Nikkei 225: August Market Panic Explained Through the Lens of Elliott Wave Theory

2024.09.03 10:11

Elliott Wave analysis has been doing an excellent job for us over the years when it comes to the Japanese stock market benchmark index . First, in November, 2019, it warned us about the Covid-19 crash of 2020 before we had even heard about such a thing as Covid. Then, in the midst of the Covid panic of March, 2020, it gave us a hint that a big recovery lied ahead.

More than two years later, in May, 2022, with the index already up 11 000 points from its pandemic low, the Elliott Wave structure indicated that this was no time for profit-taking. The bulls still had plenty of room to run, and run they did from just over 27k then to more than 42 400 by mid-July, 2024. Then, seemingly out of nowhere, the price reversed course and started falling sharply until the fall turned into a panic in early-August.

But this decline too made perfect Elliott Wave sense. In fact, our last update published six months earlier, , showed that a sequence of notable pullbacks was likely to begin for the Nikkei 225 once above the 40k mark. Let’s see the chart below now, in order to refresh our memory.

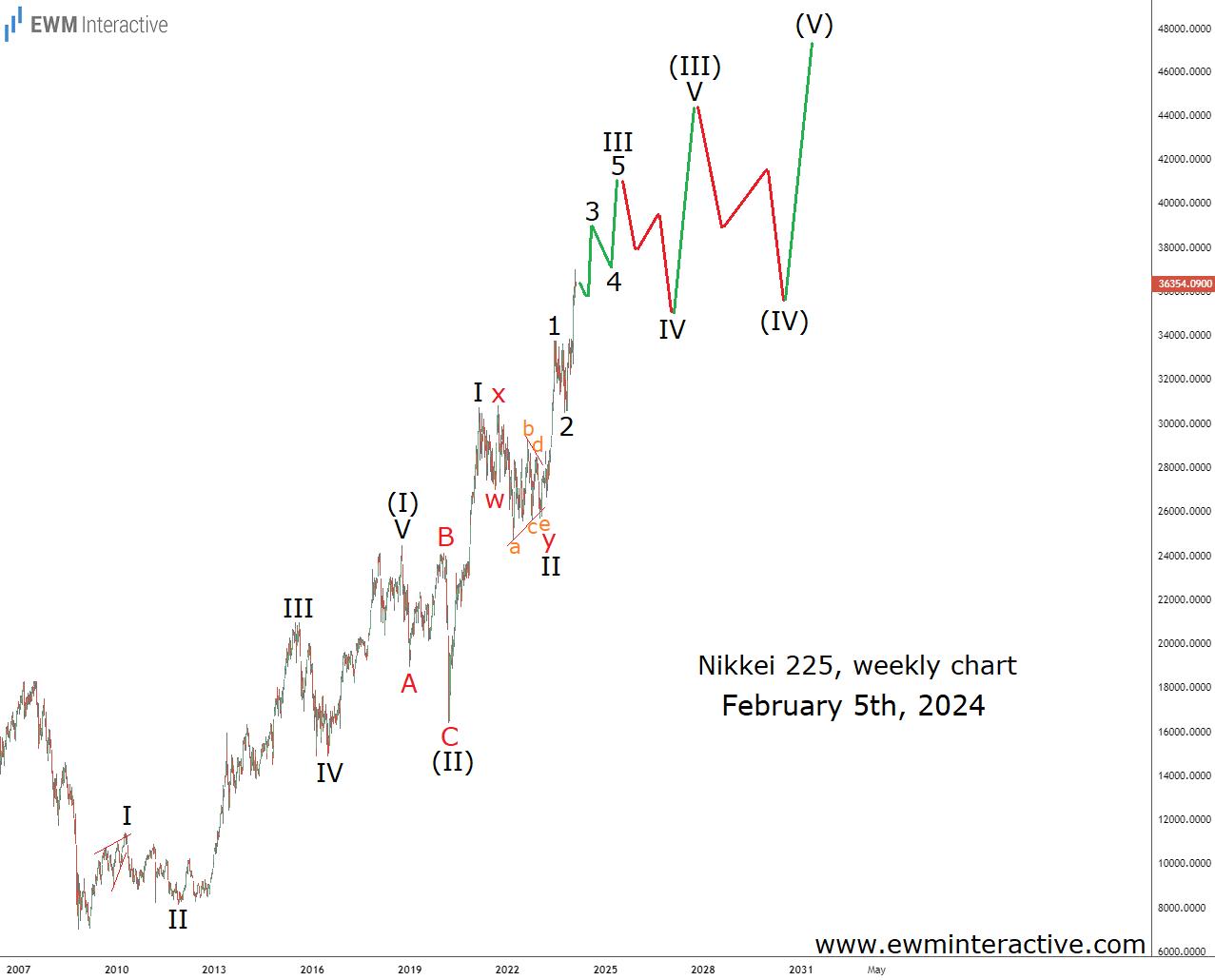

Seven months ago, in early-February, we thought that Nikkei was somewhere near the middle of a five-wave impulse pattern. We’d labeled it (I)-(II)-(III)-(IV)-(V), whose wave 3 of III of (III) was then in progress. From this it followed that we can expect more upside to over 40k, before the pattern enters a series of fourth and fifth waves. No geopolitics and no guessing what the Bank of Japan would do. Just an eye for patterns. The updated chart below shows how the situation unfolded.

Waves 3, 4 and 5 completed the five-wave structure of wave III in early-July. While we didn’t expect wave IV to be as deep as it is, it didn’t touch the top of wave I at 30 715, where the entire count would be invalidated. That’s because one of the Elliott Wave rules states that the first and the fourth waves of an impulse must not overlap.

The fact that they don’t strengthens our conviction that an impulse is indeed developing in the Nikkei 225, whose wave V of (III) we’re now witnessing. Continuing with this count, we can expect more gains to a new all-time record near 45k, before the next pullback in wave (IV) interrupts the uptrend again.

Then, wave (V) would be all that’s left to complete the pattern, putting targets near the 50k mark within reach. Instead of celebrating that major milestone when they get there, however, the bulls would do well to evacuate. According to the theory, a three-wave correction follows every impulse. Given the size of this one, it could be a real bear market.

Original Post