Microsoft Earnings Preview: Will Azure Growth Outshine Rivals Amid AI Integration?

2024.10.29 09:25

As Microsoft (NASDAQ:) heads into its next earnings report on Oct. 30, all eyes are on its ability to shake off recent disappointments and reaffirm its tech dominance.

Microsoft’s latest quarterly results sent shockwaves through the market, knocking it down from its perch as the world’s most capitalized company.

Source: InvestingPro

Now, with expectations high, the tech giant aims to show it’s back on track and ready to compete with the best.

Microsoft, currently valued just behind Nvidia (NASDAQ:) and Apple (NASDAQ:), could reclaim investor confidence with strong results this quarter.

In particular, the focus is on the performance of its cloud division, Azure, which disappointed last time with revenue growth below analyst expectations.

Despite being a crucial driver, Azure’s growth of 29% last quarter fell short of the 30.58% expected, which rippled through the stock and raised questions about Microsoft’s ability to keep pace with Amazon (NASDAQ:) and Google (NASDAQ:) in the cloud race.

What Analysts Are Forecasting

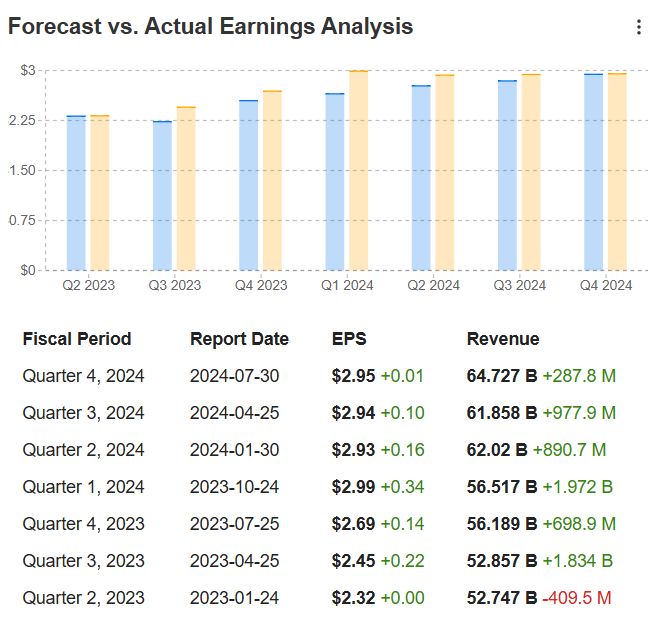

Analysts have nudged their earnings-per-share (EPS) estimates up slightly to $3.10, indicating confidence that Microsoft can deliver, while revenues are projected to hit $64.5 billion—a 14.2% year-over-year increase.

Source: InvestingPro

This outlook translates to growth rates of 3.7% for EPS and a significant boost in sales, underscoring Microsoft’s resilience and investor optimism.

Source: InvestingPro

Stock Outlook: Is Microsoft Fairly Priced?

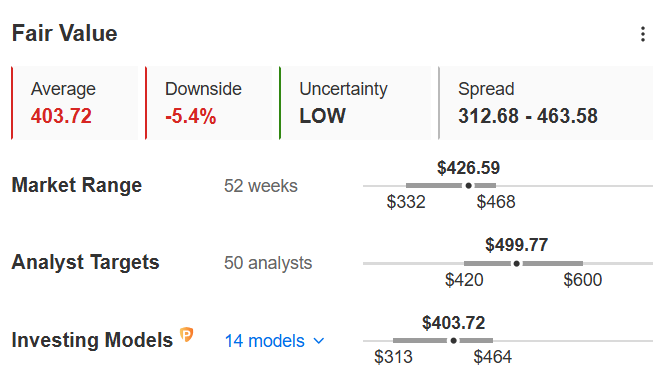

According to InvestingPro’s models, Microsoft appears fairly valued at around $403.72, only slightly below its recent closing price.

Source: InvestingPro

However, analysts on average target a higher price, setting their sights at $499.7—a bullish 17% upside, backed by 52 “Buy” ratings out of 57 surveyed analysts.

This optimism underscores high expectations but also the pressure on CEO Satya Nadella to deliver the kind of results that can maintain Microsoft’s spot in the exclusive $3 trillion club.

With earnings season ramping up, Microsoft’s report will be a key indicator not only of its own performance but of the broader tech landscape, setting the tone for investor confidence ahead of Big Tech earnings due later this week.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.