More Turmoil Expected Next Week as Stocks Face Triple-Whammy of Risks

2023.05.05 05:49

- The U.S. stock market faces a triple-whammy of risk events and developments next week.

- U.S. CPI inflation, the regional banking crisis, and the debt ceiling showdown will be in focus.

- Looking for more top-rated stock ideas to protect your portfolio amid the increasingly uncertain economic climate? Members of InvestingPro get exclusive access to our research tools and data. Learn More »

Investors should brace for fresh turmoil next week as the stock market faces risks on multiple fronts, including inflation, the regional banking crisis, and the debt ceiling showdown.

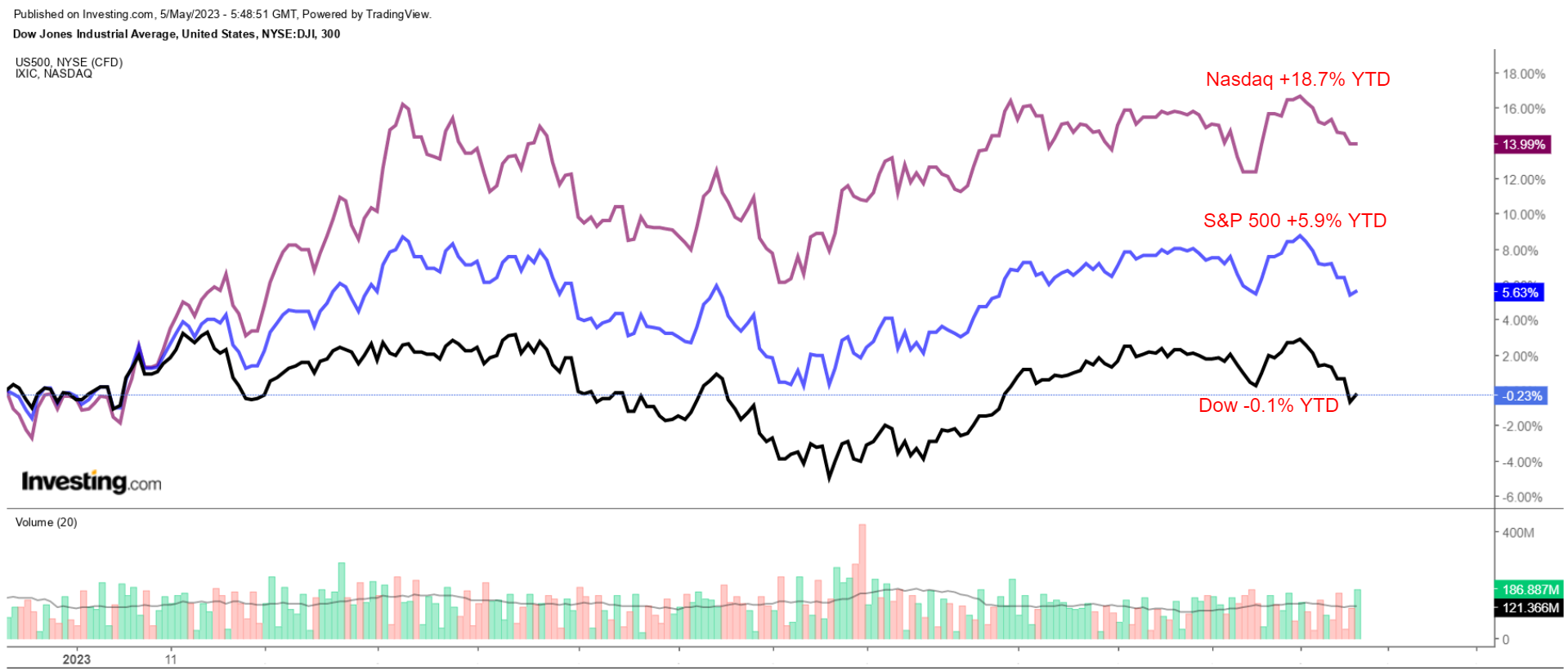

Cracks are widening in an early-year rally in stocks, with the blue-chip now down about -0.1% on the year. Meanwhile, the benchmark and the tech-heavy have trimmed their year-to-date gains to +5.9% and +18.7%, respectively.

