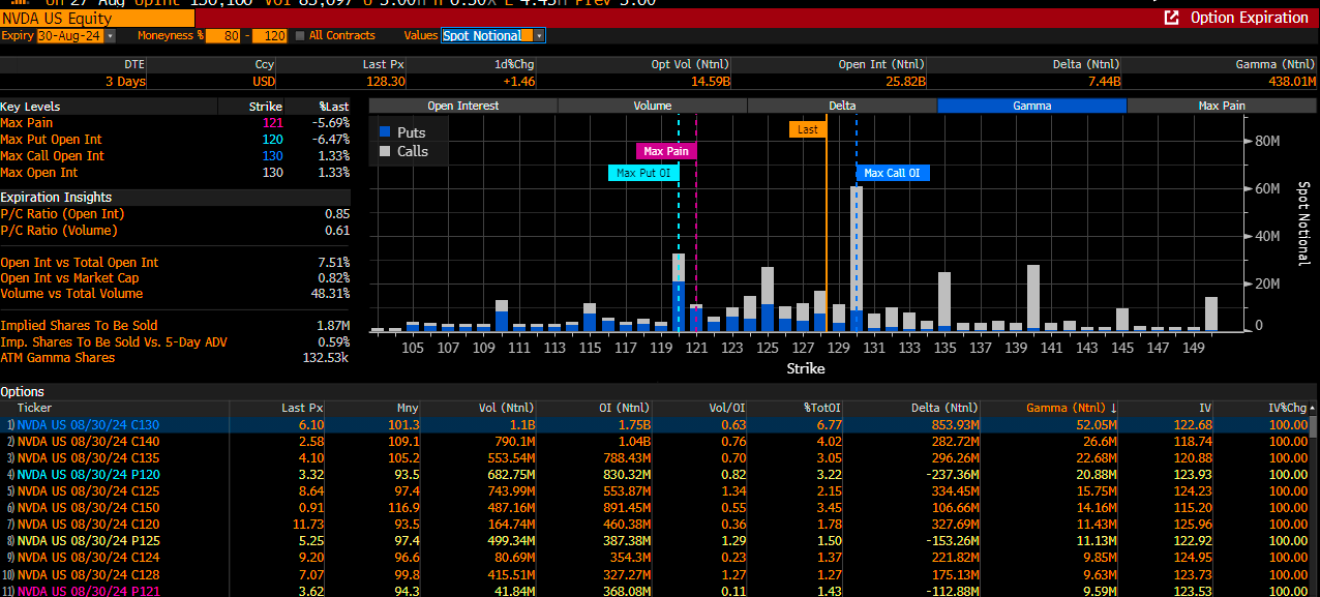

Where would this market be without Nvidia? Likely much lower. The IV for $130 calls for this week’s expiration is now up to 125%, and that figure could rise even more by the time the market closes today at 4 PM ET.

I feel that a rally for this stock won’t come easily, considering the amount of implied volatility set to roll off and how heavily positioned the stock is for a bullish outcome.

There is a good chance, the extreme levels of bullish may actually be bearish as call premiums burn.

(BLOOMBERG)

