Nasdaq: A Break Above 11400 Is A Buy Signal

2022.10.04 11:15

[ad_1]

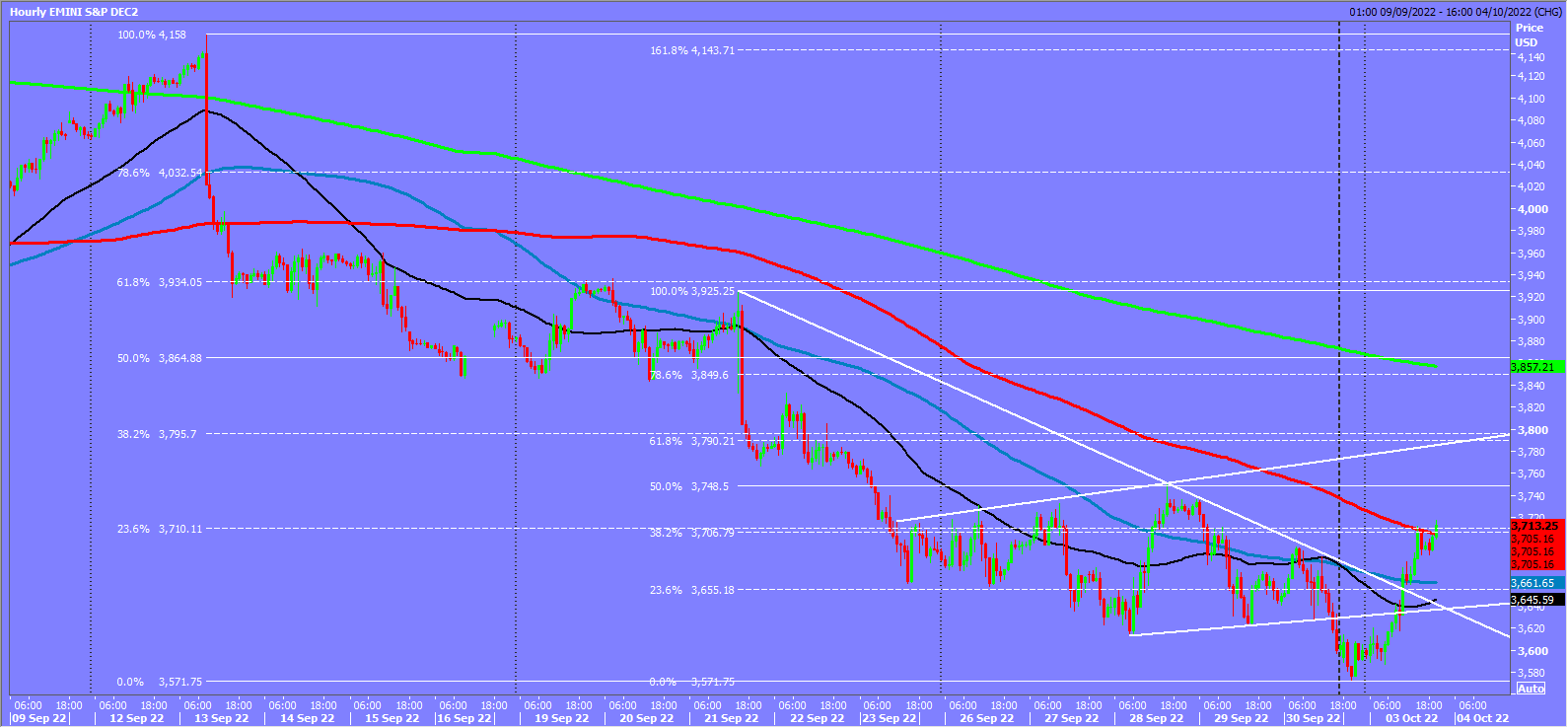

December futures initially headed lower as expected testing key 200 week moving average support at 3590/85, but over ran to 3572. We very quickly recovered above 3590 – longs did well reaching targets of 3650/60 and strong resistance at 3700/20.

A high for the day exactly here but yesterday’s bullish engulfing candle suggests a bear squeeze has started.

December tested the important 200 week moving average at 11180/150. A break below 10990 was required for a sell signal but this was the low yesterday.

E-mini followed the others higher to retest strong resistance at 29550/650 Shorts need stops above 29750.

Remember when support is broken it usually acts as resistance and vice-versa.

Today’s Analysis

E-mini S&P December bullish engulfing candle off the 200 week moving average in severely oversold conditions suggests a low for the correction, at this stage at least. A high for the day exactly at strong resistance at 3700/20 but be ready to buy a break above 3720 targeting 3750/53. We should struggle to beat this level here but shorts are probably too risky now. If we continue higher look for 3790/95. Eventually we could reach 3850/60.

A dip below 3690 signals a test of support at 3660/50. Longs need stops below 3640.

Nasdaq December bullish engulfing candle off the 200 week moving average in severely oversold conditions suggests a low for the correction, with a potential double bottom buy signal. The bounce hit the target and strong resistance at 11350/390 with a high for the day exactly here. Buy a break above 11400 targeting 11500 and 11650/700. A high for the day certainly possible but shorts are risky now in what is likely to be a short squeeze in to the end of the week.

Holding strong resistance at 11350/390 targets 11270/250 before support at 11200/150. Longs need stops below 11050.

E-mini Dow Jones shot higher to strong resistance at 29550/650 Shorts need stops above 29750. Buy a break above here targeting 29850/900 and 30150/200. Eventually we could reach 30500/600.

First support at 29300/200. Longs need stops below 29100.

[ad_2]

Source link