New Zealand Dollar Down Despite Rise in Retail Sales

2022.11.25 07:16

[ad_1]

The New Zealand dollar has edged lower on Friday. In the European session, is trading at 0.6244, down 0.33%.

Retail sales post modest gain

It wasn’t a spectacular rebound by any means, but New Zealand’s showed a gain in Q3. Headline and core retail sales both rose a modest 0.4% QoQ. This follows a soft Q2, when headline retail sales came in at -2.2% and the core release at -1.5%. The reaction of NZD/USD was subdued, likely a result of the Thanksgiving holiday, with US markets open for limited hours today.

Retail sales data may not be as positive in Q4, with the Reserve Bank of New Zealand hiking rates by a massive 0.75% this week. The RBNZ has signalled that household spending will have to drop in order to curb inflation, and with more rate hikes still to come, it’s clear that household spending will come down during the current rate-hike cycle.

The Federal Reserve has telegraphed to the markets that it will continue to raise rates, despite the last inflation report, which was softer than expected. The Fed’s message, reiterated in this week’s minutes, remains somewhat mixed. On the one hand, the Fed has signalled that the pace of rates will be easing, and the markets have priced in a ‘modest’ 50 bp hike in December after four consecutive 75-bp increases. At the same time, some Fed members are projecting that the terminal rate will be higher than previously expected. There is uncertainty as to whether this “lower for longer” stance is bullish or bearish for the , a question we’ll have to wait for market participants to answer.

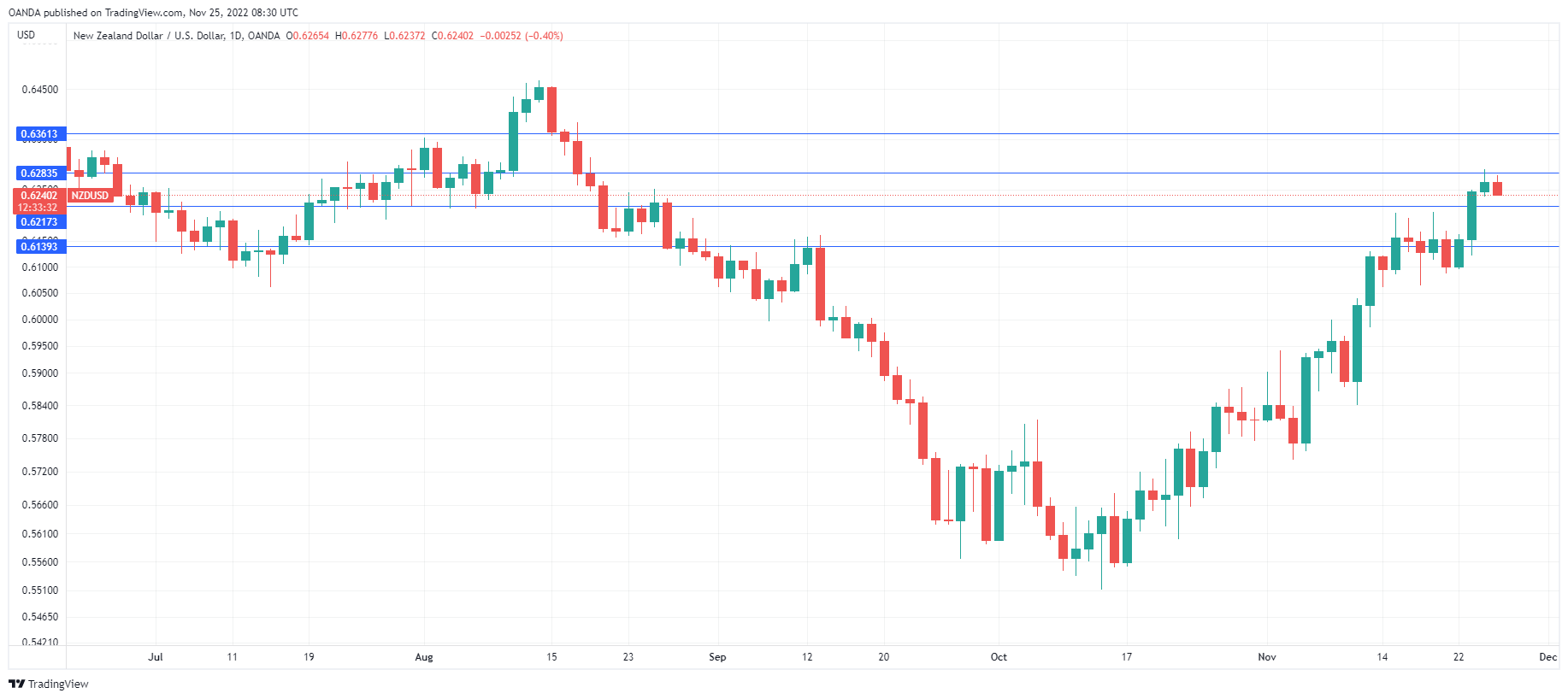

NZD/USD Technical

- NZD/USD faces resistance at 0.6283 and 0.6361

- There is support at 0.6217 and 0.6139

Original Post

[ad_2]

Source link