Nasdaq and S&P 500 Test Resistance, Russell 2000 Struggles

2023.05.01 03:25

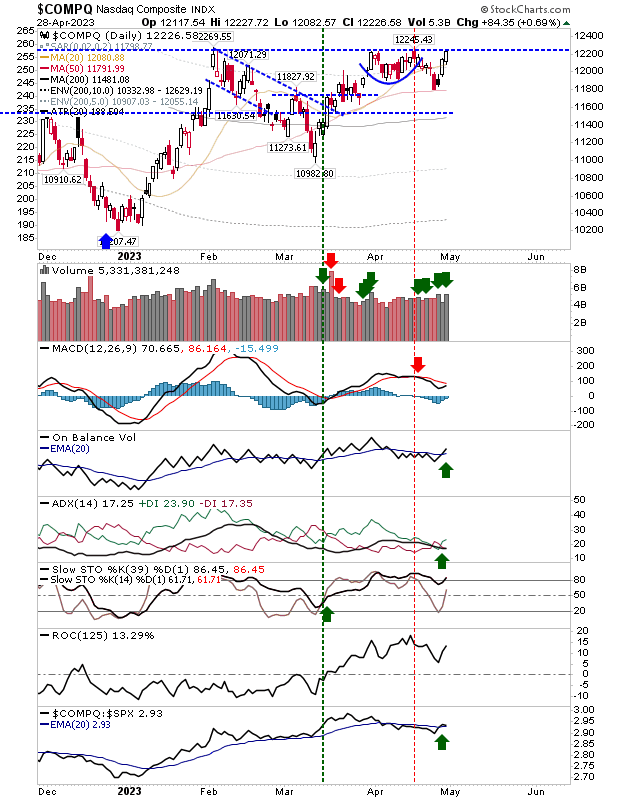

Bears could not press their advantage when the first challenge of resistance failed. Instead, buyers mounted a fresh charge with the and recording accumulation days. For the last couple of months, when buyers have had control of the Nasdaq, they have done so on bullish accumulation, but when bears had the edge, they haven’t been able to control the story.

The Nasdaq returned a fresh ‘buy’ signal in On-Balance-Volume and ADX and a return in bullish relative performance over the S&P 500. With the index back at 12,225, we have yet another knock on the door of a breakout. Remember, triple tops are rare, and for bears to have the edge, they will need a small miracle to drive this lower. I would be looking for a breakout at minimum, bears may win out with a ‘bull trap,’ but we cross that bridge when we come to it.

COMPQ Daily Chart

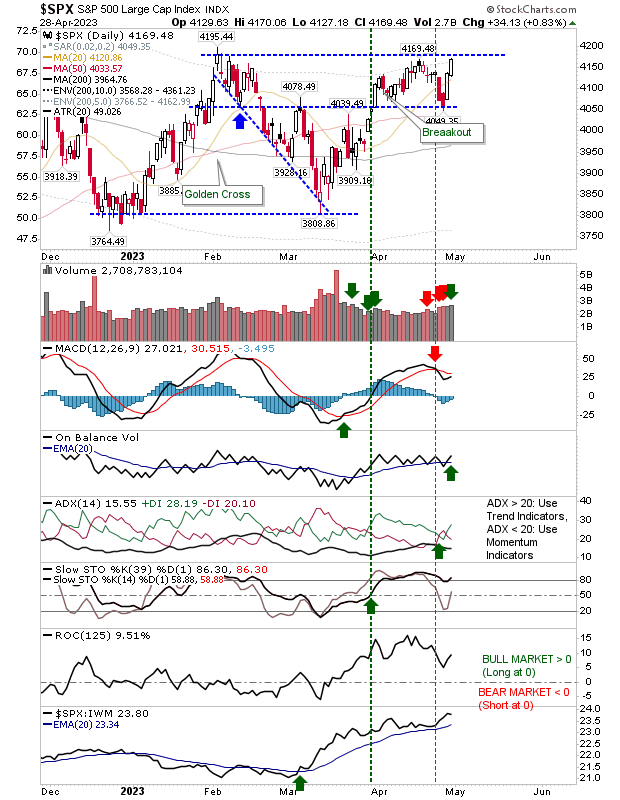

The S&P 500 is also working on a resistant break. The MACD is the only bearish technical metric, and even that is well above its MACD bullish zero line. While the index lost ground against the Nasdaq, it maintains a strong relative performance advantage over the . It hasn’t enjoyed the same degree of accumulation as the Nasdaq in recent weeks, but it’s still very positive.

SPX Daily Chart

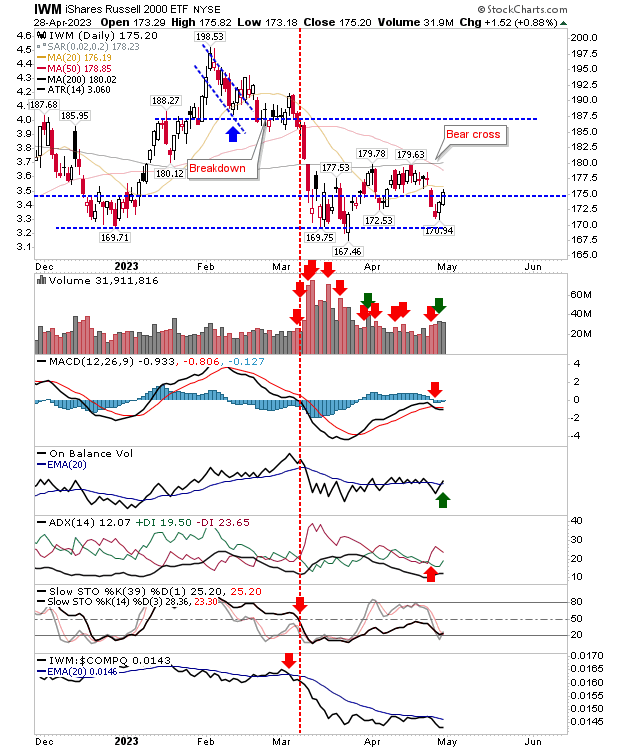

The worry is the Russell 2000. Strong bull markets need small-cap leadership, and we do not see that here. Yes, buyers came in to rescue declines, but this index is trying to build a right-hand base yet is stuck in a year-long base. Only when the ETF gets past $195 can we consider that a right-hand base is in the making. Its struggles below the 200-day MA don’t help, and then only On-Balance-Volume is bullish, but really, it’s in whipsaw.

IWM Daily Chart

Next week, we will be looking (for a second time) for resistance breakouts in the Nasdaq and S&P 500. Whether markets can build on such breakouts is a separate question, so let’s get there first.