Nasdaq: Bearish Cloud Cover Signals More Pain Ahead

2025.02.03 04:33

Market travails continue to be an issue for bulls. Positive opening gaps across indices quickly faded, leaving markets in a state of risk-off as trade war fears reemerged.

Now, are leading the selloff, plunging 2.7%. have dropped 2%, while tumbled 1.4%, shedding roughly 600 points.

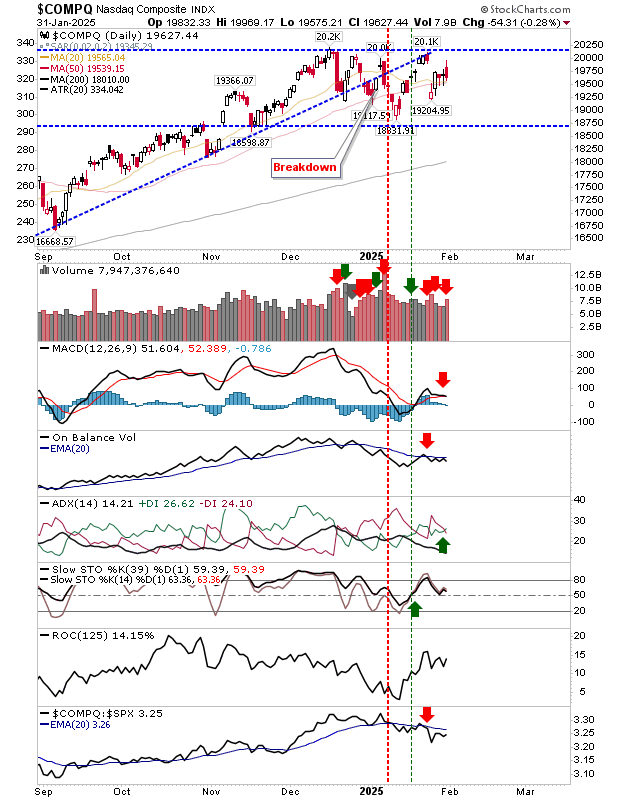

The closed its breakdown gap before reversing into a ‘bearish’ cloud cover. There are also ‘sell’ triggers for the MACD and On-Balance-Volume.

The December breakdown is still in play and the best optimists can look to is an 18,700-20,100 trading range. Look for a retest of 18,700.

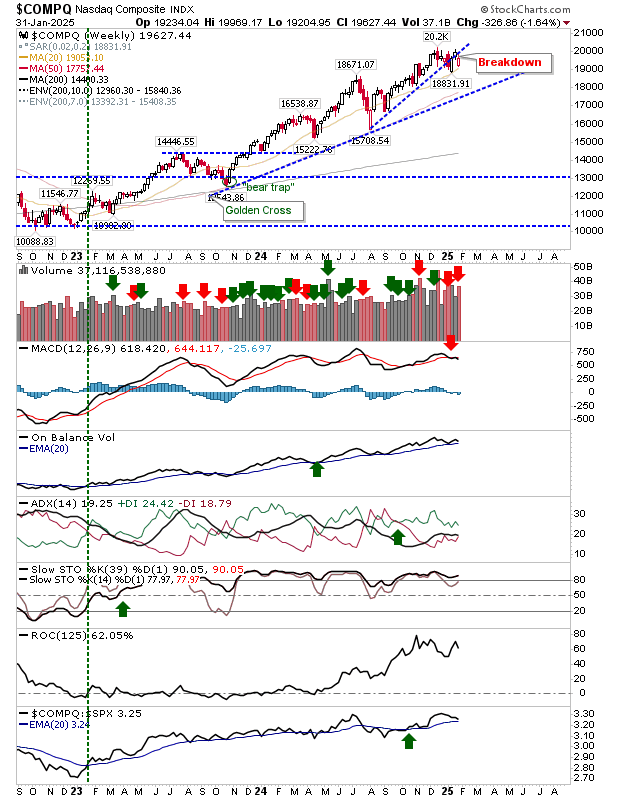

The weekly time frame shows a trend breakdown from 2024’s sharply ascending trend, with a larger bullish trend from 2023 looking ripe for a retest.

