NFT Lending Platform BendDAO Runs Out Of Reserves As Defaults Surge

2022.08.23 12:18

BendDAO co-founder has said the protocol would release a proposal to improve parameters as the protocol faces a liquidity crisis.

NFT lending protocol BendDAO has announced that it will update the protocol’s parameters as it stares at soaring debt and depleted reserves. The protocol experienced a “bank run” over the weekend as over 15,000 Ethereum were withdrawn from its contract within 48 hours, leaving only 535 wETH for repaying lenders.

How Does BendDAO work?

BendDAO is a decentralized peer-to-peer NFT lending platform on the Ethereum blockchain. The project allows NFT holders to borrow ETH using their NFTs as collateral. It also enables depositors to provide ETH liquidity and earn relatively high interest. The leveraged NFT trading is built on instant NFT-backed loans.

Holders who wish to use their NFTs as collateral can instantly get Ethereum loans of up to 40% of the NFTs’ floor price, which is the minimum price to purchase one NFT of a collection on the open market. The instant NFT-backed loan provides instant liquidity. An owner can get back their NFT after paying off the loan and interests.

The borrowers can list the collateral directly on the NFT lending protocol. “The balance after deducting debt with interests will be transferred to the borrower (seller) after the deal,” according to the project’s GitBook.

BendDAO Runs Out of ETH

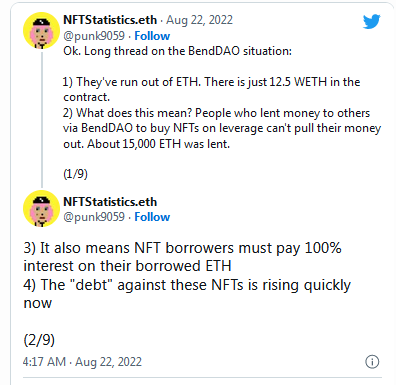

Pseudonymous NFT researcher NFTStatistics.eth has revealed that BendDAO has run out of Wrapped Ether (wETH) in its contract. Currently, the protocol’s contract only has around 535 WETH to pay lenders, with an estimated 15,000 ETH left to be paid to lenders.

In a Twitter thread, the researcher noted that users “who lent money to others via BendDAO to buy NFTs on leverage” won’t be able to access their funds now. Furthermore, NFT borrowers in the platform should now pay 100% interest on the ETH they borrowed while the debt against the NFTs rises.

Tweet

Tweet

What makes the situation even worse is that most of the NFTs that have been used as collateral and defaulted currently have no bids. In addition, a dozen more NFTs are on the platform’s alert list, meaning they are about to default and come to auction. NFT borrowers ostensibly prefer to default rather than pay their debt because of the falling NFT floor prices and rising debt and interest rates.

The researcher noted that some defaulted NFTs, including several Bored Apes and other blue-chip NFTs, have no bids because “BendDAO requires bids above the “debt” the borrower owes AND above OpenSea floor.” Moreover, users need to lock their ETH for 48 hours to open a bid.

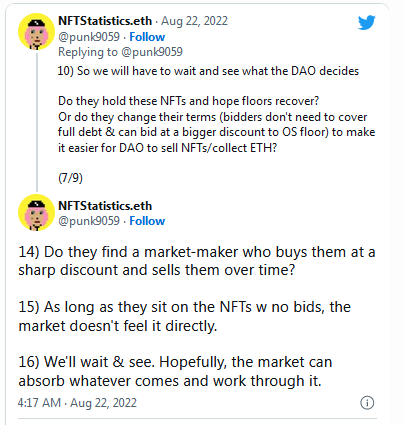

“Currently, those NFTs are hitting BendDAO auctions & not hitting exchanges. Why? Because no one is bidding on them. The DAO is getting stuffed with them & holding them. Eventually the DAO needs ETH from those NFTs to pay lenders who can’t withdraw ETH.”

BendDAO can either hold the NFTs and wait for the floor prices to recover or change their protocol to allow users to bid below the full debt or at a bigger discount to the floor price, the researcher said.

Tweet

Tweet

Meanwhile, BendDAO co-founder has said the protocol will release a proposal to change terms. “Writing a proposal to improve the protocol, including some parameters change, will post in the forum today and will effect 24 hours after voting, hope that WAGMI,” he said.