NFP Preview: EUR/USD Slips as Traders Eye Slowest Job Growth in 2.5 Years

2023.09.01 02:39

- NFP expectations are for the slowest job growth since early 2021.

- Traders, and the Fed, are looking for continued signs of slack in the labor market to signal that interest rates have peaked for this cycle.

- EUR/USD is trading between resistance near 1.0925 and support around 1.0840 ahead of the jobs report.

August NFP Expectations

Traders and economists are expecting the report (NFP) to show that 169K net new jobs were created in August and that average hourly earnings rose 0.3% m/m.

August NFP Preview

Markets are in a bit of an “in-between” stage when it comes to evaluating the economy. After years of too-high inflation readings, price pressures are finally moderating to approach the Federal Reserve’s target, as seen in today’s 4.2% reading in Core PCE. At the same time, we haven’t seen much of a meaningful slowdown in the labor market yet, though some traders are on high alert after a weak JOLTS report earlier this week.

As noted above, traders are looking for fewer than 170K net new jobs in Friday’s NFP report; this would be in line with the slowest job growth since the start of 2021! Put another way, the Fed has been looking for a slowdown in the labor market to confirm that inflationary pressures have been receding for years now, and this NFP report may confirm that labor market slack is indeed arriving.

With traders pricing in just a 1-in-8 chance of an interest rate hike at the Fed’s meeting next month per CME FedWatch, the immediate market impact of this month’s jobs report may be limited, especially if it comes out at or below expectations. That said, the US dollar remains in an interesting position after a volatile couple of weeks, so traders may still find some volatility to trade around heading into a long holiday weekend in the US.

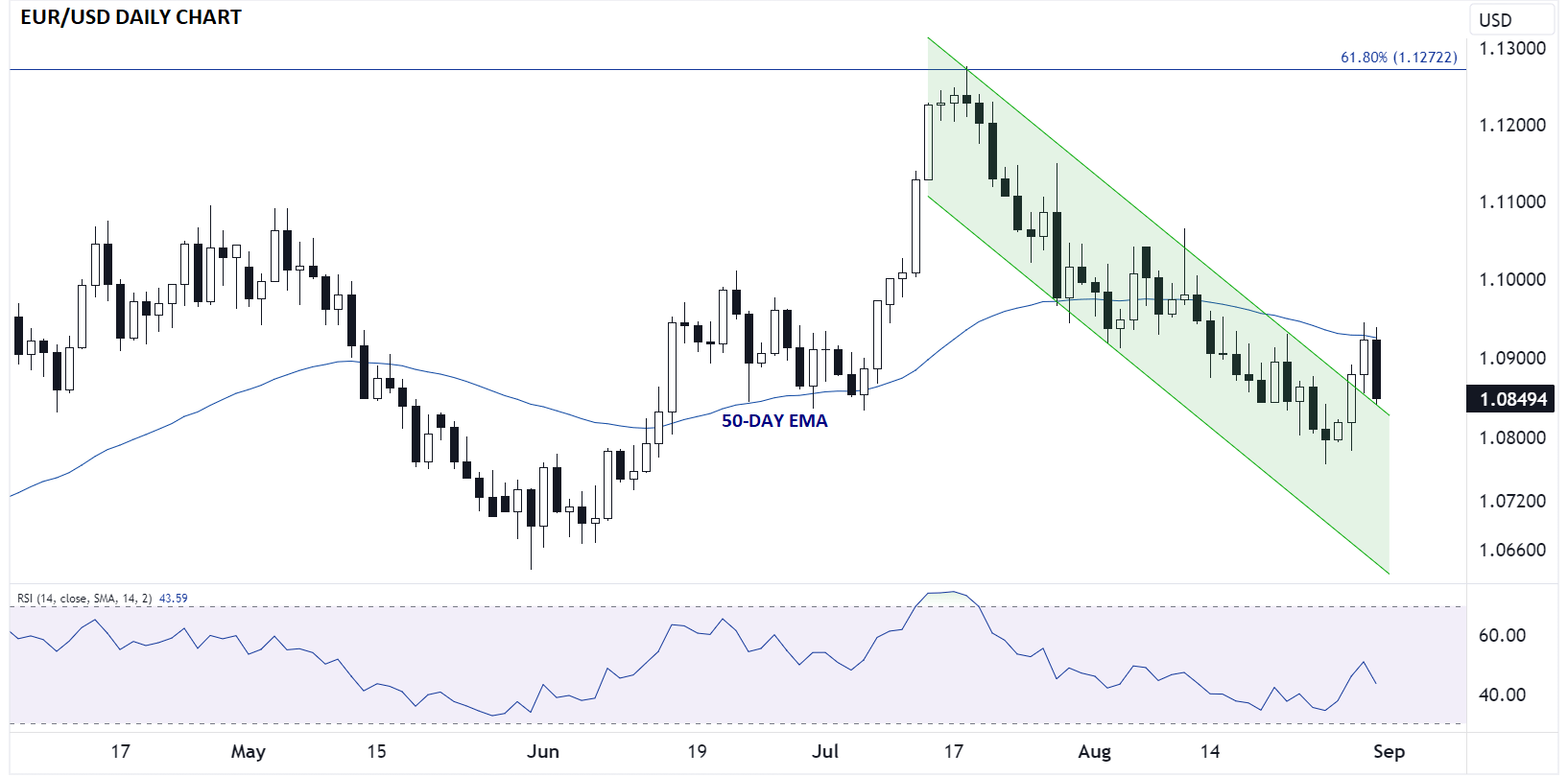

Euro Technical Analysis – EUR/USD Daily Chart

Source: TradingView, StoneX

Turning our attention to the world’s most widely-traded currency pair, broke out of a bearish channel yesterday before reversing sharply lower off 50-day EMA resistance today. Heading into Friday’s NFP report, the key levels to watch will be supported from the topside of the broken bearish channel near 1.0840 and resistance at the 50-day EMA near 1.0925.

Any surprise reading that takes the pair beyond this range could set the stage for a continuation in that same direction heading into next week.

***

Original Post