More Uncertainty: Is This a Bottoming Pattern?

2023.02.28 09:57

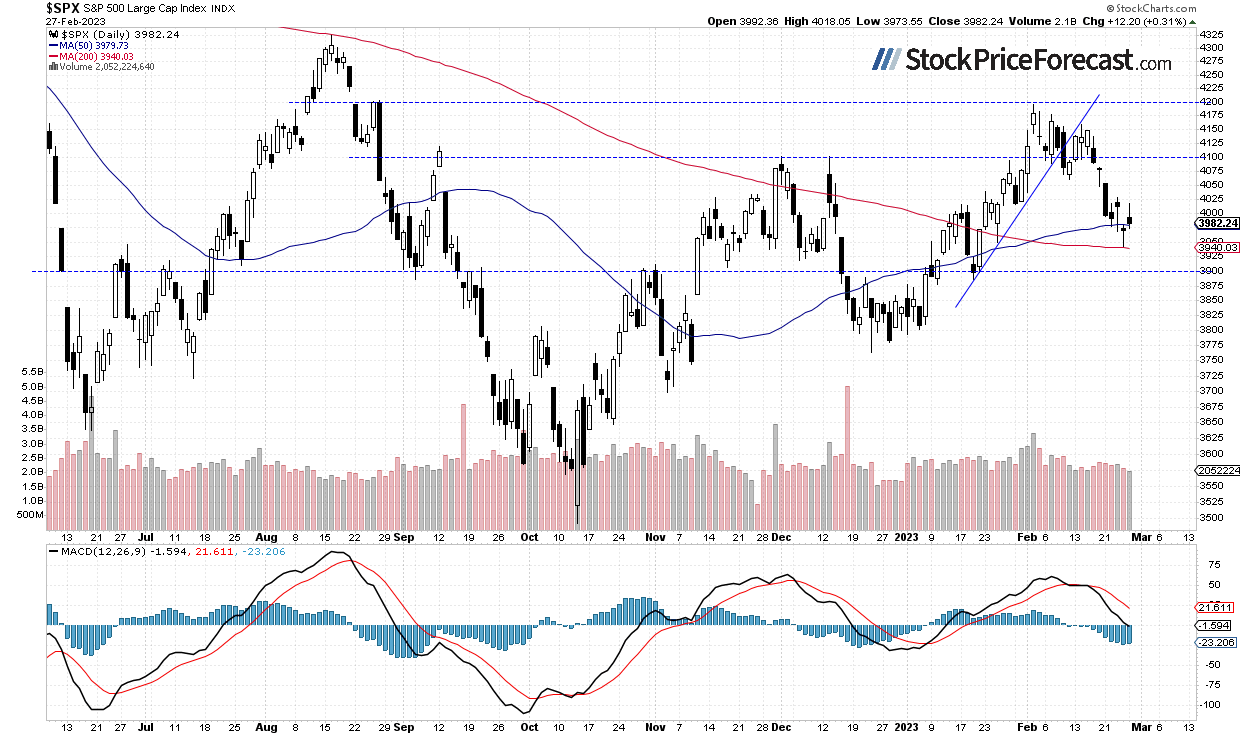

The gained 0.31% on Monday, as it fluctuated within a consolidation following its recent declines. The market opened higher, but it retraced the advance and closed below the 4,000 level again. On Friday the daily low was at 3,943.08, but the index bounced at the end of the day. There are still fears about monetary policy tightening following a series of better-than-expected economic data releases.

The market appears likely to extend a consolidation along the 4,000 level today. In early February the index broke below the upward trend line, as we can see on the daily chart:

Futures Contract Remains Close to 4,000

Let’s take a look at the hourly chart of the contract. It’s trading slightly below the 4,000 level. The resistance level is at around 4,030, marked by the recent local highs. On the other hand, the support level is at 3,950.

S&P 500 E-Mini Futures 1-Hour Chart

S&P 500 E-Mini Futures 1-Hour Chart

Conclusion

Stock prices will open slightly higher this morning. The market may be forming a short-term bottom following a decline from mid-February local highs. However, there have been no confirmed positive signals so far. Investors will be waiting for the important release at 10:00 a.m.

Here’s the breakdown:

- Stock prices continue to fluctuate within a consolidation following their recent declines.

- The S&P 500 may be forming a bottom before some more meaningful upward reversal.

- In my opinion, the short-term outlook is bullish.