Stock Markets Analysis and Opinion

Nasdaq 100, S&P 500: Potential Head and Shoulders Patterns to Watch Out for

2024.09.04 04:47

- broke out to the downside of the 10-day range with a break below 5575/5560

The low & high for the last session were 5595 – 5665.

- September collapsed from resistance at 19690/695.

Last session high & low for the SEPTEMBER futures contract: 18911 – 19683.

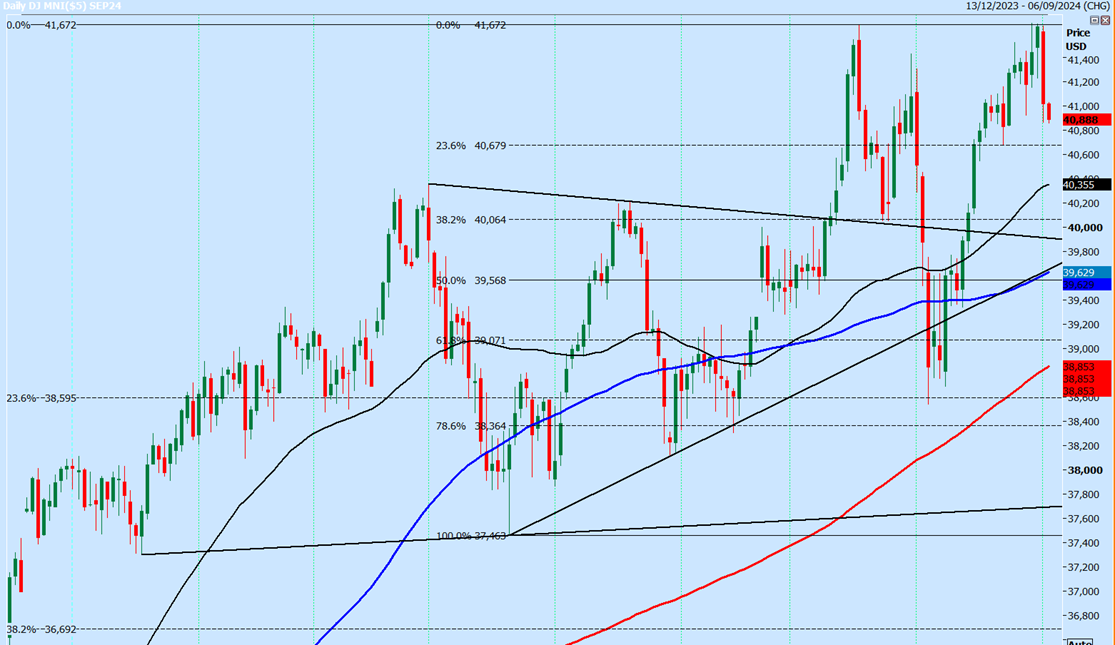

- has a potential double top sell signal after the collapse from the new all-time high at 41682.

Last session high and low for the SEPTEMBER futures contract: 41658 – 40866.

Emini S&P September Futures

- Emini S&P has now started to move with a break below the lower end of the 10-day range at 5575/5560 hitting 1st target of 5540/30 and almost as far as 5500/5490.

- It seems possible we could fall as far as 5470/60 but there is a good chance of a low for the day here.

Longs need stops below 5450. - I could argue that we could be forming a (very lopsided) 6-month head and shoulders pattern with a neckline at 5180/50.

- We should meet resistance at 5540/50 and shorts need stops above 5560.

However, if we continue higher we risk getting trapped in the recent range, so I will see where we close tonight.

Nasdaq September Futures

- The 10% collapse in Nvidia (NASDAQ:) pulled stocks lower yesterday and obviously, the Nasdaq was hit hard.

I have been warning and watching for the formation of a right shoulder in a 6-month head and shoulders pattern - Of course, this looks more likely to form after we collapsed from minor resistance at the Tuesday/Wednesday/Thursday high of 19690/695 yesterday.

- We wrote: a dip below 19500 risks a slide towards last week’s low at 19140 and perhaps as far as support at the 100-day moving average at 19065/025. A break below here targets 18880/830.

- Although I did not expect that move to happen within hours if you did manage to get into a short position on the break of 19500, there was up to 600 ticks profit possible as we hit the 18830 target.

- The index is oversold in the short term and we are testing a 2-year ascending trend line so there is a good chance of a bounce from 18880/18830. Longs need a 100 ticks stop loss below the short-term Fibonacci levels around 18700.

A break below 18700 should be another sell signal targeting strong Fibonacci support at 18600/500, with a good chance of a low for the day here.

Emini Dow Jones September Futures

- We wrote: Failure to break above the all-time high leaves a potential double top pattern, which would trigger a move towards 41160/100 & 40950/900. Look for short-term support at 40700/650. Longs need stops below 40550.

- Well, quite a move yesterday as we collapsed to my targets of 41160/100 and 40950/900, with a low for the day only about 30 ticks below.

- To repeat: Look for short-term support at 40700/650. Longs need stops below 40550.

A break lower see 40650/700 act as resistance targeting further losses towards 40400/350 and perhaps as far as 40100. - I think gains are likely to be limited as downside risks suddenly open and we should have resistance at 41150/200 than at 41350/390.