Nasdaq Vs. S&P 500 Vs. Dow Jones

Nasdaq Vs. S&P 500 Vs. Dow Jones

As investors continue to gauge the outlook for interest rates and inflation, assess the fallout from the recent bank failures, and wait on a political resolution to the U.S. debt ceiling situation, a lot will be on the line in the week ahead.

The Fed interest rates by a quarter of a percentage point in a widely expected move on Wednesday and opened the door to a pause in its aggressive tightening cycle.

The Fed funds target rate now stands in the 5.00%-5.25% range, following 500 basis points of hikes since March 2022.

In an overt shift, the U.S. central bank dropped from its policy statement language saying that it “anticipates” further rate increases would be needed, only that it will watch incoming data to determine if more hikes “may be appropriate.”

The market took those comments as a signal that a peak in U.S. rates had been reached and moved to price in rate cuts later this year, despite Fed Chair Jerome Powell pushing back on such expectations.

Speaking at his post-meeting press conference, Powell said that it was too soon to say with certainty that the rate-hike cycle is over as inflation remains the chief concern.

“We are prepared to do more” he warned, with policy decisions from June onward to be made on a “meeting-by-meeting” basis.

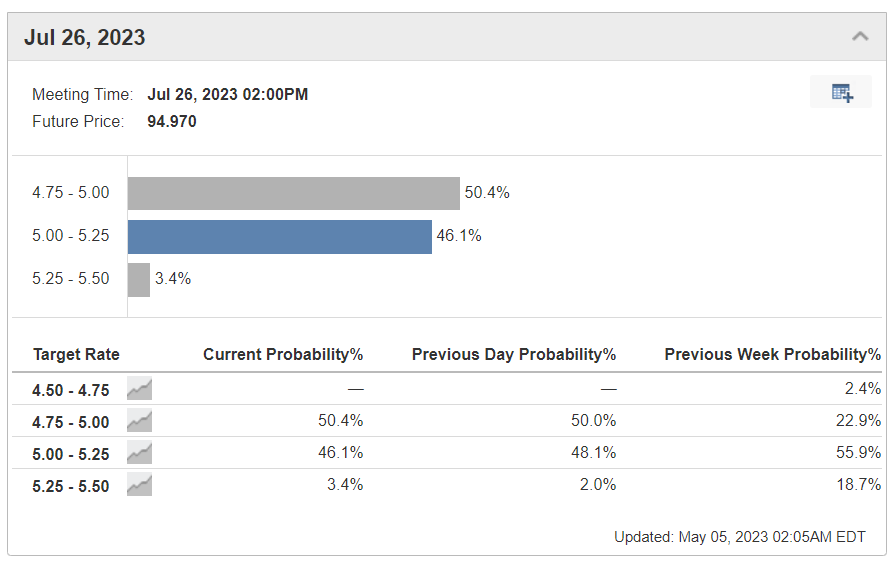

As of Friday morning (before the release of the April jobs report), financial markets are pricing in a 97.9% chance of the Fed pausing its rate hikes at its next meeting in June, compared to a 2.1% chance of a 25bps cut, according to Investing.com’s Tool.

The rate futures market has also factored in a roughly 50% chance of rate cuts starting as soon as the July meeting.

Source: Investing.com

All in all, the market expects about 50-to-75bps in rate cuts through to the end of the year, with traders betting on a Fed funds rate at 4.33% by December. While that is possibly true, it’s not a guarantee by any stretch.

Next week will help determine what the Fed’s next move will be as the U.S. central bank faces the difficult task of balancing between its ongoing battle against inflation and growing signs of financial instability.

Stubborn Inflation

With Chairman Powell reiterating that his main objective is to bring inflation back under control, next week’s inflation data takes on extra importance.