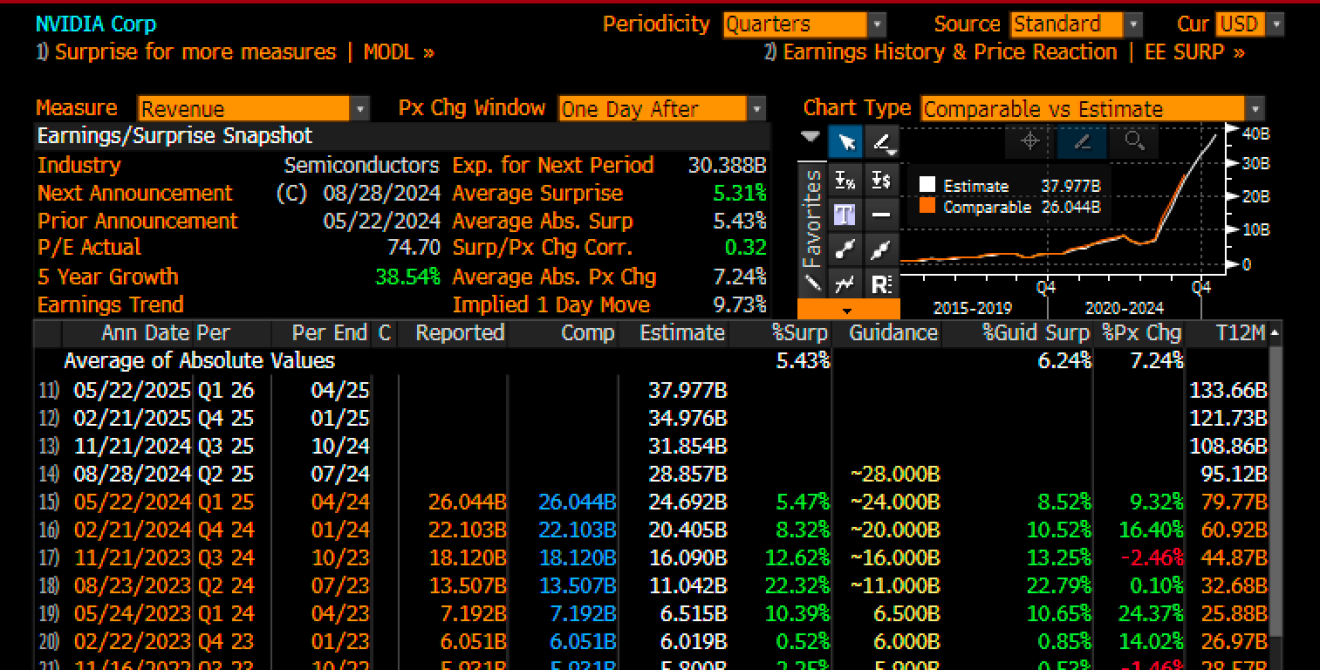

Additionally, the market has become accustomed to Nvidia delivering $2 billion beat-and-raise quarters. Analysts are already expecting $31.85 billion in revenue for the November quarter—so can Nvidia once again guide 8% above the street and hit $34.4 billion?

Also notable is how analysts consistently raise their sales estimates above the company’s guidance. For the February quarter, Nvidia guided to $16 billion, analysts estimated $16.09 billion, and the company delivered $18.1 billion.

In May, guidance was set at $24 billion; analysts expected $24.7 billion, and Nvidia reported $26.0 billion. This quarter, with guidance at $28 billion, estimates have climbed to $28.9 billion.

So, if Nvidia reports $30 billion in sales, the beat shrinks to $1 billion instead of $2 billion.

Typically, Nvidia guides the next quarter to $4 billion above the previous one. For example, the company guided $20 billion for the February quarter, then $24 billion for May, and $28 billion for August.

Analysts have now estimated $31.9 billion for the November quarter, effectively following the pattern. However, if Nvidia only guides to $32 billion, it might not be enough, as this has already been priced in.

The company might need to break the mold and guide $6 billion above its previous quarter’s guidance to reach $34 billion.

A $1 billion beat on the top line paired with an inline guide could trigger a less-than-favorable reaction in a market where the stock is trading at 21 times its next twelve months’ revenue estimates.

(BLOOMBERG)

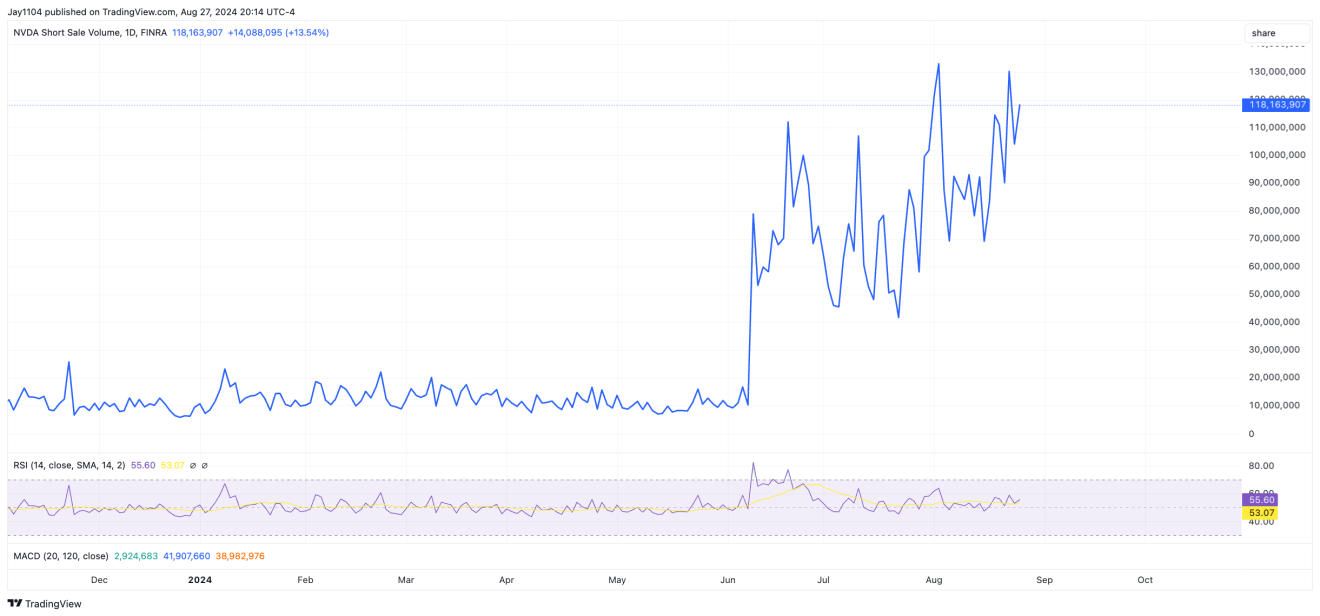

Also, short sale volume has been on the rise in recent days

Anyway, the continues to steepen, now trading at -7bps.

Meanwhile, the continues to weaken versus the , with the USD/JPY now testing that big support level at 143. A break of technical support at $143 sets up a potential decline back to the August 5 lows.

Original Post