NASDAQ 100: Did the Bears Fumble?

2023.08.23 16:00

Three weeks ago, see ; we found, based on our interpretation of the price action for the using the Elliott Wave Principle (EWP)

“A drop below $15375 will be our first signal the red W-c/iii has topped, and the index is ready to embark on at the least the red W-iv? correction to ideally $14400+/-200.”

Last week, see , we then concluded,

“If the index drops below yesterday’s low [$14972] without reaching the $15450-7530 region first, we will look for the impulse lower to extend to the $14600-14800 region before it can try for another attempt to reach that zone.”

Fast forward, and the index dropped below $14972 last Wednesday, bottomed out Friday at $14557, which was only 43p (0.3%) below the aforementioned region, and is now trading at $15170s. Thus, our assessment of the general path on a drop below $14972 has so far been correct.

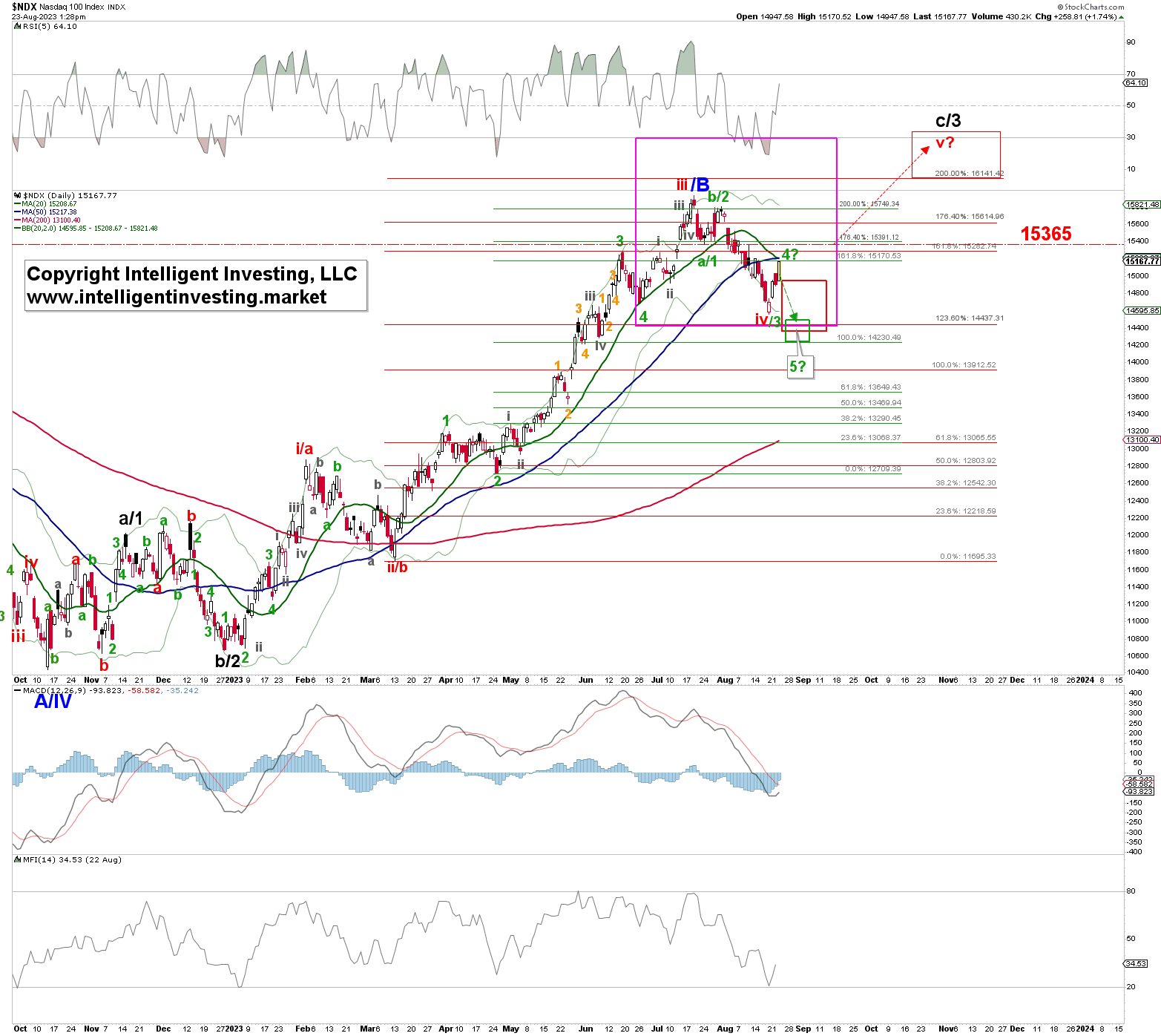

However, the question now is “Was Friday’s low all the red W-iv?, or can we see one more drop to complete an impulse lower?” See the purple box in Figure 1 below.

Figure 1. NASDAQ 100 daily resolution chart with technical indicators and detailed EWP count.

