Nasdaq 100 Stampede Poised to Take a Breather

2023.07.20 03:49

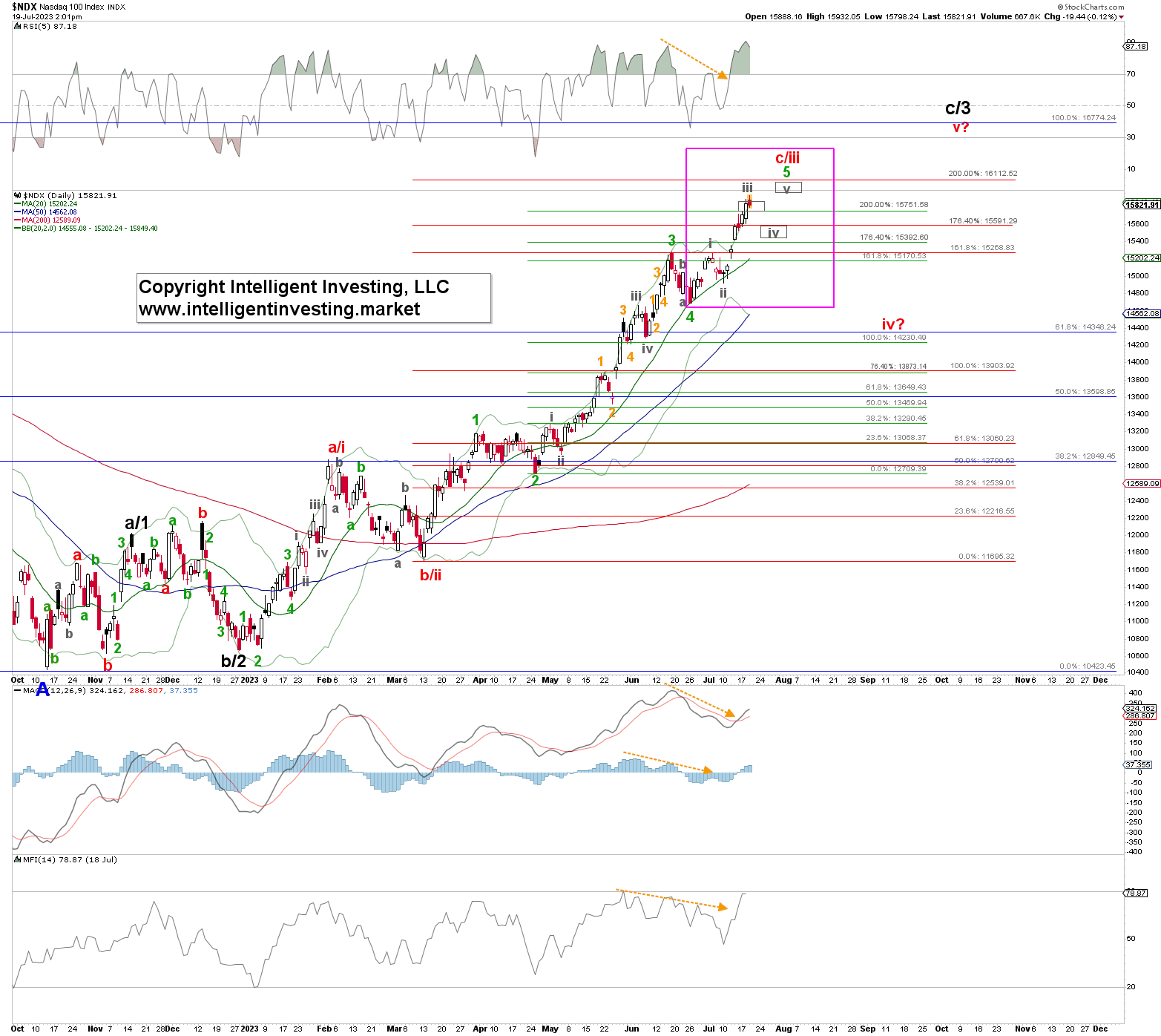

Two weeks ago, see ; our primary expectation based on our interpretation of the price action for the using the Elliott Wave Principle (EWP) was to drop to $14000 before rallying to $15500+. We found,

“The index gave the Bulls their first warning by dropping below the June 28 high. It has since rallied to close the opening gap. The NDX will have to fall again below that level, [$14970], to suggest the index is in grey W-iii of green W-c of red W-iv. The anticipated pattern will officially be confirmed below the June 26 low, [$14687] but below $14870 will already be a severe warning for the Bulls that $15500+ will have to wait a while, and the index should first revisit $13900-14230. Our thesis will be proven wrong on a break above $15284. In that case, we should expect, ideally, $15435-525.”

Fast forward, and despite the negative divergences on the technical indicators (TIs, orange arrows), the index decided to take the direct route to $ 15,500+. It rallied strongly on the July 12 Consumer Price Index () data, breaking above the critical $15284 level. Hence, our thesis was wrong. But as we announced publicly the day before, a breakout would target $16,1K. We had warned that there was “no need to front-run: Reaction to CPI tomorrow will most likely tell us which direction.”

Now that the index topped today at $15932, it is time to re-assess the charts. See Figure 1 above, focusing on the price action inside the purple box. Namely, after careful re-analyses of the charts, the rally from the June 26 low to the July 3 high can be counted as a five-wave impulse, grey W-i, albeit unorthodox as the final set of 4th and 5th waves of that impulse did not adhere to the standard Fibonacci-based impulse pattern. But we know the market does not have to follow that pattern; it is simply the initial road map we look for. As such, we can, therefore, never be right all the time in our forecasts. Or, as we always say,

“While everyone always wants to know exactly what’s next, there are often times when things are less clear, and we must let the market communicate. Please remember our work is ~70% reliable and ~95% accurate. That is as good as it gets, as there are no prophets or market gurus because not everything always works. Thus, we must have realistic expectations: do not expect perfection and zero wrong calls in a dynamic, stochastic, probabilistic environment because all we can do is ‘anticipate, monitor, and adjust if necessary.”

The July 10 low was then grey W-ii, and the index should now complete grey W-iii. From the EWP, we know that waves four and five come after the third wave in an impulse. Moreover, the W-iv cannot overlap with the W-i high. The grey boxes show where the W-iii, -iv, and -v should ideally be completed based on a standard Fibonacci-based impulse pattern. Note the upper end of the grey W-v box (the 200.0% extension of grey W-i, measured from the grey W-ii low) coincides with the red 200.0% extension of red W-a/i, measured from the red W-b/ii low.

Typically, a W-c/iii targets the 161.8% extension, which was reached to the T on June 19. As such, the index had done enough to consider that wave complete and why we were looking for it to drop to $14000. But, in this case, despite all the negative divergences in the TIs to support that case, the index decided to extend. Wave extensions can always happen but cannot be known beforehand. We must wait for a break above or below key price levels, in this case, $15284, to tell if such an extension is at hand. We can then re-calculate the next upside target. For example, we knew on July 11 that a breakout would then target $16.1K. A voila, here we are.

Lastly, a drop below $15725 will mean grey W-iv is underway to ideally $15525+/-25 from where grey W-v to ideally $16110+/-25 kicks in. The index will have to drop below the grey W-i high, $15275, to tell us the more significant red W-iv is underway.