Nasdaq 100 May Need to Dip Before Rallying Again

2022.12.02 17:16

[ad_1]

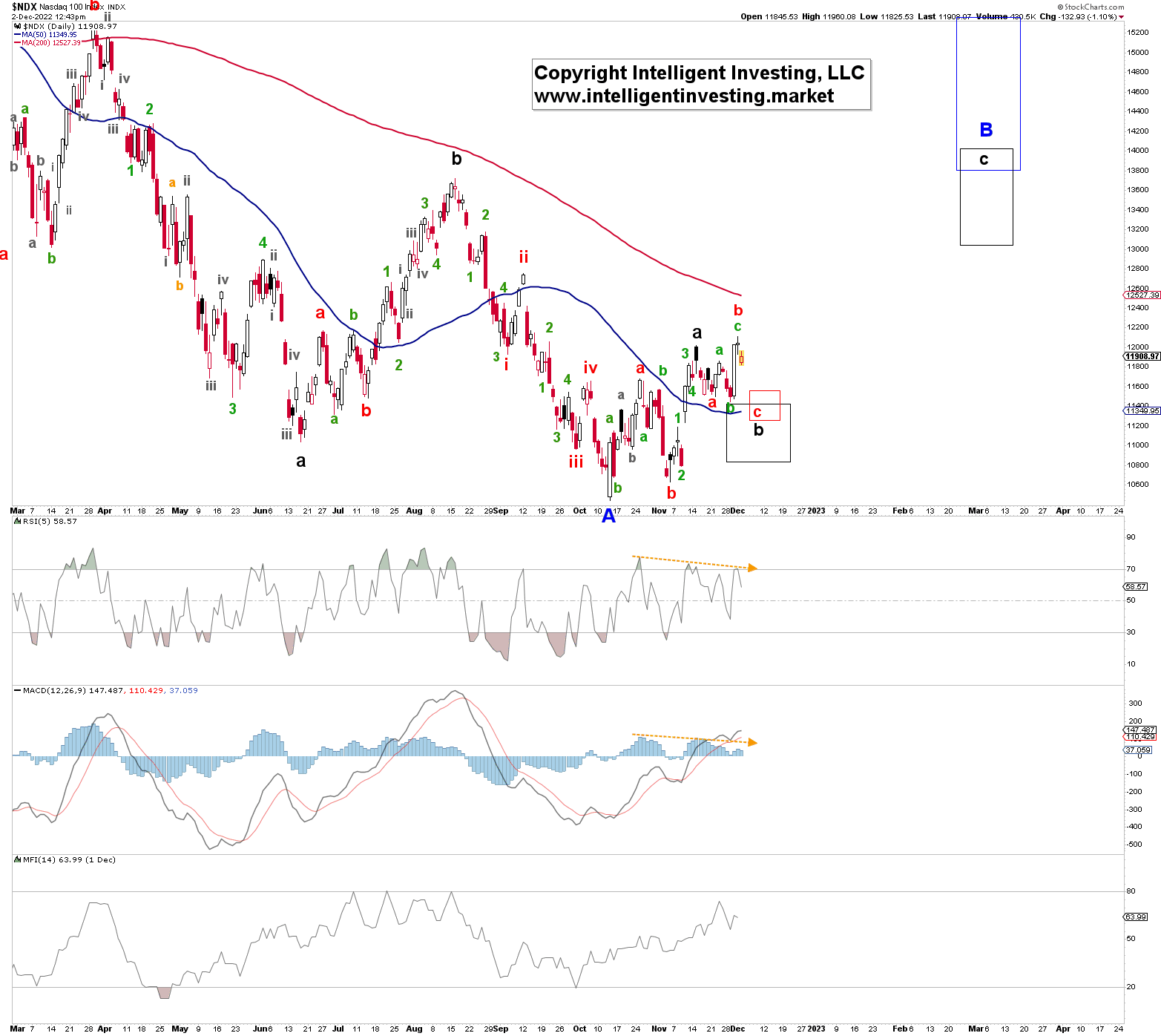

Two weeks ago, see here, we found for the (NDX) using the Elliott Wave Principle (EWP),

“… the general path laid out in late October remains our focus and is filling in rather well. Once black W-a tops (ideally around $12-12.6K), I still expect a sizable pullback first (W-b) to ideally $11.2K +/- 200 before the next rally (W-c) starts to ideally $13.8-15.4K. I can narrow this target zone down once more price data becomes available.”

After two weeks of sideways consolidation, the index broke higher on Powell’s speech on Wednesday and reached $12115 yesterday, only to drop lower on better than expected today. As the saying goes, “The market giveth, the market taketh away.” The index is only 1.7% higher since my last update, so the question is: where does all this whipsawing lead us?

See figure 1 above. My primary expectation is that the index topped yesterday for an irregular b-wave of an irregular flat in EWP terms (see example here). It should now be working on the final (red) c-wave lower to ideally $11300-11600 for the larger black W-b before the next rally (black W-c of blue W-B) to ideally $13.8-15.4K starts. The technical indicators look slightly tired, with negative divergences (dotted orange line), and ready to move lower. But that is a condition, not a signal.