To answer that question, we must acknowledge the index has reached perfectly inside and moved outside of the ideal (red) target zone for red W-iv?, but has, so far, only completed three (green) waves lower from the July high. Three waves lower is corrective. The NDX must remain below $15365 (green W-a/1) because otherwise, the potential W-4?; why do we label the waves as (green) a/1, b/2, (red) iv/3 until the market proves one of the two will overlap with W-a/1, and that is not allowed in an impulse. We will then shift focus to the red W-V? to ideally $16775+/-25.

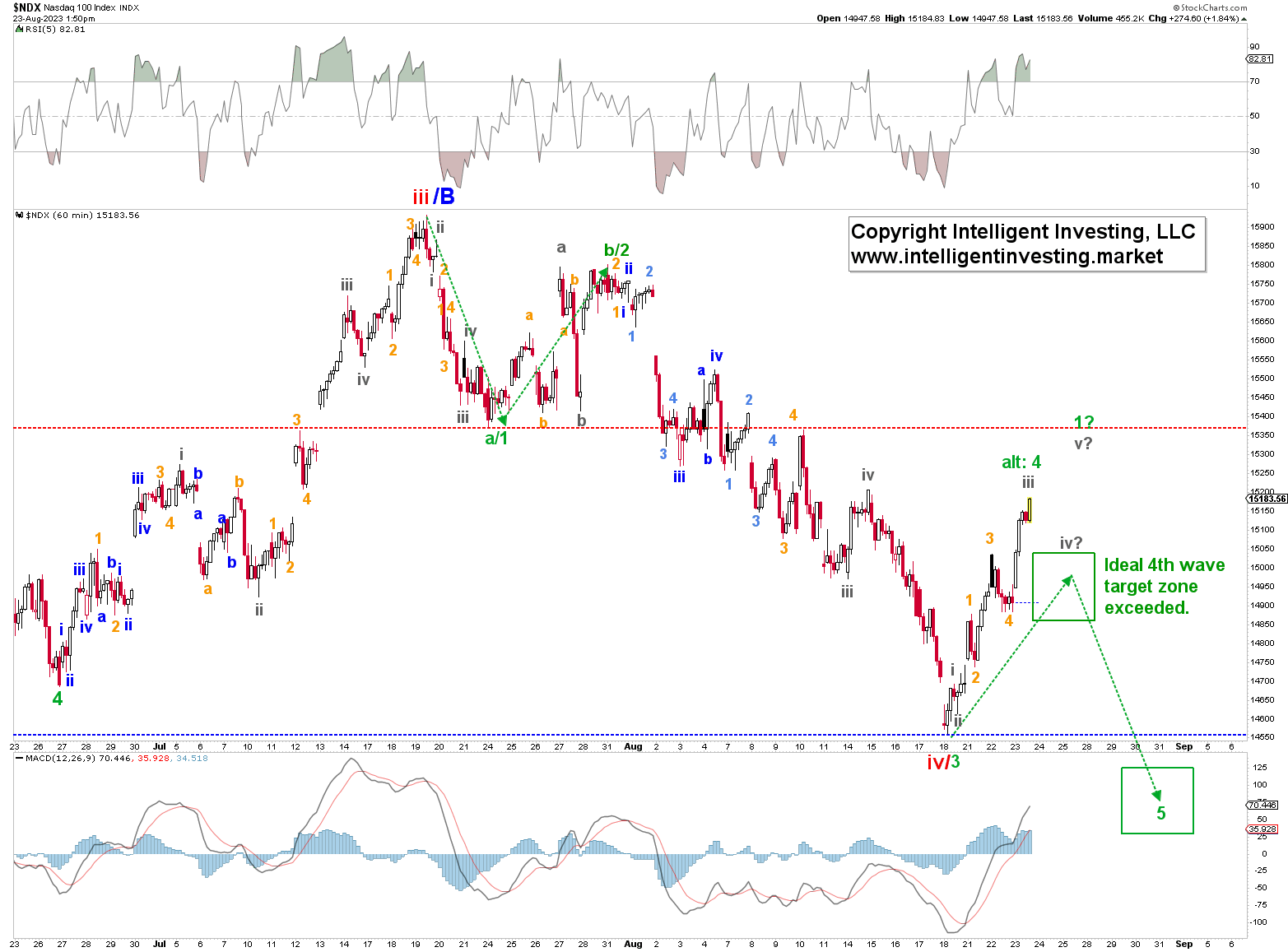

However, the hourly resolution chart (see Figure 2 below) has not yet presented us with five waves up from Friday’s low. When we see five waves up, the next pullback will have to stay above $14557, and the index will have to rally back above the five waves-high to tell us $16775s are most likely next.

Figure 2. NASDAQ 100 hourly resolution chart with technical indicators and detailed EWP count.

The only caveat we must present is that “after three waves down, expect at least three waves back up.” What does that mean? The market can present us with a flat correction consisting of three waves down, three waves back up, and five waves down (3-3-5). See three waves back up, which could now be underway, can challenge or exceed the July high, whereas the five waves down can target or exceed the recent lows. But that pattern will be our alternate EWP count.