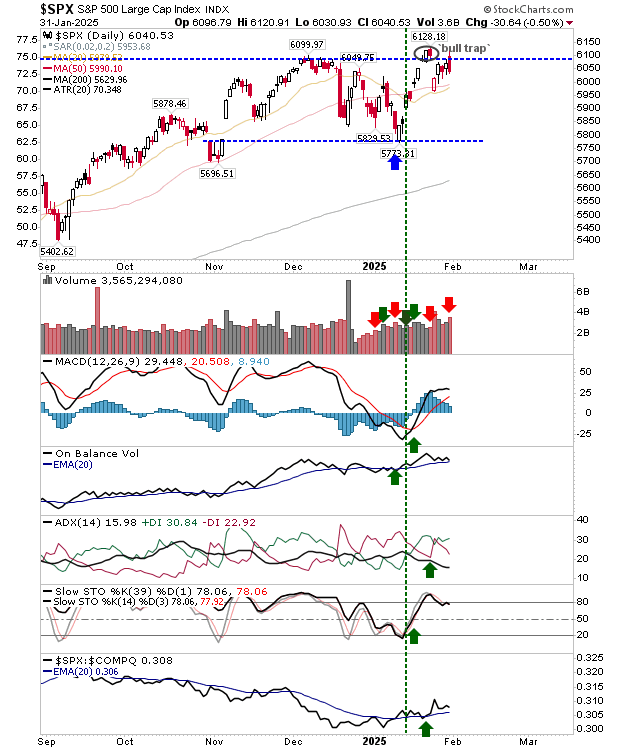

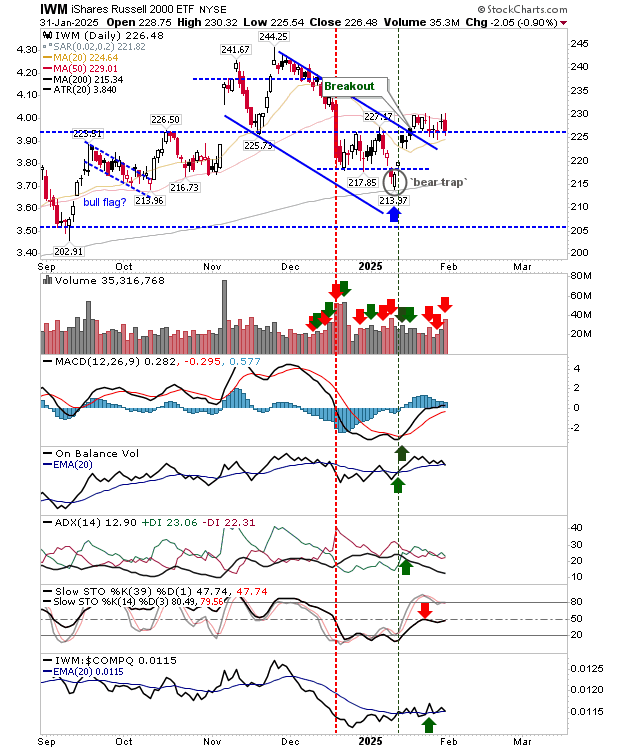

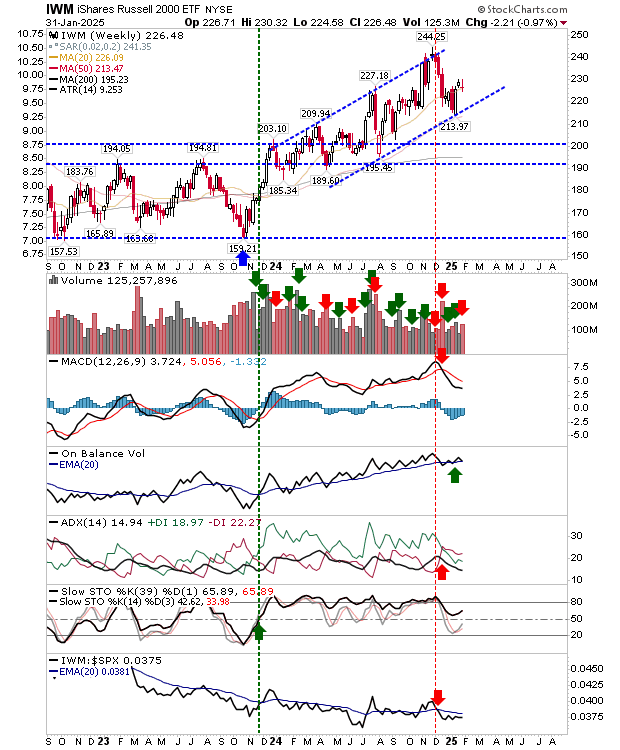

Meanwhile, the ‘bull trap’ is still an issue for the with Friday’s action registering as a distribution day to boot. On the plus side, technicals are again net positive.