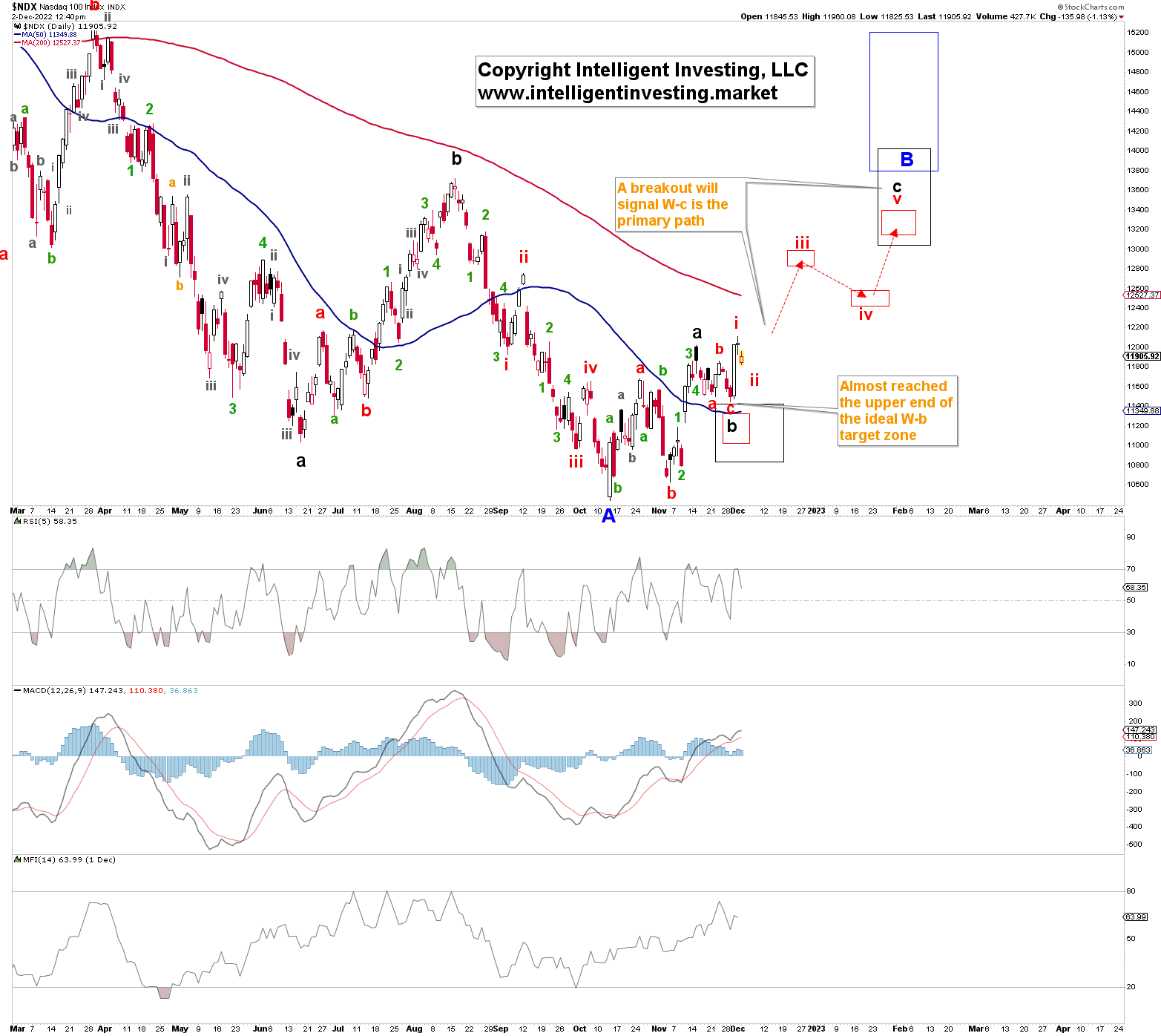

Namely and however, if the bears cannot muster a breakdown, then the alternative option I am tracking becomes operable. In that case, a more immediate five-wave rally to ideally $13.2+/-2K will become the primary path. See figure 2 below.

Figure 2.

Just as a reminder, while some misunderstand the EWP and my work, claiming that I’m saying the market will either go up or down, I only look at it from the perspective of probabilities because there are no certainties. Therefore, everything has to be approached with “if/then” views. I provide those perspectives by ranking probabilistic movements based on the structure of the price action. I offer a primary EWP perspective, and if that pattern breaks due to the price breaking above or below a certain level, it tells us that the assessment was wrong. The alternative EWP option is then operable. In a probabilistic environment, there’s never one option. If there were, then it would not be a probabilistic environment but a certainty. This approach is like an army general preparing a primary battle plan and, simultaneously, a contingency plan if the initial battle plans do not work. We prepare for battling the markets in the same manner.

Bottom Line

Two weeks ago, we found that:

“The general path laid out in late October remains our focus and is filling in rather well. Once black W-a tops (ideally around $12-12.6K), I still expect a sizable pullback first (W-b) to ideally $11.2K +/- 200 before the next rally (W-c) starts to ideally $13.8-15.4K. I can narrow this target zone down once more price data becomes available.”

After two weeks of go-nowhere price action, the NDX finally reached the ideal target zone yesterday. It topped at $12,1K. Today’s decline should be the initiation of the final decline to that W-b target zone before W-c starts. That is the primary battle plan. Our contingency plan is that on a more immediate breakout above yesterday’s high, we will look for the index to reach $13.2+/-2K without a more significant pullback.

[ad_2]

Source link