Nasdaq Flirts With ‘Bear Trap’ After Underpinning 50-Day MA

2025.01.13 02:30

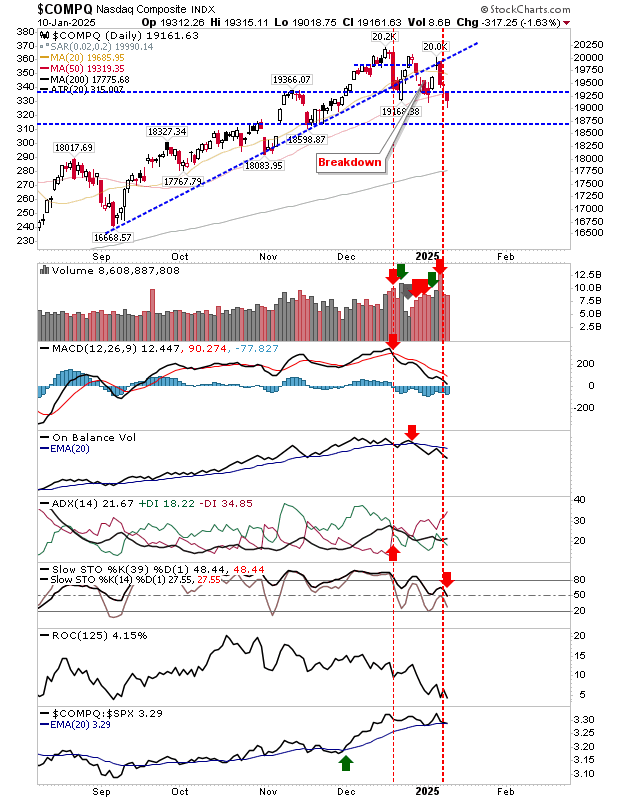

The undercut its 50-day MA as technicals edged net bearish. However, stochastics [39,1] only just dropped below the 50 mid-level (on the daily timeframe), so this could be a bullish pullback ‘buy’; a close above 19,350 would effectively confirm a new ‘bear trap’.

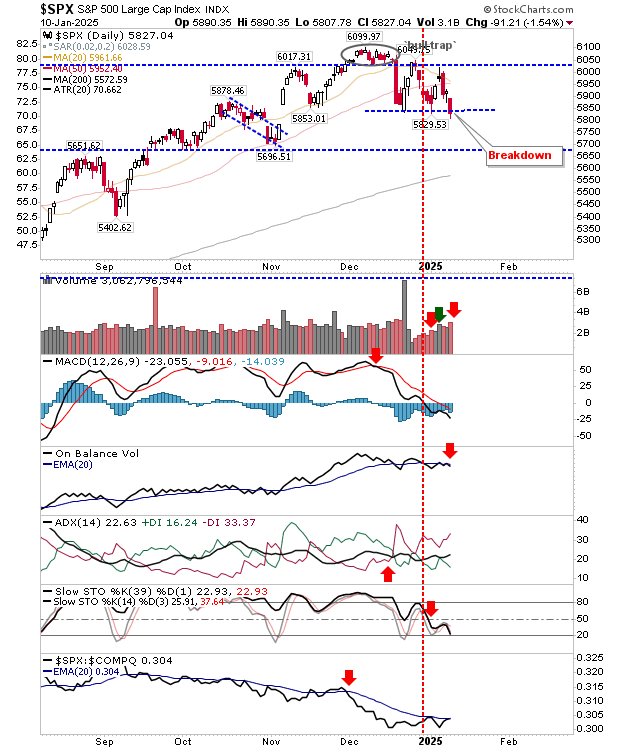

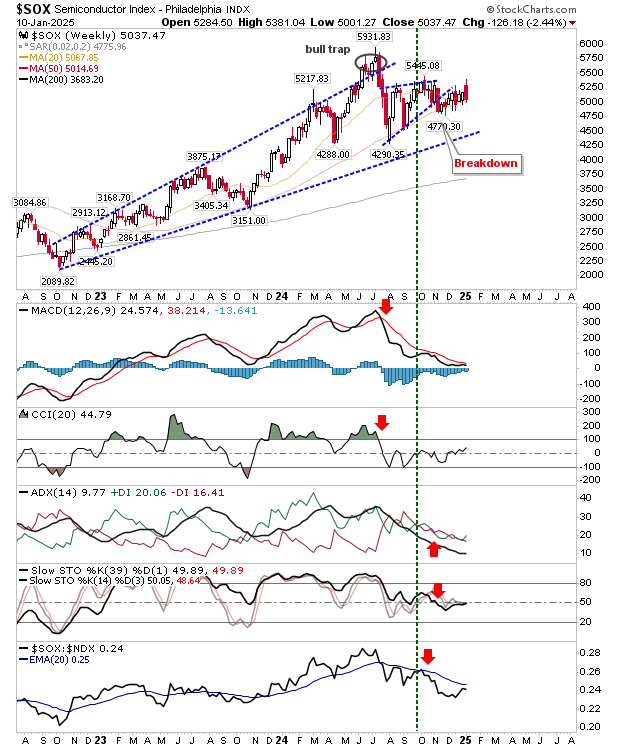

The undercut the December swing low with a new breakdown on higher volume distribution. Next target is the November swing low near horizontal support of 5,670.

Technicals are net bearish, although stochastics are not fully oversold and weakness in the MACD histogram is expanding – so tomorrow could see further downside.

