Nations building their own AI models add to Nvidia’s growing chip demand

2024.08.28 21:43

By Arsheeya Bajwa

(Reuters) – Nations building artificial intelligence models in their own languages are turning to Nvidia (NASDAQ:)’s chips, adding to already booming demand as generative AI takes center stage for businesses and governments, a senior executive said on Wednesday.

Nvidia’s third-quarter forecast for rising sales of its chips that power AI technology such as OpenAI’s ChatGPT failed to meet investors’ towering expectations. But the company described new customers coming from around the world, including governments that are now seeking their own AI models and the hardware to support them.

Countries adopting their own AI applications and models will contribute about low double-digit billions to Nvidia’s revenue in the financial year ending in January 2025, Chief Financial Officer Colette Kress said on a call with analysts after Nvidia’s earnings report.

That’s up from an earlier forecast of such sales contributing high single-digit billions to total revenue. Nvidia forecast about $32.5 billion in total revenue in the third quarter ending in October.

“Countries around the world (desire) to have their own generative AI that would be able to incorporate their own language, incorporate their own culture, incorporate their own data in that country,” Kress said, describing AI expertise and infrastructure as “national imperatives.”

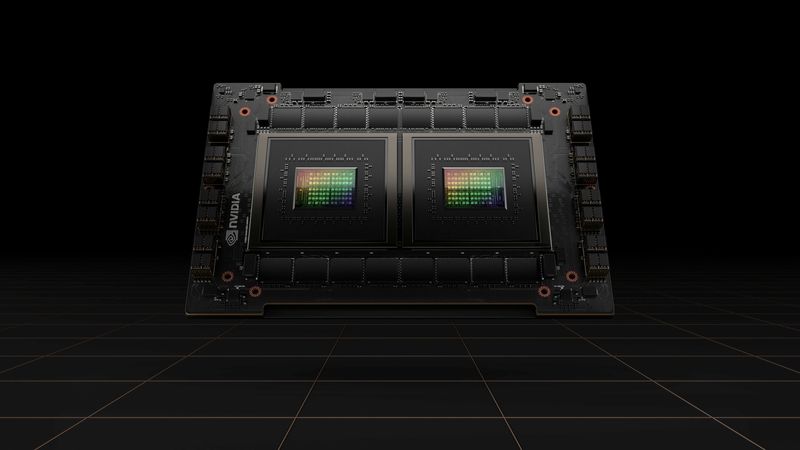

She offered the example of Japan’s National Institute of Advanced Industrial Science and Technology, which is building an AI supercomputer featuring thousands of Nvidia H200 graphics processors.

Governments are also turning to AI as a measure to strengthen national security.

“AI models are trained on data and for political entities -particularly nations – their data are secret and their models need to be customized to their unique political, economic, cultural, and scientific needs,” said IDC computing semiconductors analyst Shane Rau.

“Therefore, they need to have their own AI models and a custom underlying arrangement of hardware and software.”

Washington tightened its controls on exports of cutting-edge chips to China in 2023 as it sought to prevent breakthroughs in AI that would aid China’s military, hampering Nvidia’s sales in the region.

Businesses have been working to tap into government pushes to build AI platforms in regional languages.

IBM (NYSE:) said in May that Saudi Arabia’s Data and Artificial Intelligence Authority would train its “ALLaM” Arabic language model using the company’s AI platform Watsonx.

Nations that want to create their own AI models can drive growth opportunities for Nvidia’s GPUs, on top of the significant investments in the company’s hardware from large cloud providers like Microsoft (NASDAQ:), said Bob O’Donnell, chief analyst at TECHnalysis Research.