Nasdaq and Russell 2000 Break Channels, S&P 500 Holds Firm: What’s Ahead?

2023.08.11 03:58

Bears were able to fire a shot across the bow of bulls with existing rallies for the likes of the and slowed by channel breaks. While the breaks might be seen as bearish, more likely, these will represent a shift to a sideways trading range rather than a straight bearish reversal.

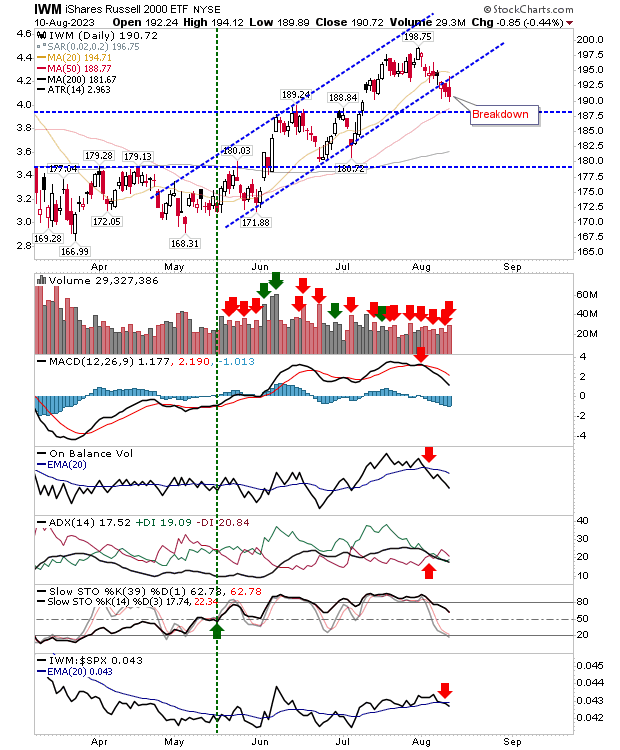

The Russell 2000 has confirmed a break from its channel, but realistically, this channel has only been running since May, and breakout support around $188s is more important. Today’s volume ranked as distribution and technicals are net bearish, but with the 50-day MA nearby, I would view this with a degree of optimism.

IWM Daily Chart

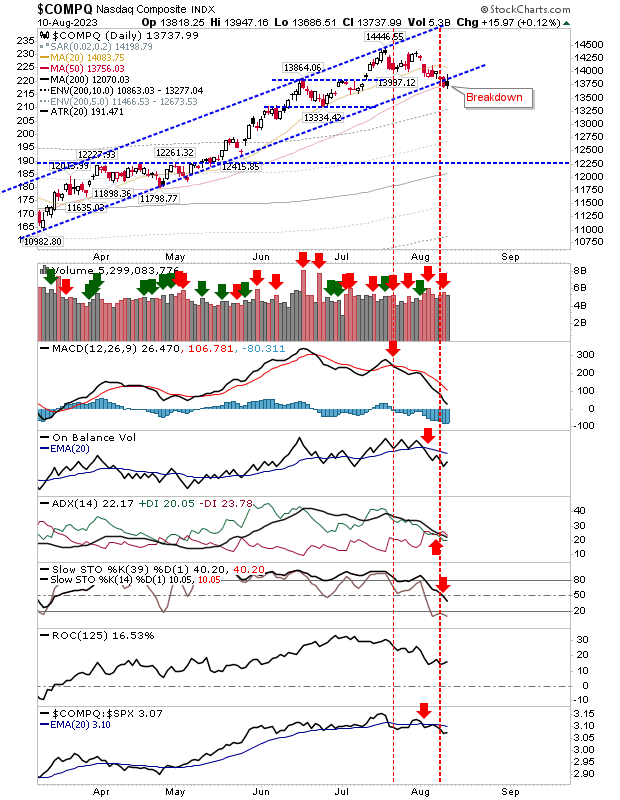

The Nasdaq may have a more significant break, although it only barely closed outside of channel support. Despite this, the index is holding on to 50-day MA support, and one strong day of buying would be enough to push this back inside the channel.