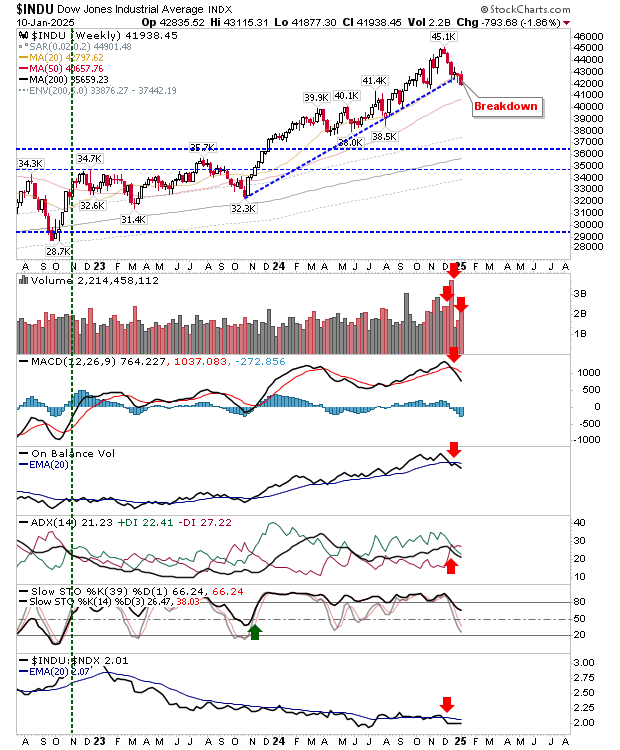

End-of-week breakdowns for the () and ($DJIA) put pressure on averages for the week ahead.

There is an opportunity for ‘bear traps’ next week but follow-through losses today would likely kill that chance off.

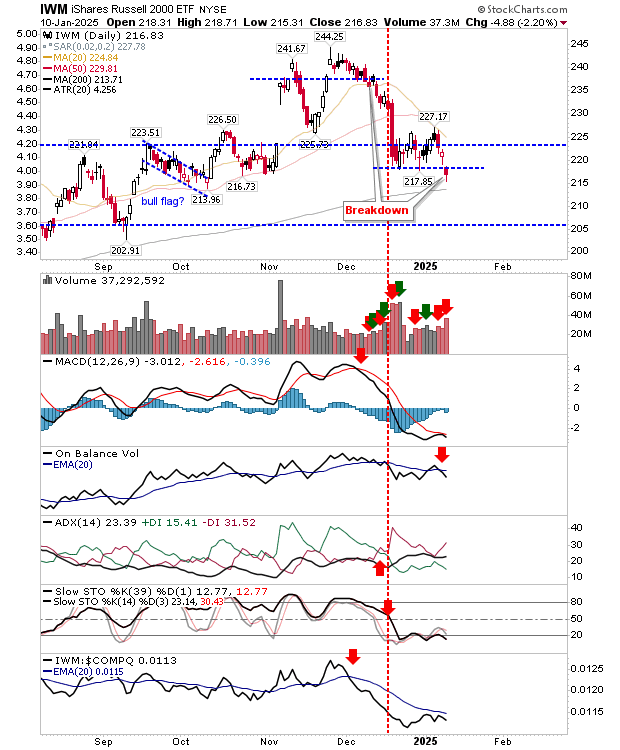

The Russell 2000 has the best chance to deliver on the ‘bear trap’ given the proximity of the 200-day MA.

Technicals are net bearish, but the MACD is on course for a weak ‘buy’ signal. A close above $219 would confirm the trap, but a sustainable reversal won’t come until there is a break of the 20-day MA.

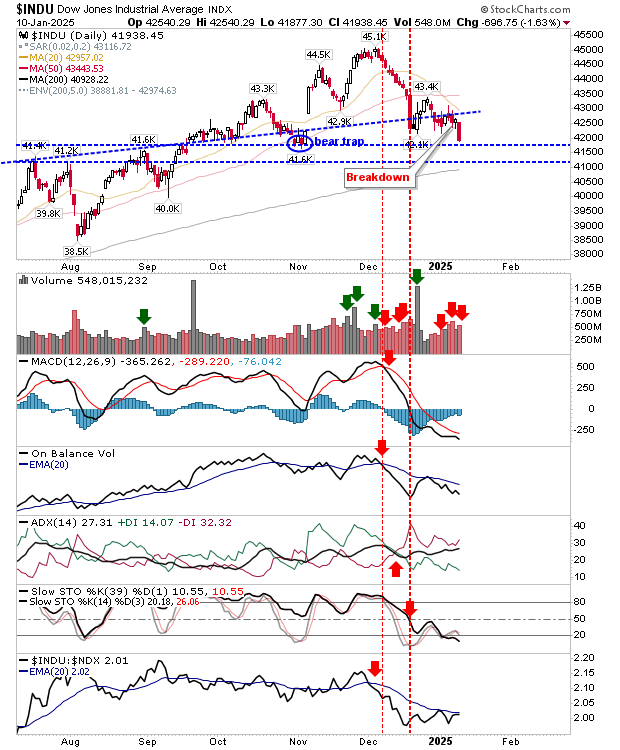

An ugly day for the Dow Industrials led to the breakdown in the weekly timeframe. There is a chance the November swing low (a ‘bear trap’) will play as support, although higher volume selling ranked as distribution on both daily and weekly timeframes. If the November swing low fails as support, then the 200-day MA (or 50-week MA) is the next port of call.

The final chart I’ll show is the weekly . It has been hugging the 50-week MA for several weeks, but it looks primed for a big weekly loss.

A tricky week lies ahead for indices. With weekly breakdowns in some markets, it’s likely going to take a few weeks to see how this plays out. It has been a while since we have seen an undercut of 200-day MAs in indices, and it’s only natural to expect such undercuts sooner rather than later.