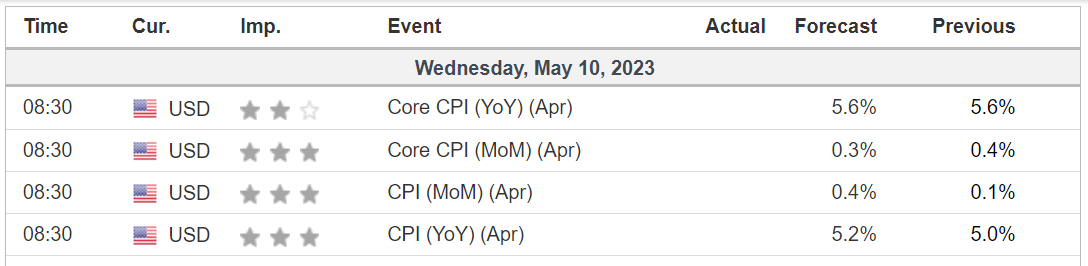

The U.S. government will release the April report on Wednesday, May 10, at 8:30 AM ET, and the numbers will likely show that neither CPI nor are falling fast enough for the Fed to slow its inflation-fighting efforts this year.

Source: Investing.com

As per Investing.com, the is forecast to rise 0.4% on the month after edging up 0.1% in March. The headline annual inflation rate is seen rising 5.2%, accelerating from a 5.0% annual pace in the previous month.

Meanwhile, the April is expected to rise 0.3% on the month and 5.6% from a year ago. The core figure is closely watched by Fed officials who believe that it provides a more accurate assessment of the future direction of inflation.

Prediction:

- Overall, while the trend is lower, the data will likely reveal that inflation is still well above what the Fed would consider consistent with its 2% target range.

- A surprisingly higher reading, in which the headline comes in at 5.3% or above, will keep the pressure on the Fed to maintain its fight against inflation.

Powell told reporters this week,

“We on the committee have a view that inflation is going to come down not so quickly, it will take some time. In that world, if that forecast is broadly right, it would not be appropriate to cut rates this year.”

