New Zealand Dollar Sinks After Soft Jobs Report

2023.08.02 09:49

- New Zealand unemployment rate rises

- NZD slide continues

- ADP Employment report smashes estimate

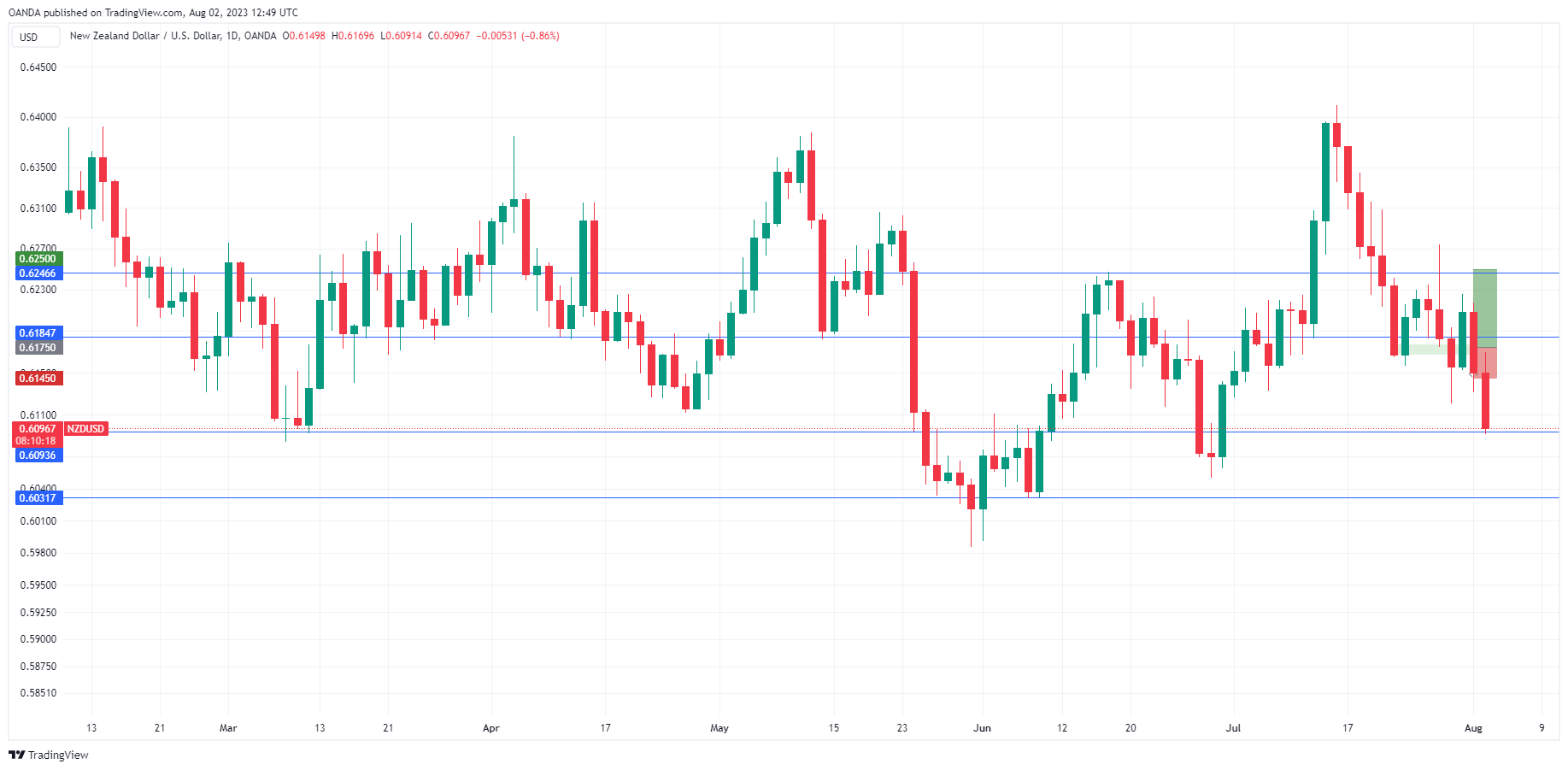

The New Zealand dollar has extended its losses on Wednesday. In the European session, is trading at 0.6093, down 0.91%. Earlier, NZD/USD touched a low of 0.6091, its lowest level since June 30th.

New Zealand unemployment climbs, wages dip

The New Zealand labour market has been tight, despite aggressive tightening by the Reserve Bank of New Zealand. Wednesday’s employment report for the second quarter showed some softening, which has extended the New Zealand dollar’s losses.

The unemployment rate rose to 3.6%, up from 3.4% in the first quarter and above the consensus estimate of 3.5%. Wage growth eased to 4.3%, below the 4.5% reading in Q1 and the estimate of 4.4%. These numbers point to a weaker labour market, but Employment Change rose 1.0%, up from 0.8% in Q1 and above the estimate of 0.5%. The mixed numbers show that the labour market may have lost a step but still remains strong enough to bear further rate hikes from the RBNZ. In July, the central bank maintained the cash rate at 5.50% and meets next on August 16th.

China released July PMIs this week, and the soft readings are weighing on the New Zealand dollar. China is New Zealand’s largest trading partner and the New Zealand dollar is sensitive to Chinese economic releases. We’ll get a look at the Caixin Services PMI on Thursday. The consensus estimate stands at 52.5, following a June reading of 53.9. A reading above 50.0 points to expansion.

In the US, the ADP Employment report kicked off a host of job releases, highlighted by nonfarm payrolls on Friday. ADP impressed with a gain of 327,000 for July, below the June reading of 455,000 but blowing past the consensus estimate of 189,000. A month ago, ADP came in at 497,000, fuelling speculation that nonfarm payrolls might follow suit with a strong release. In the end, nonfarm payrolls fell significantly, as expected. Will the NFP follow ADP’s lead and crush the estimate?

NZD/USD Technical

- NZD/USD is testing support at 0.6093. Below, there is support at 0.6031

- 0.6184 and 0.6246 are the next resistance lines

Original Post