Nasdaq Struggles at 50-Day MA as S&P 500, Russell Diverge Further

2024.07.31 03:34

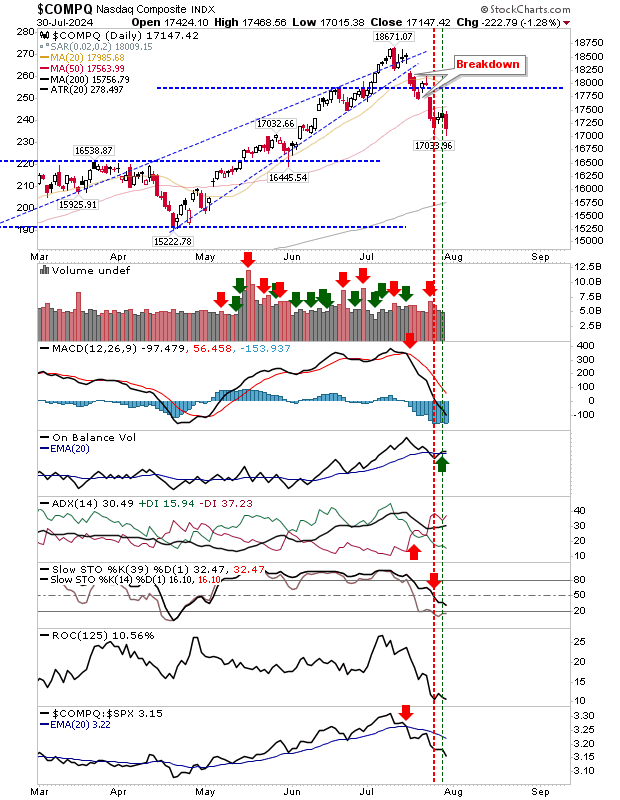

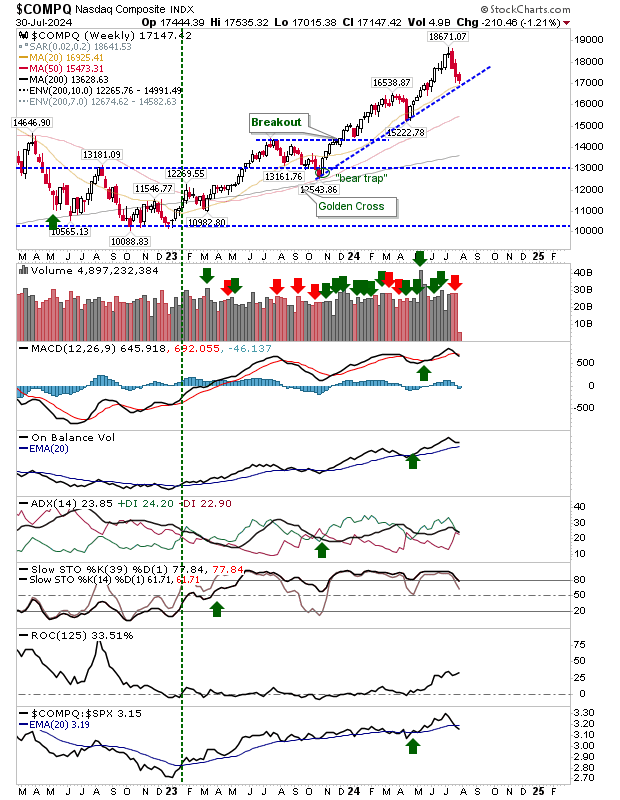

Yesterday, the price action in the was the most telling. The last couple of days have seen the index struggle to recover its 50-day MA, as it closed yesterday with the bearish ‘black’ candlestick that’s common in reversals. Buyers did their best to defend the 17,033 swing low, but I’m not sure it will be enough.

There is a gap around the 15,850 mark from May that will suck prices down to it, then there is the 200-day MA for long-term support. Technicals are bearish, but not fully oversold, although On-Balance-Volume edged a new ‘buy’ trigger. However, I wouldn’t be surprised if we saw a bullish ‘hammer’ or ‘doji’ that tagged *weekly* trend support intraday before bouncing.