Although on a weekly time frame, there is an ever so slowly narrowing ‘bearish’ wedge.

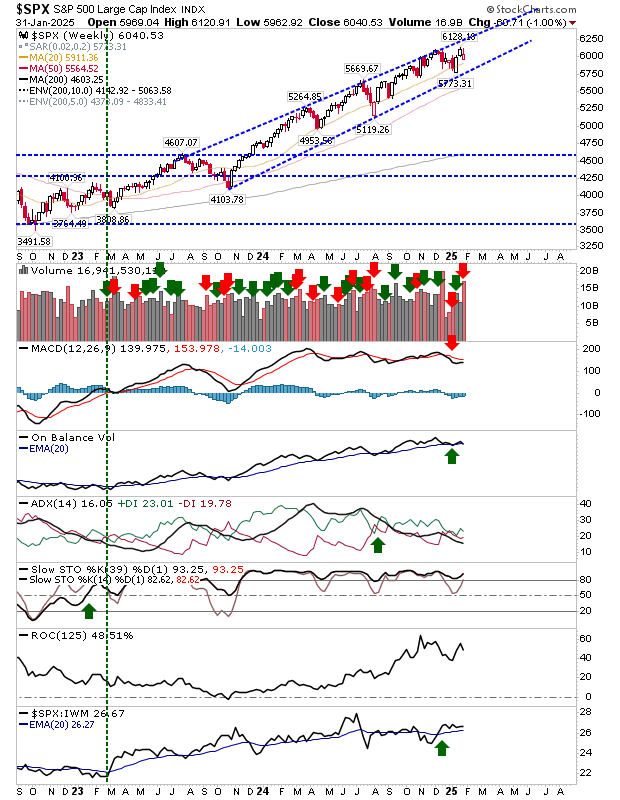

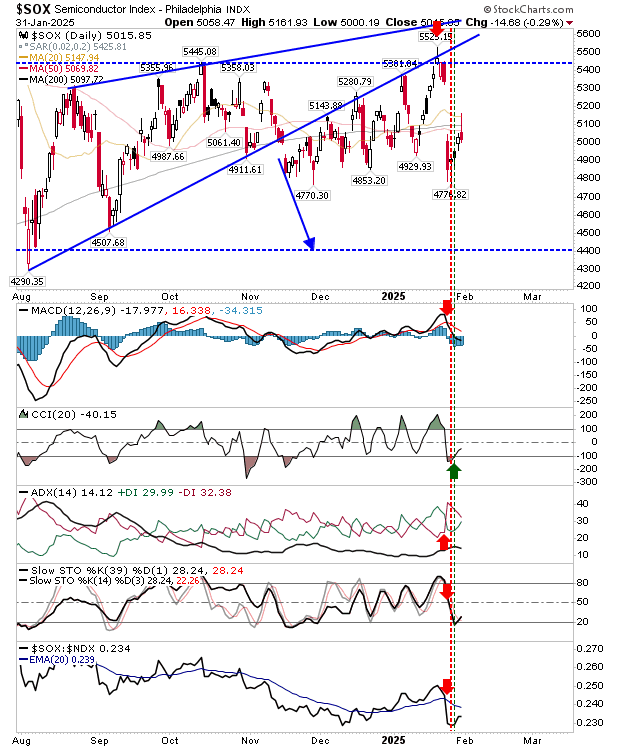

The () spent another day under its 50-day MA after trying to break through.

Repeated attempts to challenge a support or resistance level typically lead to a breakthrough after at least 3 attempts; we are now on 7 attempts and counting for a breakout of its 50-day MA.

I have redrawn the trend on the weekly timeframe, with the week finishing on a higher distribution. Technicals are mixed.

On a final note, the , having undercut moving averages on the gap down, finished Friday with a bearish “inverse hammer” that spiked into those same moving averages. If bears want a shorting candidate, this is it.

For the week ahead, watch for a bearish follow to Friday’s selling. If this lasts a couple of days, then prepare for larger tests of support as defined by indices’s trading ranges. The index looking most vulnerable to selling is the Semiconductor Index.