U.S. Regional Bank Turmoil

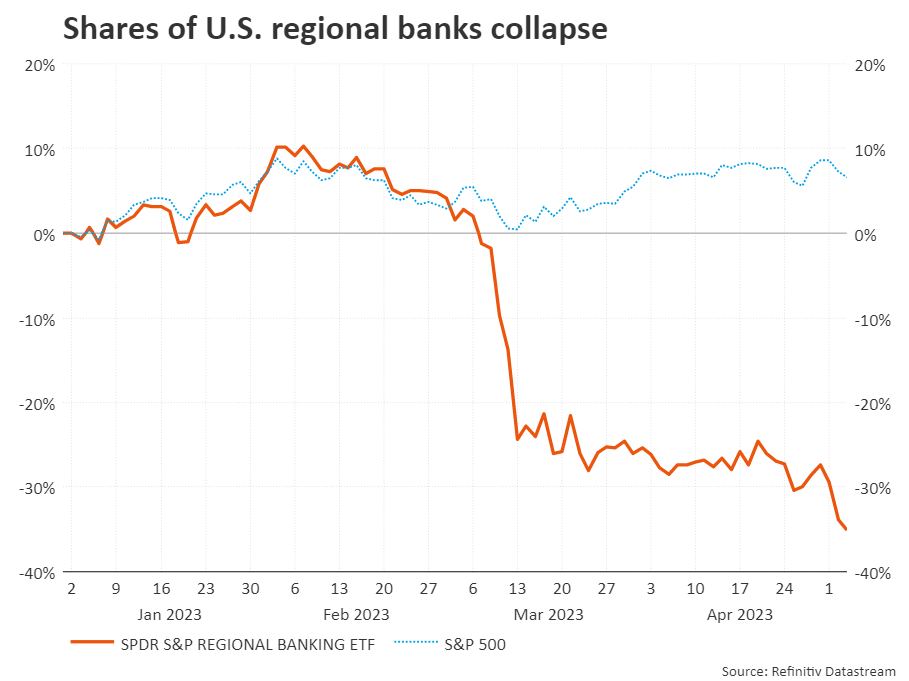

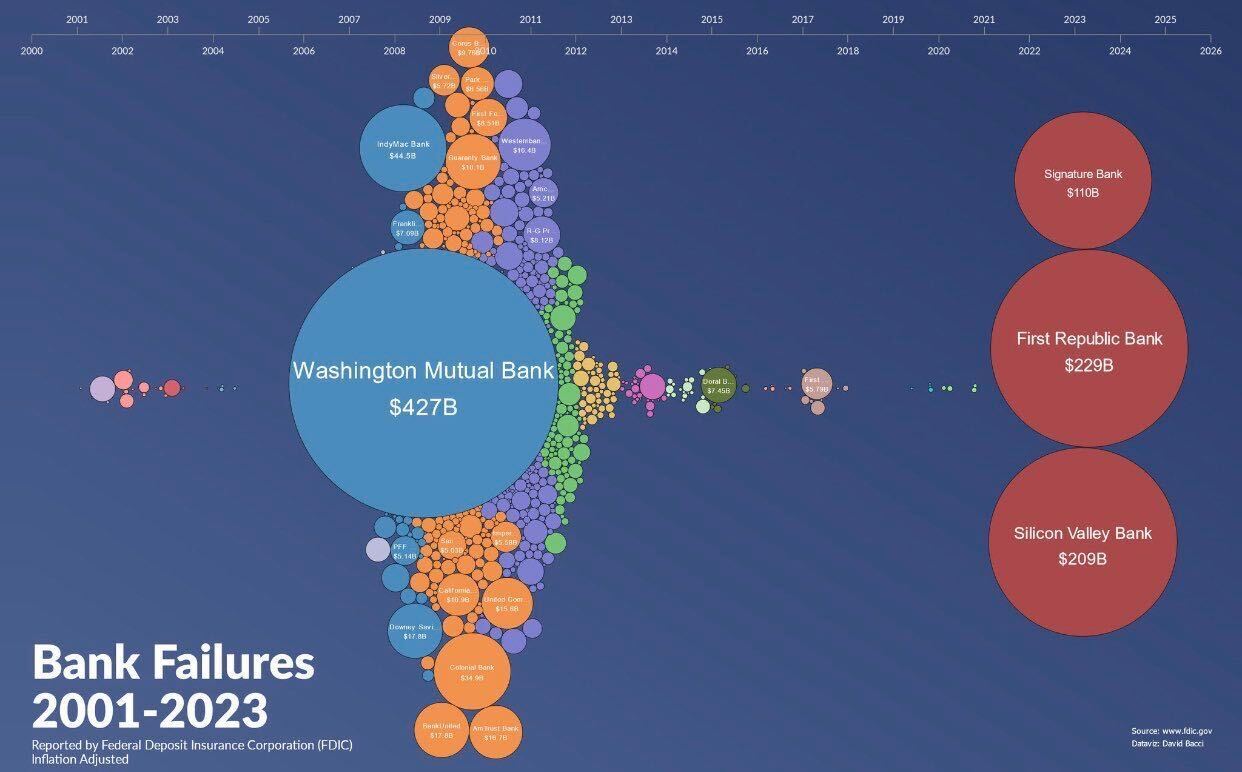

Outside of the inflation drama, market participants will continue to be fixated on contagion fears in the regional banking sector, as worries over further bank failures remain a big risk.

The rout in regional banks picked up steam again in the past week, with several stocks suffering sizeable losses amid the turmoil sweeping through the industry.