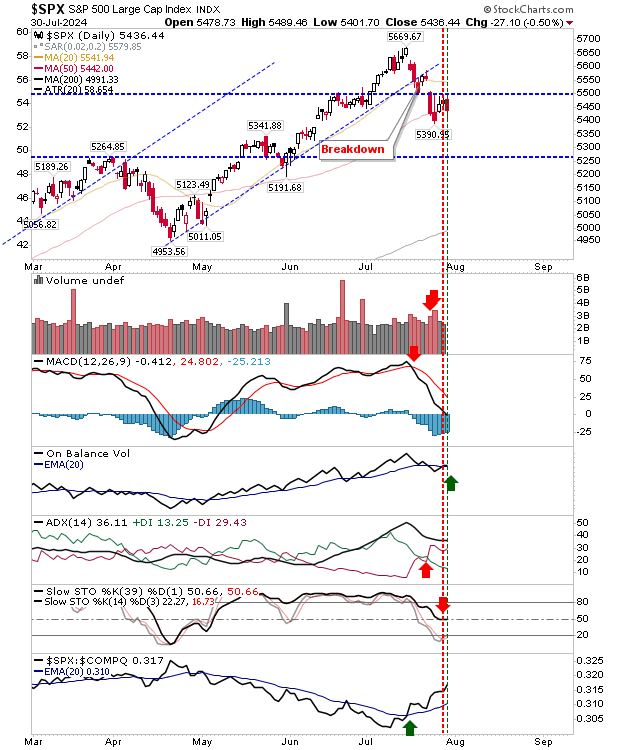

It was a similar story for the , if a little more bullish. Buyers stepped in late to recover the 50-day MA as On-Balance-Volume also saw a new ‘buy’ trigger. Interestingly, intermediate stochastics are holding the bullish mid-line, suggesting the current decline is a pullback in a broader bullish trend (from May). If this is to prove true then today requires a higher close.

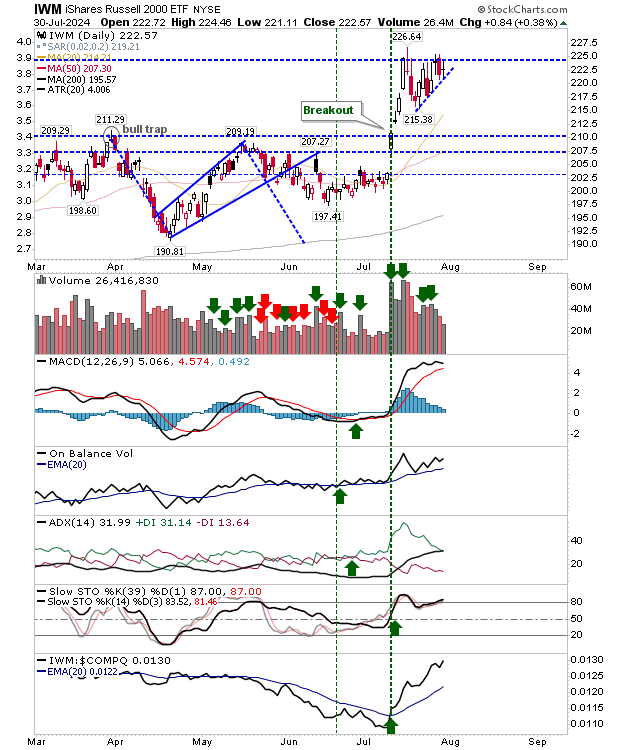

The () is doing its own thing. Prices are getting squeezed into a coil, making for a good swing trade opportunity (options play). The expectation is for an upside break of $225, but a move in the other direction will catch many traders out and could deliver a big 1-day loss. Technicals are net bullish with relative performance particularly strong.

For today, watch pre-market action for an undercut of the swing low from last Thursday. There is a host of economic announcements to move the market before it opens. If we get a gap down in the Nasdaq, then it will be hard for the S&P 500 to hold moving average support and may even influence the Russell 2000.