If this proves to be the case, then it may be necessary to redraw the bullish support line. As with the Russell 2000, technicals are net bearish. I’m not too concerned with the channel break at the moment.

COMPQ Daily Chart

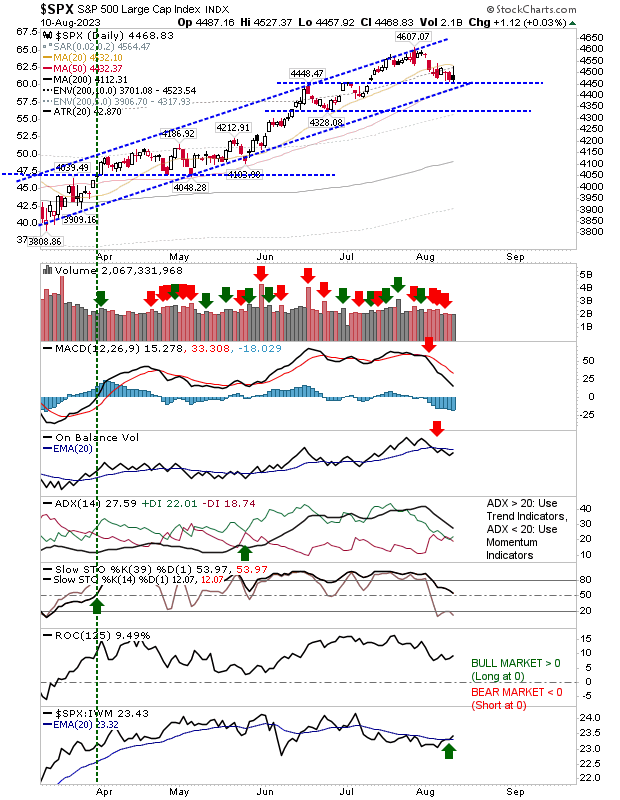

The is the only index not to rock the boat with a channel breakdown. Because of this, it’s still holding on to overall bullish technicals, despite ‘sell’ triggers in the MACD and On-Balance-Volume. Today’s trading volume was also light. The 50-day MA is running alongside channel support that should help bulls.

SPX Daily Chart

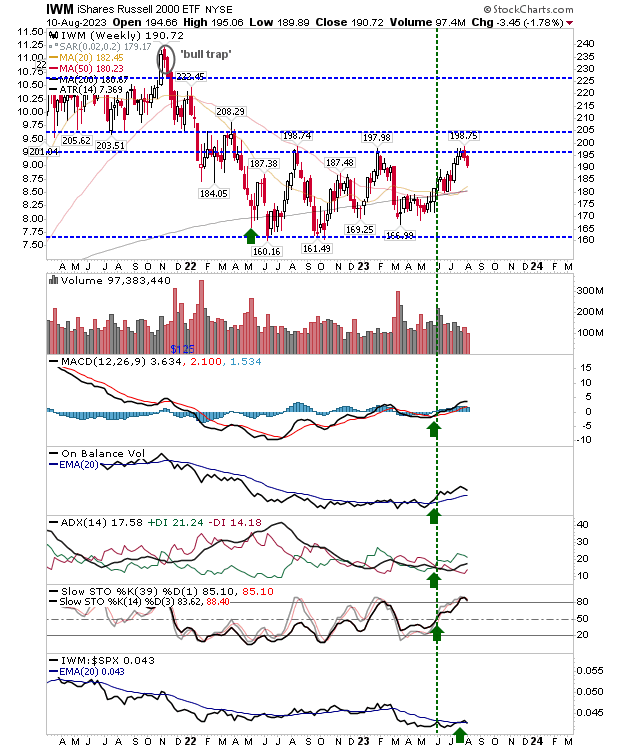

While the week isn’t up yet, I’ll finish with the iShares Russell 2000 ETF (NYSE:) weekly chart. Once again, we had a rebuttal off $196 resistance, a supply level running back to last summer. If the index can close a weak above this price, it would go a long way to driving the next (powerful) phase of the rally.

IWM Weekly Chart

Let’s see what tomorrow brings. With holiday trading in full swing, I’m not expecting any major acceleration lower despite today’s breaks. As we get closer to September, we can start to see more typical trading volume.