US Reginal Bank Stocks Collapse

US Reginal Bank Stocks Collapse

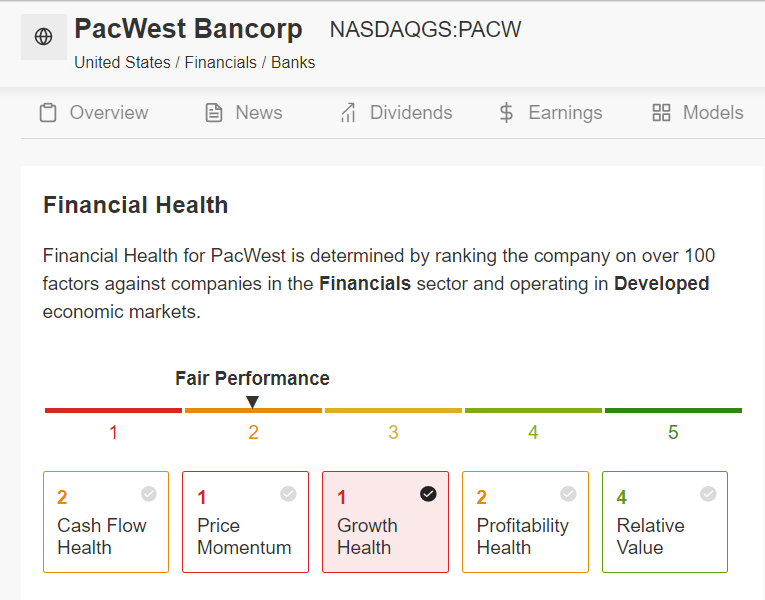

In fresh signs of stress, Los Angeles-based Pacific West Bancorp (NASDAQ:) tumbled 50% on Thursday to a record low after confirming it was exploring strategic options, including a sale.

Source: InvestingPro

Meanwhile, Tennessee-based First Horizon (NYSE:) sank 33% after the regional lender and Toronto-based TD Bank (TSX:) announced that they were terminating their $13.4 billion merger agreement.

Other notable declines included a drop of 38% for Arizona-based Western Alliance (NYSE:).

Shares of small-and-midsized U.S. regional banks have come under heavy selling pressure this week after First Republic was seized by regulators and sold at a discount to JPMorgan Chase (NYSE:), marking the third failure of a regional bank since the start of March and the biggest since 2008.

The SPDR® S&P Regional Banking ETF (NYSE:) and the KBW Bank ETF (NASDAQ:) are down 42% and 33%, respectively, over the last two months.

Zion Bancorp, KeyCorp (NYSE:), Valley National Bancorp (NASDAQ:), and Comerica (NYSE:) are on watch for next week amid worries about other ticking bombs in the sector.

Prediction:

- Many investors thought falling inflation would be the main driver for a Fed pivot on rate hikes, but now, it’s likely to be dictated by growing risks of a full-blown regional banking crisis.

- A worsening meltdown that could trigger a sharp decline in lending activity and weigh on economic growth would underline the view that the Fed will soon have to begin easing monetary conditions.

- Fed chair Powell tried to soothe concerns about the bank turmoil, saying conditions across the sector had “broadly improved” since the period of “severe stress” in early March and that the system as a whole was “sound.”

This crisis is still unfolding, and I think the worst is yet to come.

Debt Ceiling Showdown

Risks around a U.S. debt limit standoff between Republicans in Congress and President Joe Biden may also shape how Fed officials weigh the risks facing the U.S. economy and how that will impact their next move on interest rates.

Fresh uncertainty on the political front has added to the sense of caution about trying to tighten financial conditions further.

Treasury Secretary Janet Yellen warned earlier this week that the U.S. could run out of measures to pay its debt obligations by June 1, sooner than the government and Wall Street had been expecting.

That would raise the risk of a historic U.S. debt default unless Congress agrees to pass a bill in time to raise the government’s $31.4 trillion debt ceiling.

In light of the new, earlier estimate, President Joe Biden invited the “big four” congressional leaders — Senate Majority Leader Chuck Schumer, Senate Minority Leader Mitch McConnell, Republican House Speaker Kevin McCarthy, and House Democratic Leader Hakeem Jeffries — to a May 9 meeting at the White House to discuss the debt limit.

Prediction:

- For Fed officials, the ongoing political standoff could influence their view of whether the economy and inflation are likely to slow more – perhaps much more – quickly than anticipated.

- Powell warned that a U.S. debt default would be unprecedented and have “highly uncertain” and “quite diverse” consequences for the U.S. economy.

“No one should assume that the Fed can really protect the economy and the financial system and our reputation globally from the damage that such an event might inflict,” he added.

If you’re looking for actionable trade ideas and investments to navigate the current market volatility, the InvestingPro tool enables you to identify winning stocks at any given time.

Here is the link for those of you who would like to subscribe to InvestingPro and start analyzing stocks yourself.

Find All the Info you Need on InvestingPro!

***

Disclosure: At the time of writing, I am short on the S&P 500 and Nasdaq 100 via the ProShares Short S&P 500 ETF (SH) and ProShares Short QQQ ETF (PSQ). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.